Sponsored Content - Recently, there has been a lot of press about Central Banks buying gold. It is completely true, says Rich Checkan, president & COO, Asset Strategies International.

So, I thought I’d take the opportunity to pull back the curtain on Central Bank gold purchases, who they buy from, how they buy, how much they have been buying, and…why all this is important to you right now.

From Whom Do Central Banks Buy Gold?

For every buyer, there must be a seller.

Most commonly, the first option for Central Bank gold purchases is to buy Over the Counter (OTC). The Central Banks buy directly from wholesalers large enough to handle their order volume. So, that typically means bullion banks. Some current and former bullion banks include:

- BNP Paribas

- Citibank

- Credit Suisse

- Goldman Sachs

- HSBC

- ICBC Standard Bank

- JP Morgan Chase

- Merrill Lynch

- Morgan Stanley

- TD Bank

- UBS

- Standard Chartered Bank

Of these, the dominant force is JP Morgan Chase. OTC purchases can also be made through major gold refiners such as MKS PAMP. The second option available to Central Banks for gold purchases is the Bank of International Settlements (BIS). BIS is a Central Bank’s bank located in Basel, Switzerland. The last option available to Central Banks is to buy home-grown, locally sourced gold. This option is often the most cost-effective choice for countries that produce gold. Local gold purchase programs exist in China, Russia, Mongolia, and the Philippines.

Of course, other Central Banks or super-nationals may sell from time to time as well. For example, the Central Bank of India famously purchased 200 metric tons of gold directly from the International Monetary Fund (IMF) back in 2009, at a price of roughly $1,050 per ounce. At the time, I stated publicly that I thought that was the end of three-digit gold (gold less than $1,000 per ounce). Fourteen years later, I’m certain I was right.

Regardless of the source of gold, Central Banks tend to buy Good Delivery Bars. The standards for Good Delivery Bars are set by the London Bullion Market Association (LBMA). These bars must have a minimum purity of 95.5%, and they must weigh between 350 and 430 troy ounces.

Have Central Banks Really Been Buying Gold?

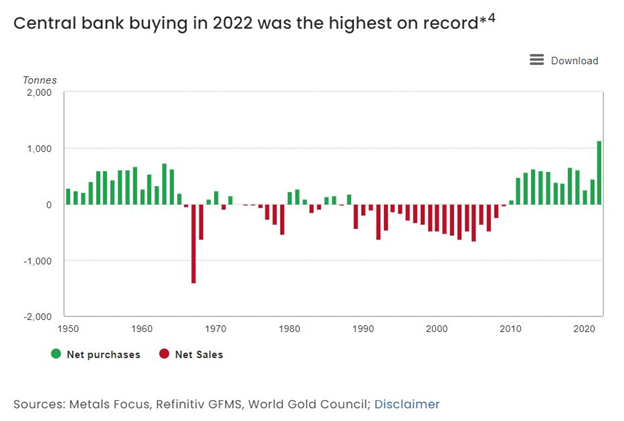

Boy, have they ever! Look at this chart from the World Gold Council…

For the past thirteen years, Central Banks have been net buyers of gold. In fact, last year, Central bank buying was at an all-time high. We had not seen buying numbers even close to 2022 totals since the 1950’s and 1960’s. As a result of the record-setting Central Bank buying in 2022, most analysts predicted there must be a drop-off in 2023. However, Central Bank buying in the first Quarter 2023 (228.4 tons) was 76% more than the first Quarter 2022 (82.7 tons)…and 34% higher than the previous first Quarter record of 170.4 tons back in 2013! This train is not slowing down. The biggest buyers are Singapore, China, Turkey, India, and the Czech Republic.

Why Are Central Banks Buying Gold and Why Is That Important?

In the most recent World Gold Council Survey of Central Banks, Central Banks noted two primary reasons for buying more gold.

1. Gold’s performance during times of crisis.

2. Gold’s role as a long-term store of value.

None of this should be a surprise in an environment riddled with geopolitical uncertainty, persistent inflation, fears of recession, and banking instability. Further, I absolutely believe the weaponization of the US dollar has driven both enemies and friends to reduce the number of US dollars they hold in currency reserves. In the place of US dollar reserves, Central Banks are opting for increased exposure to gold and other foreign currencies…such as the Chinese yuan.

Why? Simple. Either because they were cut-off from the world’s banking system (enemies) or because they fear they might be cut-off from the world’s banking system in the future (friends), the Central Bankers are diversifying out of our mismanaged dollar. In a nutshell, Central Banks are buying gold for all the reasons we buy gold personally. It is first and foremost their wealth insurance…

“Gold as wealth insurance is simply a store of purchasing power, with high liquidity, for a potential financial crisis you hope to never have.”

That’s why Central Banks bought gold in record numbers last year. That’s why Central Banks bought gold in record numbers in the first quarter of this year. That’s why you should be following their lead.

Knowing what they know about the state of the world’s financial system, and given they are buying gold in such a robust manner, don’t you think you should be buying as well? In 2023, there is no better way to Keep What’s Yours than to buy gold here and now.

Good investing…

Learn more about Rich Checkan at AssetStrategies.com.