Sam Shames, vice president of Options at Simpler Trading, speaks about how to manage your risk position and sizing your trades using sophisticated indicators like the EMAs and squeeze techniques.

As a trader, position sizing can help you trade more strategically, taking a more calculated or measured risk.

The approach to position sizing is similar to playing blackjack. In blackjack, you’re willing to bet more money when you think there are a lot of high cards in the deck—a better opportunity to win against the house. And when there are only lower cards remaining, you’ll likely take less risk. The same is true in the markets: when you think the market is in your favor, you’ll likely trade larger positions.

And how do you know when the market is in your favor? Let’s talk about how to read the market and how to decide what trading positions and position sizes to take.

What Is Position Sizing?

To put it simply, position sizing determines how much money a trader is willing to allocate to a single trade. It helps control risk and mitigate potentially major losses…whether you’re day trading or swing trading. I’ve found the best way to determine how much to risk is by rating the trade setups; your rating will directly impact your decision on how to size the trade. If you have a really good trade setup, you’re more likely to increase your exposure.

I think it’s best to consider the size of your account in terms of percentage, and not dollars. In my experience, it’s easier to think about the risk from that perspective and to arrive at a comfortable position size to take for your trade—whether it’s 5% or 20%. I can only suggest this position sizing technique, but the actual decision on trade size is based on your personal risk profile…it’s something only you can answer. In my personal trading plan, a healthy position size for a standard trade is around 5%. From there, I know that I can size the position up or down, according to the quality of the setup.

How to Determine Your Trading Positions

I take several factors into consideration before I enter a trade. Let’s walk through some of my decision-making processes.

First, I really like to look at market momentum—I rely on a momentum oscillator indicator called TrendOscillator Pro. It helps me scout for stocks that may appear to have a quality trend and using the TrendOscillator Pro can help validate its movement.

In addition, I rely on my go-to setups when making trade decisions. As I mentioned, the quality of your setups will have a direct impact on your position sizing. Here is how I evaluate a trade and determine the position size.

Stacked Moving Averages

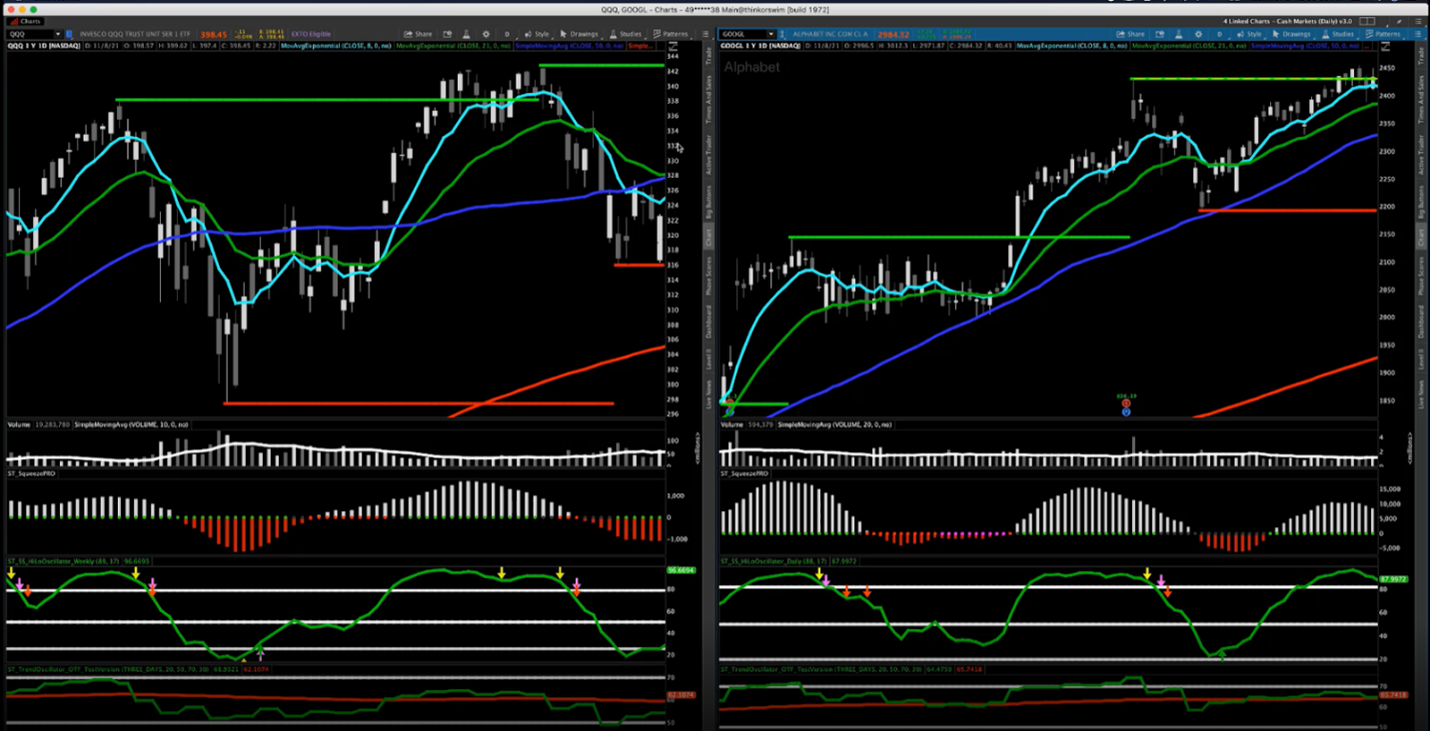

You’ll want the moving averages to look like the Alphabet (GOOGL) chart below on the right. You will notice blue, green, and light blue lines moving in a defined upward angle. The angles are important indicators because essentially they will tell you if you are in a bullish or bearish trend.

Do You Have a Squeeze?

A squeeze is a moment in time when a potentially explosive price point will occur within a stock. You’ll want to observe a stock that has been highly compressed in the market because there is a possibility for a major directional move. You can see both the GOOGL and PowerShares QQQ Trust Ser 1 (QQQ) charts above are printing squeezes.

Is the Index and Sector Confirming?

You will then want to know if the stock that you are observing is in sync with its parent sector. For instance, you’ll want to see trendlines that are identical with each other. And in the chart above, GOOGL and the QQQ index are synchronized and have similar trendlines.

Are You Near a Buy Point?

The last thing to observe is if the position is near the daily 21 exponential moving average (EMA) or the daily 50 simple moving average (SMA). If that’s the case and the position meets the rest of the criteria above, then it may be a good candidate to trade.

Keep Your Position Sizing Technique Flexible

Once you've determined your initial position, you'll want to adjust based on market movement. For instance, witnessing a yield curve within the market is a perfect example of why you should stay flexible while trading. Your ability to react to changes, and have data from your indicators and setups, will better equip you to take advantage of new opportunities or mitigate increasing risk.

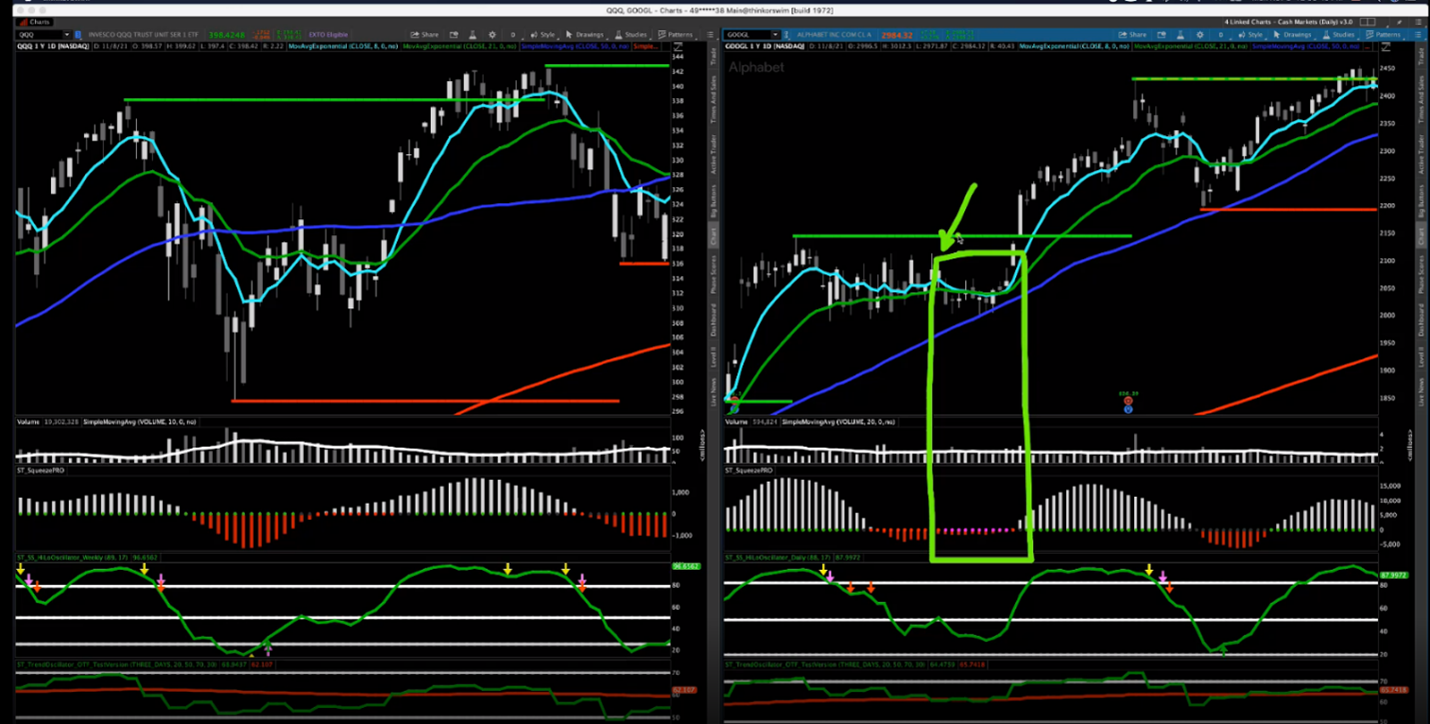

In cases where a stock has dropped significantly, you’ll have three options: you can sell, hold your position, or buy more. If your position holds true to your setups, you may see it as a discounted buying opportunity and add more exposure. If you have the capital and the discipline, it may be a lucrative position to increase your capital within that trade. The chart below with GOOGL and the QQQ shows an example of staying in the game after a loss and buying more when the setup held true.

The chart on the right shows the entry point, marked by the arrow. Losses started to happen fairly quickly. However, the stock was in an upward position, with a squeeze, and the trendline was above the stacked moving averages, all the while the index confirming the strength of GOOGL. The decision to stay in GOOGL was validated by the setup, and the price increase shown in the chart proves the technique worked.

It was just a matter of time until GOOGL moved up again, but that is the power of position sizing. You do the research and find the stocks that meet your criteria within the setup, and then you make your trade. If it’s a highly rated setup, then start off with a modest amount—10% for example—and continue to evaluate from there.

Overall, focusing on position sizing is one of the most important things you can do for yourself as a trader. Using reliable trade setups can help you avoid higher risk as well as identify a chance to grab more profit.

If you’d like more information and education on position sizing and trade strategies, be sure to visit us at SimplerTrading.com.