A less hawkish Fed and a pause in the U.S.-China trade war gave risk sentiment a boost. However, market volatility returned today. The UK has a risky week ahead as Parliament votes on PM Theresa May’s Brexit plan, writes Amelia Bourdeau Tuesday.

Oil prices are materially lower since the last Bank of Canada policy meeting. Traders want to hear what the Bank of Canada has to say about it. This could have further negative implications for CAD.

A temporary respite

Last week, Fed Chairman Jerome Powell backed off hawkish Fed rhetoric and the November FOMC minutes showed a dovish transition to language of data dependency, suggesting a more tentative approach by the Fed to rate hikes in 2019. The U.S. 10-year bond yield fell, which weakened the U.S. dollar (USD). However, the less hawkish Fed stance gave a boost to US equities late last week.

The main takeaway from the much-anticipated Trump-Xi dinner at the G20 meeting was the announcement of a 90-day truce in the U.S.-China trade war. U.S. and global indexes rallied Monday.

However, today at the time of writing, volatility has jumped and U.S. equity indexes are down heavily. The market has turned skeptical of the Trump announcements regarding the U.S.-China trade war. It seems as if “the emperor has no clothes” in that not much if anything concrete has been decided on in terms of trade negotiations with China. Traders are also worried that the flattening of the U.S. yield curve implies an economic slowdown ahead.

In light of the very volatile U.S. equity trading sessions lately, I thought it was worth looking at December seasonality for the Dow Jones Industrial Average. It is worth noting that, over the past five years, the DJIA tends to finish higher in December (see chart below).

Related: Wall Street drops Tuesday on trade truce doubts, bond market jitters, reports Reuters.

Chart: DJIA seasonal performance last 5 years

Source: Bloomberg

Regarding the G10 currencies, although the USD has lost a bit of support through lower U.S. yields, its safe-haven bid remains. There are still many global event risks: strength of the U.S. economy going forward, fuel tax riots in Paris, Italy budget situation, Brexit, and U.S.-China trade talks into the 90-day deadline.

Deal or no deal?

The season finale of the United Kingdom is approaching. The UK seems poised to end 2018 with a drama-filled December. The House of Commons debate on PM Theresa May’s Brexit deal starts on Tuesday. The vote on whether to approve the deal is December 11. In between there will be more debates, proposed amendments and headlines moving the British pound (GBP). Bloomberg reports that May's government “has repeatedly refused to say what it would do if it loses the vote.” Options presumably include pursuing a no deal exit, seeking a vote of no-confidence in the government, and ousting May as the leader of the Tory party.

Watch Amelia Bourdeau in a short video: Never waste a crisis when trading.

All of the uncertainty has not been good for GBP. Not even the one-two combo of a halt in the trade war, which lifted general market risk seeking sentiment, and a less hawkish Fed, which weighed on the USD, could boost GBP. GBP/USD remains in the 1.2850 – 1.2700 range (see chart). It even tested the bottom of the range, temporarily trading to 1.2699.

Traders remain short GBP/USD, so it will take fresh negative headlines to make a decisive break of 1.2700 support. However, GBP feels “heavy” – and there is plenty of UK event risk over the next week – so stay tuned.

Chart: GBP/USD remains in range

Source: Bloomberg

No CAD do

Since, the Fed is moving to more data dependency regarding further rate hikes, there is a possibility that the Bank of Canada (BOC) may move in that direction as well. As a result, Wednesday’s BC monetary policy statement could lean a bit dovish. Traders also are looking to see what the BC has to say on oil prices. The BOC is expected to keep its policy rate unchanged at 1.75%.

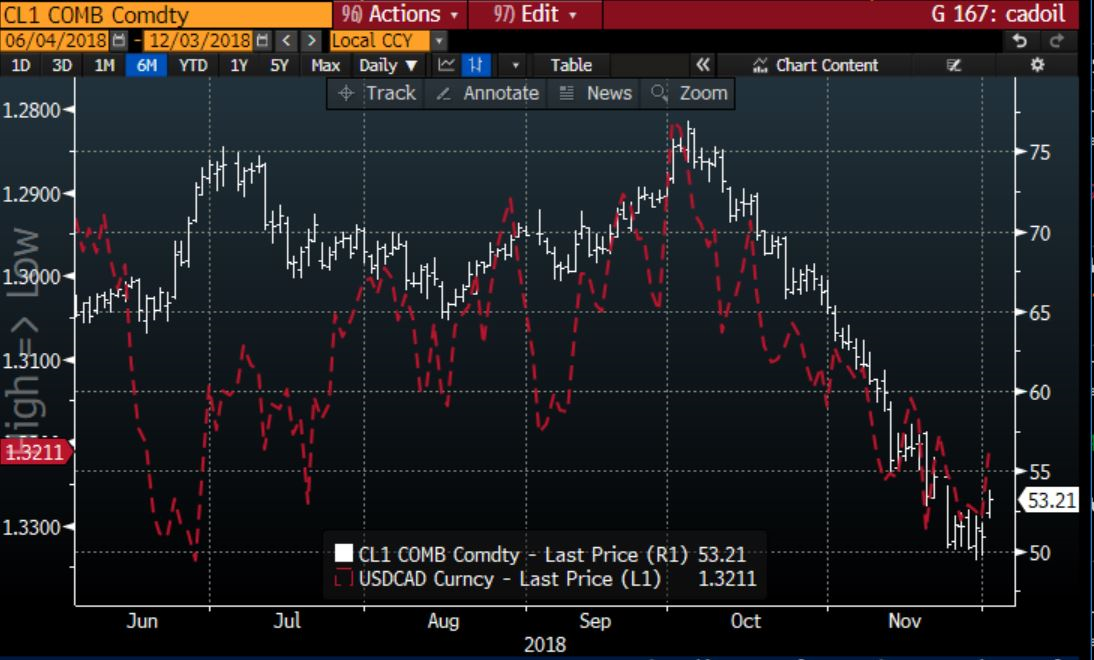

The chart below shows USD/CAD vs Crude Oil 1st future. Note, that the left side axis for USD/CAD is inverted so the red line moving lower means the USD is strengthening vs. CAD and the red line higher means the USD is weakening vs CAD.

One can see the two series moving together. With the latest slight rise in oil price, CAD halted its decline against the USD. However, if the BOC sounds very concerned about the impact of materially lower oil prices (since its last policy meeting) on the economy, the market could move to price out the 25bp rate hike for the January BOC meeting. This would weigh on CAD.

Chart: USD/CAD vs. Crude Oil 1st Future

Source: Bloomberg

You can find out more about Market Compass and sign up for free content at www.marketcompassllc.com. Click on “Get the Guide Now.”

Follow Market Compass: Instagram: @marketcompass; Facebook: Market Compass LLC; Twitter: @ameliabourdeau

Watch Amelia Bourdeau in a short video: Never waste a crisis when trading.

Recorded: TradersExpo Las Vegas, Nov. 13, 2018.

Duration: 2:58.

Amelia Bourdeau: Trading volatility, in a short video.

Recorded: TradersExpo Las Vegas, Nov. 13, 2018.

Duration: 4:31.

Related: Bill Baruch’s Midday Market Minute short video for Dec. 4 here.