Stocks and bonds have retreated recently due to the fallout of the Israel-Iran conflict, higher oil prices, and higher bond yields. Most high-yield asset classes in our model portfolio took a step back over the past few days in tandem with the broader market. But I like Apollo Tactical Income Fund Inc. (AIF) here, explains Bryan Perry, editor of Cash Machine.

The resilient US consumer has the Fed on hold for near-term rate cuts, as the latest retail data came in above forecast. Labor markets remain in good shape, and yet there is a real need to bring rates down to support the troubled commercial real estate market and the cost of servicing the federal debt.

Meanwhile, the Atlanta Fed raised its forecast for gross domestic product (GDP) to 2.8%, which bodes well for corporate debt, business development company (BDC) lending, energy infrastructure, and covered-call blue-chip growth.

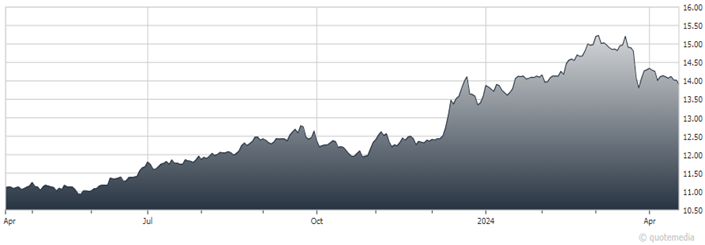

Apollo Tactical Income Fund Inc. (AIF)

The sell-off in the bond market comes right after the Fed published its dot plot chart calling for three quarter-point rate cuts by year's end. This forecast was quickly discarded by the bond market after the hot Consumer Price Index (CPI) print for March crossed the tape, coupled with some Treasury auctions that saw soft demand even as yields hit six-month highs.

Roughly 90% of the total assets recommended in the Cash Machine model portfolio are in domestic companies where the majority of revenue is derived from domestic sales. As long as the US economy is on good footing, the model portfolio is on good footing. We just need the bond market to settle down and everything held will catch a strong bid.

AIF is one of my top buys, with a yield of around 11%.

Recommended Action: Buy AIF.