Earnings season always separates the wheat from the chaff, the future winners from those that will end up being a source of year-end tax selling to offset capital gains, explains Bryan Perry, editor of Cash Machine.

Currently, the market cares about most the stocks of those companies that exceeded Wall Street estimates and raised guidance for the third quarter and all of 2018. We’re in a “take no prisoners” market where, if a company misses its quarterly numbers, its stock will suffer greatly.

What is even more compelling is that we are in the midst of what is arguably the riskiest time of the year for the stock market — through mid-September — when Wall Street’s A-Team is vacationing in the Hamptons and the B-Team is left to mange the market amid bold headlines and thin trading volume.

A top priority for me is to maintain a high level of asset stability in light of the risk of the China trade talks failing, a Turkish lira currency crisis possibly involving capital controls erupting and an Italian bank crisis occurring from too much exposure to emerging market debt.

It could be any one or a combination of these exogenous factors, among others, that can trigger renewed selling pressure. Because trading is light, the moves are more exacerbated.

And while the market landscape is currently somewhat of a post-earnings-season minefield, there are plenty of stocks that are trading higher against nearly any and all negative forces that impact the broader market.

For example, within the electronic payments sector, there are some true market standouts that rarely give much ground on bad days and just march higher month after month, year after year.

Visa (V) and MasterCard (MA) are the most widely known and owned, but there are other lesser-known stocks that are just as impressive. These companies facilitate the point-of-sale transaction companies like Visa, MasterCard, American Express (AXP), Discover Financial Services (DFS), PayPal (PYPL), Square Inc. (SQ), Apple Pay and Google Wallet, along with bank debit and credit cards.

Such digital payment infrastructure stocks offer technology that focuses on the smooth processing of billions of dollars of daily transactions around the globe. My favorite companies within this space include Global Payments (GPN), Total Systems (TSS) First Data (FDC), Fiserv (FISV) and Worldpay (WP).

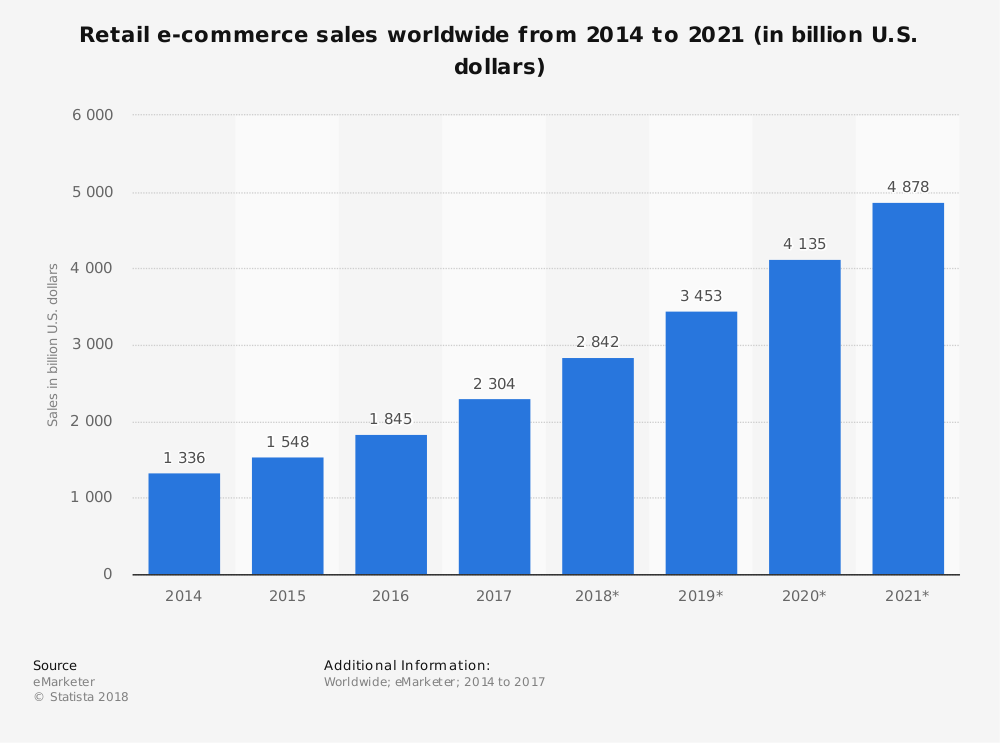

These companies operate in both the physical and mobile payment platforms where the compounded annual growth rate (CAGR) of digital payment just in the United States is expected to be 13.5% through 2022. The working term is “digital commerce” and the Transaction Value is set to grow from $2.8 trillion in 2018 to $5.4 trillion in 2022.

So, no matter what happens with China, Iran, Turkey, NAFTA, the World Trade Organization, Europe or the mid-term elections, the growth of mobile e-commerce and digital commerce is going to rapidly expand.

My view is that any headlines that cross the tape that inflict any short-term price pressure on any of these stocks noted should be used as an opportunity to initiate and add to positions.

It is rare that investors can buy into a five-year secular trend within a mature bull market that literally touches all aspects of businesses, governments and individuals. While Wall Street spends billions of dollars researching the “next big thing,” my advice to investors is simple — follow the money.