The markets — stocks, tech, Bitcoin, gold, and even uranium — rallied after Fed Chairman Jay Powell maintained his stance to cut interest rates three times in 2024 once inflation has subdued. It’s worth remembering that “The trend is your friend…until it ends,” opines Mark Skousen, editor of Forecasts & Strategies.

“Never fight the Fed.” — Marty Zweig

Since price inflation is staying stubbornly high at 3% or more, the Federal Reserve has postponed cutting short-term interest rates for now. Moreover, as we get closer to the election, Fed members may be reluctant to cut rates. Powell & Co. want to maintain their independence from politics.

In addition to Fed policy, my other key indicator is gross output (GO), which measures total spending in the economy, including the value of the supply chain. Like gross domestic product (GDP), real GO for the United States has been rising lately, and that’s a good sign for the economy. Other nations, including Europe and China, are struggling these days, so America is carrying the weight of economic growth.

The unemployment rate remains low and corporate profits are high and doing better than expected. Despite perennial forecasts of a bear market or even a crash in the stock market, I join Jay Powell in maintaining our bullish stance in stocks and alternative investments like gold, silver, uranium, and Bitcoin.

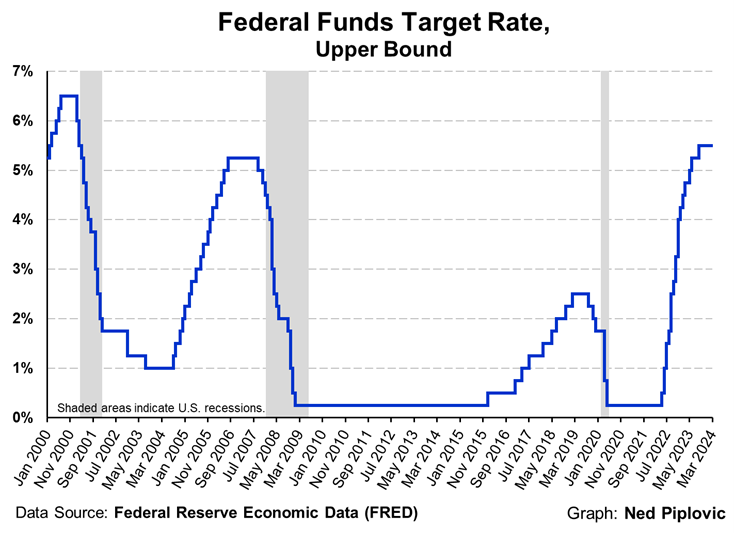

The Fed is famous for its volatile policies. As the chart below shows, the Fed has switched from easy money to tight money, or vice versa, six times.

But note that there is a lag between interest rate policy and the stock market -- and the lag can sometimes be a couple of years.

Since 2022, the Fed has imposed a tight money policy. The initial reaction on Wall Street was negative, but since 2023, we’ve enjoyed a bull market. That bull market has been extended after the Fed announced late last year that it was pausing its aggressive rate increases.