Sponsored Content - To be sure, I very much am of the view that a great many resource-oriented stories and the best companies have incredible futures ahead of them, says Chris Temple, editor and publisher, National Investor Publishing.

Whether we first must go through another deflationary market bust, and/or grapple with China now being a negative influence on metals prices especially, or whatever, the future is bright nonetheless.

And that is why—though I remain stand-offish on sector positions (like ETFs and such) where most base and battery metals go—I nonetheless have quite a few individual companies in these areas on my recommended list. A few of those that both represent superior opportunities and who I am especially close to (and which are helping underwrite the distribution of this Special Report) are profiled in it.

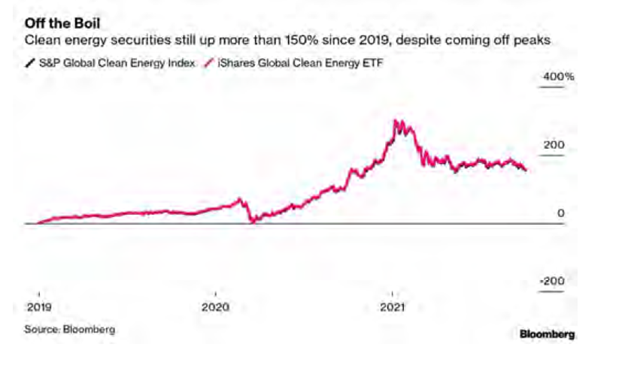

For those kinds of stocks especially, generally speaking, this is an especially good time to be looking at them. After a huge surge for most of 2020, these kinds of stocks generally are down a fair bit for 2021. As you see in the chart below, as a group the clean energy-oriented stocks this year were recently down nearly 40% from their previous highs. Certain previously red-hot darlings have really been shellacked: hydrogen fuel cell maker Plug Power (PLUG) was recently down a bit more than half from its January high and QuantumScape Corp. (QS)—a maker of batteries for EVs—is but 20% or so off its late-2020 peak.

There are three major reasons as I see things. First, that the broad stock market, so-called “meme stocks,” crypto currencies, and the like have been on such tears more recently, it has taken attention away. Second, markets have seemed to understand a fair bit a lot of the concerns I have voiced in the Special Report: namely, that—for all its talk—the Biden Administration has badly handled all of this green economy, infrastructure, and related business and has, of this date, nothing to show for its goals and promises.

Third, this space in some ways is akin to the behavior that was manifested by the Internet and dot-com stocks of the late 90s and the first big marijuana craze surge several years ago. Similarly to those two prior episodes (but especially now with the Fed making so much liquidity available that traders are more stupid and feel even more bullet proof than ever) piles of money flowed into most anything to do with batteries, EVs, and whatnot. Now, some of that has settled back down. IMO, both Plug and QS are still too expensive for where things stand now. Yet—if anything of substance does come out in the days ahead from Washington and/or Glasgow—each may have seen their bottoms.

Look at Tesla (TSLA), which—as the week of October 25 commenced—reported that Hertz has put in an order for 100,000 vehicles. That has catapulted its market cap to within a whisker of $1 trillion, valuing it even more so as worth more than every other auto company on Planet Earth combined.

Tesla’s offtake agreement last year for lithium with Piedmont Lithium (PLL) took shares in that company (which you’ll learn more about in the Special Report) from the $6.00 area I was pounding the table on last summer to the $80.00 area. Tesla wanted to have some ability to tie up the raw materials it will need to meet Hertz’s and other orders in years to come.

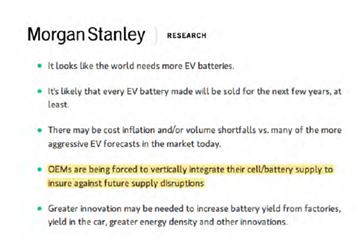

An investment theme going forward will be to ask “Who’s next?” With resource nationalism…the need to build and control vertical supply chains as close to “home” as possible…and all, I am on the hunt for “the next Piedmonts” (a few of which you’ll be reading about in the Special Report, and more of which I am researching.) There are a good many battery/base metals projects throughout the world…and throughout North America and South America alike. But especially with the Biden Administration taking so many out of play, we’ll need to look at those that aren’t in Sleepy Joe’s or Deb Haaland’s sights to be killed.

As time goes on, we’ll be hearing more about moves such as Tesla’s last year to tie up a portion of Piedmont’s coming lithium hydroxide production. One example of many from just a few weeks ago was Ford’s announcement that it’s committing some $11 billion to build a total of three battery and related facilities in western Tennessee and central Kentucky. Among other things, this investment will mean 11,000 direct jobs; further, the automaker announced that about half a billion dollars will be earmarked for a trade school network of sorts to train mechanics.

Yes, there is near-term risk. Yes, the Biden Administration has ruined, so far, just about everything it has touched, and set back causes these companies are pursuing. BUT that does not mean we just sit on our hands. And also, as I alluded to earlier—and display just in the Special Report with a few very unique story stocks—there are any number of compelling stories among companies helping to “green” the planet in one way or another that thankfully are not on the hit list of “milk comes from the grocery store crowd.”

If you want to learn how to power your portfolio into the future with 10 stocks that could profit from the green economy revolution, click her to download Chris Temple’s Special Report: Building the Green Economy.