With the new cyclical calendar beginning with spring, it was the appropriate time for an FOMC meeting.

With the new cyclical calendar beginning with the spring equinox, it was the appropriate time for a Federal Open Markets Committee (FOMC) meeting. The Fed turned a little more dovish in there statement coming out of the March FOMC meeting, acknowledging that they won’t be raising rates this year. Why do you suppose they decided that?

Here’s an opinion that you didn’t hear on television today. As many of you know, a couple of months back I quoted Daniel Estulin who stated some of the Band of International Settlements statistics shows world debt at over $233 trillion and when you tack on derivatives that number balloons all the way up to $1 to $2 quadrillion.

If that’s the case, why am I not part of the sky is falling crowd? First off, vibrational square outs in the market are my navigational instrument. When its going to drop, chances are, I’ll see the square out first. Just as important is the bond market. Everything is good until such time long-term rates start getting out of control. They are not out of control right now. Servicing debt doesn’t become a problem until it does. Instruments will go over an invisible line, which is the point of no return. We know all about that from 2008. We won’t be there until the bond market starts challenging last year’s lows.

riefly, the bull market for bonds ended a couple of years ago—though it is hard to precisely define the end of a 36-year trend until years later. Do you really believe that all we are going to get is a three-year reaction to a 36-year trend? We could be in a higher rate environment for years to come. So, the clock is ticking.

More important for anyone remotely interested in market cycles is the March seasonal change point, which comes on the change of season. As a sweetener, March 20-21st is the equivalent of New Year’s Day for financial markets. The Gann calendar starts right here. What you’ll find is certain turns in the market throughout the year will be calibrated to this time period. Many markets will change direction this time of year.

Basically, the Fed said growth will remain decent this year, but not at the pace of 2018. So, they acknowledge a slowdown. A money manager on one of the business channels celebrated the news by suggesting the economy, if it were to hit a recession, will come to one of those “soft landings.”

We haven’t heard this sentiment in years. History suggests there is no such thing as a soft landing. Getting back to my opinion, I believe the Fed is not going to raise rates the rest of this year and minimally into the foreseeable future because they are aware of the global debt issue and don’t want to do anything to irritate the situation.

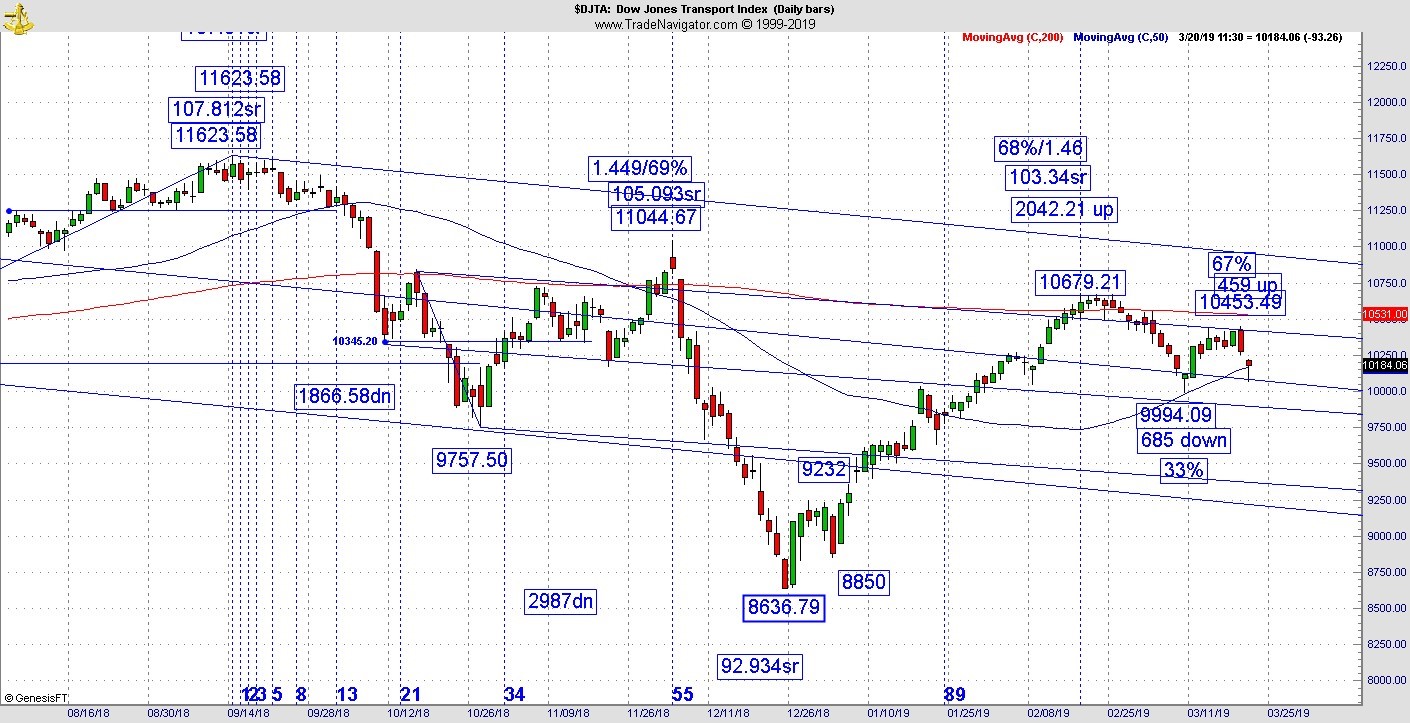

Leading into the seasonal change point was a bad earnings report for FedEx (FDX), which was taken to the woodshed Tuesday night. United Parcel Service (UPS) moved in sympathy and the Transports gapped down as well. We already have a divergence working as the Dow and Russell 2000 failed to set new highs. If the Transports don’t recover, this will mark the beginning of an important Dow Theory divergence which could end up tipping the whole market over. What has developed in the Transports is since the high in February, they put in a secondary high supported by a gap down (see chart below). Does that confirm a secondary high since the peak in the rally that started at the end of last year?

On the chart of the week, here’s what we need to be concerned about. The recent February high was a 68% retracement of the top. The current retest of that high is a 67% retracement and what I’ve found is, since markets are non-linear, the fractals they create tend to replicate. That’s why we have a 67% retracement following on the heels of a larger 68% retracement. Can it recover? Sure it can, but look what has happened over the past week or so. Boeing (BA) has their problems and experienced part of their 737-fleet grounded all around the world. The stock got crushed and while BA is not a traditional transportation stock, its related. Then we had the bad report from FDX just the other night. FDX could now become a poisoned well, which probably won’t recover anytime soon. We know Boeing is a poisoned well which won’t recover anytime soon. You can figure out the rest.

If we lose the Transports, it will be just as important — if not more important — than losing the Russell 2000. In a healthy market, small caps are leading to the upside. Once upon a time Amazon was a small cap. Every new bull market represents new technology that didn’t exist in the prior bull market. When small caps are leading to the downside, some key ingredient to the next good business cycle is not there. That’s where we are right now.

It’s been a good recovery for the market this year but now for the first time we see some areas of concern. If it is not rectified, it will mean trouble later in the year.