Does this Bull have room to run? If you watch too much financial news like I do, you may be concerned that the market has run too far, too fast and that valuations (particularly tech) are stretched. The market is always climbing a wall of worry which means there is always a bear case to be made. But bull markets can run for a long time – and this one is relatively young, advises Nancy Tengler, CIO at Laffer Tengler Investments.

I heard one commentator recently quip: “The bears always sound smarter.” But they are rarely right. Stocks go up two-thirds of the years recorded back to the early 1900s. In good times and bad.

On average, stocks return an annualized 8%-9% (depending on the period measured) and fortunes have been lost by investors trying to market time. Getting out is one thing. Getting back in at the right time is another. Few, if any, have achieved that feat.

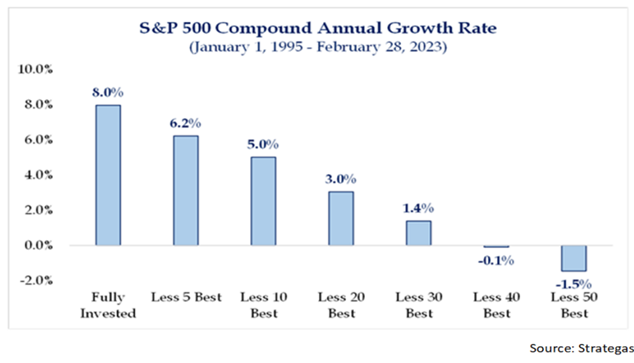

Below is a chart I featured in the second edition of my book The Women’s Guide to Successful Investing. It shows the effects of missing the five-best days (as well as the 10-, 20-, 30-, 40-, and 50-best days) to a portfolio invested in the S&P 500 over an almost 30-year period.

Fully invested investors received an annualized return of 8%. Missing the five-best days resulted in an annualized return of 6.2% -- a meaningful cost compounded over the long-term!

This is not to say that we cannot prepare for difficult times, though. We can and we do.

Yet despite strong returns, we have only recovered what was lost in the 2022 bear market and appreciated modestly above pre-bear market levels. So sure, we are due for a correction. But when we get one, we will be buying the dip.