I’ve been waiting for this. Saudi Aramco CEO Amin Nasser just said Western policy makers should give up the “fantasy” of phasing out oil and gas. Then, he laid out an argument that matches my own almost point for point. Meanwhile, I have some thoughts about the “high valuations in tech” talk, says Keith Fitz-Gerald, editor of 5 With Fitz.

Like it or not, reality is that a) Electric Vehicle (EV) tech isn’t ready for prime time and b) demand for dinosaur juice continues to accelerate globally. Nasser also reinforced something you’ve heard me talk about many times...the need to manage realistic demand assumptions rather than the delusion of EV acceptance.

Think about it. The world has invested nearly $10 trillion over the past 20 years in alternative energy but still can’t displace dinosaur juice at scale. Invest accordingly.

Big energy companies are particularly attractive at the moment, having been beaten to smithereens in recent months. My favorite continues to make astounding capital investments capable of paying off for years to come, pays a great dividend, and has just returned record amounts to shareholders. Not for nothing, Warren Buffett’s company just bought more shares recently.

Meanwhile, I’ve seen a litany of charts lately highlighting how and why the current AI “bubble” may be worse than the tech bubble of the 1990s, especially when it comes to PE ratios.

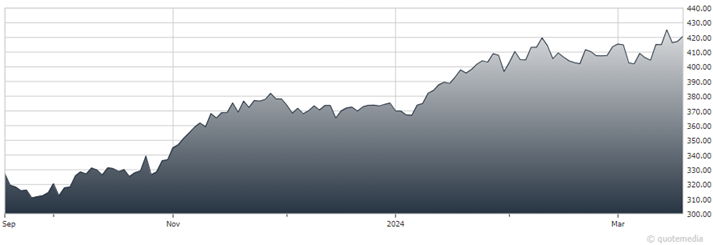

Microsoft Corp. (MSFT)

Not true. The 1990s tech bubble was driven by three things: 1) unstable IPOs with no revenue and no customers, 2) leverage, and 3) astoundingly high cash burn rates.

This time around, the “tech” is being led by large, tremendously profitable and established companies like Nvidia (NVDA), Microsoft (MSFT), and others. The losers are still private, so the investing public isn’t on the hook because, for the most part, they can’t be. And the leveraged-up-to-your-eyeballs mentality of the past simply doesn’t exist in current C-Suites, at least the ones I’m familiar with.

Not for nothing and to close the loop here: The PE ratios that most critics are yammering on about don’t accurately reflect tech, nor do current accounting regulations – something I’ve spoken about several times on CNBC, FBN, and other networks in recent months.

In fact, I would submit that seemingly “high” tech PE ratios are a “go” sign, not a harbinger of doom when it comes to breakthrough tech. Not all tech is the same if you know what you’re looking for.