Following a recent, sour consumer confidence report and a set of employment figures that showed a clear hiring slowdown, bonds caught a fresh bid, and stocks haven’t looked back. Meanwhile, Golub Capital BDC Inc. (GBDC) reported Q1 results that were excellent, notes Bryan Perry, editor of Cash Machine.

The fear of missing out has made its way back into market sentiment amid renewed optimism surrounding the anticipation of potential rate cuts later this year. Plus, earnings season continues to support the base case of a steadily growing economy, although there have been some trapdoor selloffs of some well-known and broadly held stocks that make for a stock-picker’s-market set of conditions.

At the same time, over $6 trillion remain on the sidelines happily collecting 5%-plus in money markets, Certificates of Deposit (CDs), and T-Bills. And with the whiff of the Fed easing rates in the air once again, the market is responding positively to the change in the narrative.

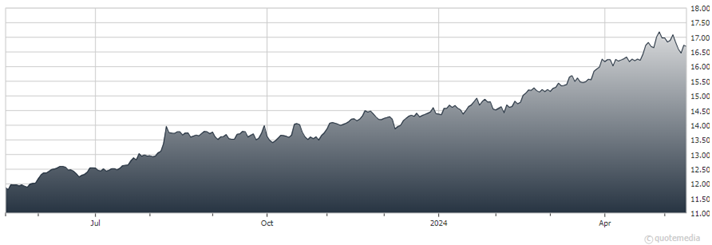

Golub Capital BDC Inc. (GBDC)

As for GBDC, the company posted earnings of $0.51 per share, a penny light of estimates and 22% higher over the first quarter of 2023. Golub posted revenues of $164.2 million for the quarter, surpassing the $162.2 million estimate and up 20% year over year. This compares with year-ago revenues of $146.9 million.

The company has topped consensus revenue estimates four times over the last four quarters. Its shares also recently yielded 9.3%.

Recommended Action: Buy GBDC.