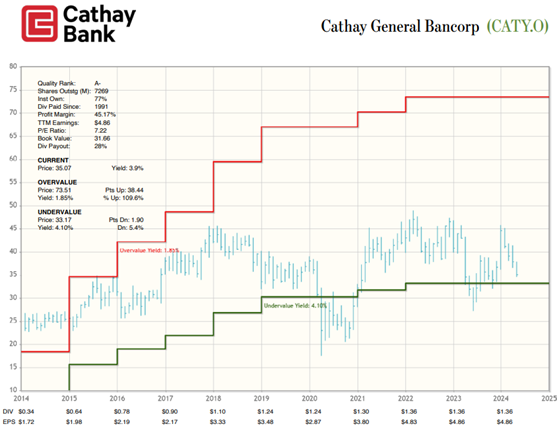

It is always interesting to see how our rankings of internal cash flow measures react when the market goes down instead of up. We’re looking for superior cash flows, which are what they are regardless of the direction of stock price. Such is the life of the dividend-centric value investor. One name I like is Cathay General Bancorp (CATY), says Kelley Wright, editor of Investment Quality Trends.

CATY was founded in 1962 and is headquartered in Los Angeles. It operates as the holding company for Cathay Bank, which offers various commercial banking products and services to individuals, professionals, and small- to medium-sized businesses in the US. The company offers the typical deposit and loan products at a regional bank, as well as public funds deposits and trade financing, letter of credit, forward currency spot and forward contract, and securities and insurance products.

CATY’s loan portfolio has grown at a compounded annual growth rate of 6.9% over the last five years, so last year’s 7.1% loan growth was in line. Management suggested the bank may see a slow down to the 5% area in the first half of 2024, however.

Cathay General caters to high-density, Asian-populated urban areas across the country, especially in California and New York where unemployment has been higher in comparison to many other regions of the US.

Higher unemployment, slower loan growth, and margins that were suppressed by higher interest rates in 2023 have pressured the stock price. But if interest rates do decline in the latter half of 2024, loan growth and margins should improve.

The ROIC, FCFY, and PVR were recently 8%, 4%, and 0.7, respectively. The Economic Book Value is $51.66 per share.

Recommended Action: Buy CATY