Last month, one of the largest stocks in the market, Nvidia Corp. (NVDA) became the latest S&P 500 component to announce a stock split in 2024. Now, it’s trading at the post-10-for-1 levels. This is a moment to be embraced, advises Matthew Carr, editor of Tipping Point Profits.

There was a time stock splits were all the rage. But they’ve gone nearly extinct. In fact, we can count on one hand the announced splits for 2024. The Cooper Companies Inc. (COO)…Walmart Inc. (WMT)…Chipotle Mexican Grill Inc. (CMG)...and then Nvidia.

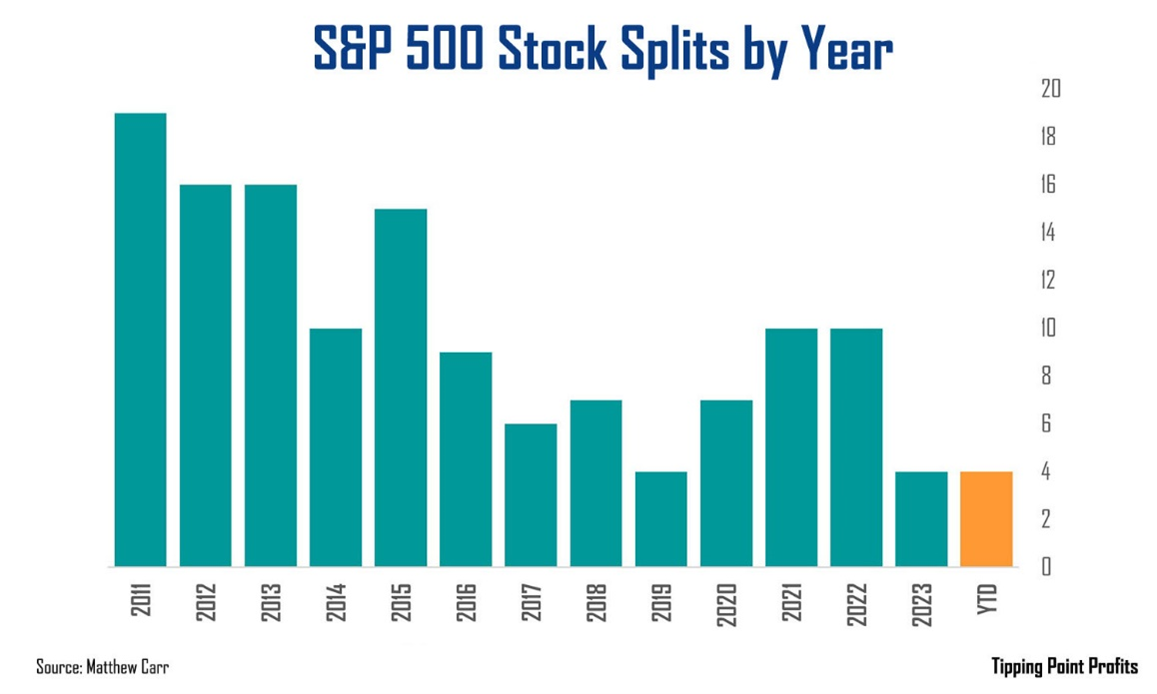

They’ve become uncommon, especially among the elite S&P 500. In fact, the number of index components that have announced forward splits (not reverse splits) has dropped 79% since 2011!

Now, there are a few arguments as to why stock splits approached near extinction. One is that the market has been controlled by institutional investors, not retail investors. I’ve long argued as the market has become more volatile, a higher share price tends to create stability. The second argument is that companies maintain a high share price because they’re less confident about the future.

But whatever the cause, the result is quite clear. There are now 288 companies on the S&P 500 with share prices above $100. Of those, 53 sport hefty price tags above $400. That’s more than 10% of the entire index! Not to mention there are 10 S&P 500 components with quadruple-digit share prices.

All of this translates into extremely expensive stocks. The average share price of an S&P 500 stock is more than 480% higher than the $36.53 it was in 2003. But all that really matters when it comes to splits is…they deliver outperformance. And not just a little.

You see, a company’s share price surges because business is booming. Investors, both small and large, want a piece of the action. But once share prices cross a certain threshold, they are seen as too expensive to smaller investors.

A company’s success ultimately prices some investors out of participating. This is why stock splits are key. And why they tend to deliver outperformance.

Two separate studies by David Ikenberry – on 1,000 companies that did 2-for-1, 3-for-1, and 4-for-1 splits – found these shares post-split outperformed the market by 8% in the year following the split. And over the longer term, they fared even better, outperforming by 12% over the ensuing three years.

Part of the reasoning for this outperformance is those expensive shares – which many investors want to own – are suddenly more affordable. And when companies cut their share price in half – or more - it helps continue the momentum that led to the share price hitting such high levels in the first place. It triggers renewed investor interest. It reignites investor demand.

For decades, stock splits have declined to the point of near extinction. They are almost as rare as unicorns. And we may never see stock splits return to the levels we saw in the 1980s and 1990s. But that means when they do occur, we can’t be afraid to take advantage. We can’t be afraid to rush out and grab a piece of the action….whether that’s Nvidia, Cooper, Walmart, or Chipotle.

Recommended Action: Buy NVDA.