I’ve covered the gold market and talked about it to investors and media for the better part of 40 years, but I’ve never recommended the metal as urgently as I am now. There are three simple and compelling reasons: Debt…debt…and more debt, advises Brien Lundin, editor of Gold Newsletter.

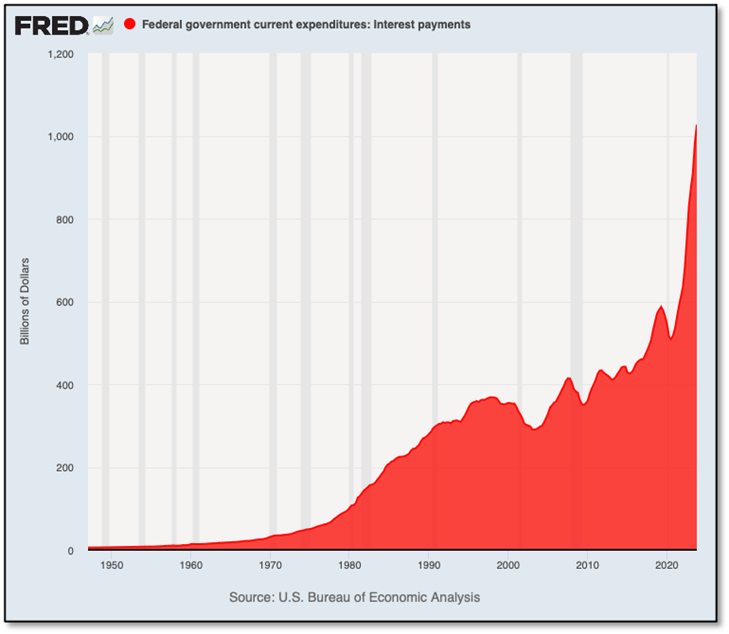

As I’m about to show you, a trend that had its beginnings in the 1960s has now entered its endgame — the point where the level of accumulated debt has become completely unmanageable. In the US, for example, the cost of servicing the federal debt has reached the shocking level that I’ve long predicted: $1 trillion in interest payments.

It’s bad enough to run annual deficits of one or two trillion, but now we’re adding another trillion on top in interest. Every year. The interest costs alone are more than any other single budget item, including national defense!

So, where is all this money coming from? Thin air, created with the tap of a few keys. And each new dollar conjured into being makes every other dollar that much cheaper. The bottom line is that the US and other developed nations are now trapped in debt spirals. At this point, no degree of spending cuts, tax hikes, or economic growth can save them.

Basic math tells us that the end result will be...has to be...very significant currency devaluations. And history tells us that the only sure protection will be found with gold.

To understand why, we need to look backward, as nothing we’re seeing today is new. Throughout human history, governments have always overspent their means, creating unmanageable debts.

Whether it be military campaigns, lavish lifestyles for rulers, or bread and circuses for the masses, excessive debts have been a natural outgrowth of human nature and a consistent characteristic of governments from time immemorial. From ancient Greece and Rome to today, the solution to these debts has always been the same: To depreciate the currency.

The end result is that we’ll have negative real rates going forward, essentially as long as the current monetary regime is in place. And that will be an extremely bullish environment for gold and silver, along with virtually every commodity.

This is the primary reason why we can rest assured that the prices of gold and silver, and mining stocks, will be much higher over the long term. Throw in the fundamental and irresistible trend of ever-easier monetary policy, and the bottom line is that every investor who has accumulated any degree of wealth needs to protect that wealth by owning gold and silver.

Whatever you do, don’t delay. The trends I’ve discussed here are only accelerating.

Recommended Action: Buy gold.