While the stock market as a whole is trading at record valuations, the least expensive stocks are actually undervalued on a relative basis. That’s surprising given the long period of market strength, with the S&P up five-fold in 10 years. I like Metalla Royalty and Streaming Ltd. (MTA) here, says Adrian Day, editor of Global Analyst.

According to Jeremy Grantham, the 20% most expensive stocks are in their 10% highest range relative to the market, while the 20% lowest valuation stocks are in their 7% lowest range. In many cases, of course, these stocks are still reasonably valued, but very undervalued relative to the market.

We have suggested before that when these leaders stumble, investors will rotate into the stocks that have been left behind, value stocks and high dividend payers, and commodity stocks (including gold stocks). And globally, they will move from the US to global markets, particularly to the laggards such as Japan and smaller markets, where valuations are generally reasonable.

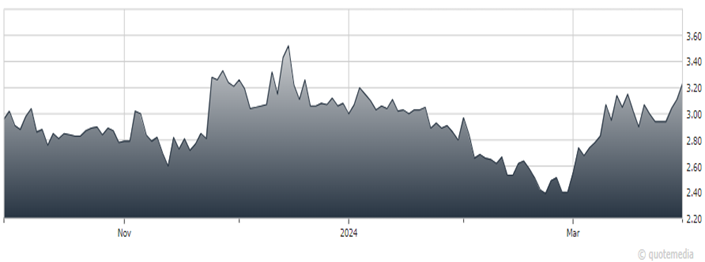

Metalla Royalty and Streaming Ltd. (MTA)

As for Metalla, it reported its year-end financials, with attributable gold received up nearly 50% on 2022, and exceeding its guidance. Nonetheless, the company recorded a loss of $5.8 million for the year, down from more than $10 million the previous year.

The decline in losses was largely due to a one-time gain from the sale of some mineral claims. As of year end, Metalla had cash of just over $14 million.

It was a transformative year for Metalla, most notably the merger with Nova Royalty, and a new strategic plan. That included the cancellation of its “At-the-Market” equity issuance plan, a doubling of the Beedie convertible loan facility to C$50 million, plans to reduce debt, and plans to pay dividends.

Meanwhile, three mines on which Metalla holds royalties are scheduled to begin production this year: Tocantinzinho in Brazil, and Cȏté and Amalgamated Kirkland, both in Ontario, Canada. Each royalty will see relatively little revenue this year as mines ramp up or move towards royalty ground, but increase in coming years.

This is particularly true of Cȏté, where Metalla’s royalty covers only a small part of that deposit, but all of the adjacent Gosselin deposit. It currently has a resource of 7.4 million ounces (indicated and inferred) and is undergoing an aggressive drill program. Operator Iamgold Corp. (IAG) has not yet announced plans for when Gosselin will be mined.

Recommended Action: Hold, but look to buy MTA.