The QuantCycles Oscillator has Amazon oversold and turning higher, reports John Rawlins.

With news of a Congressional antitrust investigation against major U.S. technology companies, we thought it would be a good time to look at one of its major players.

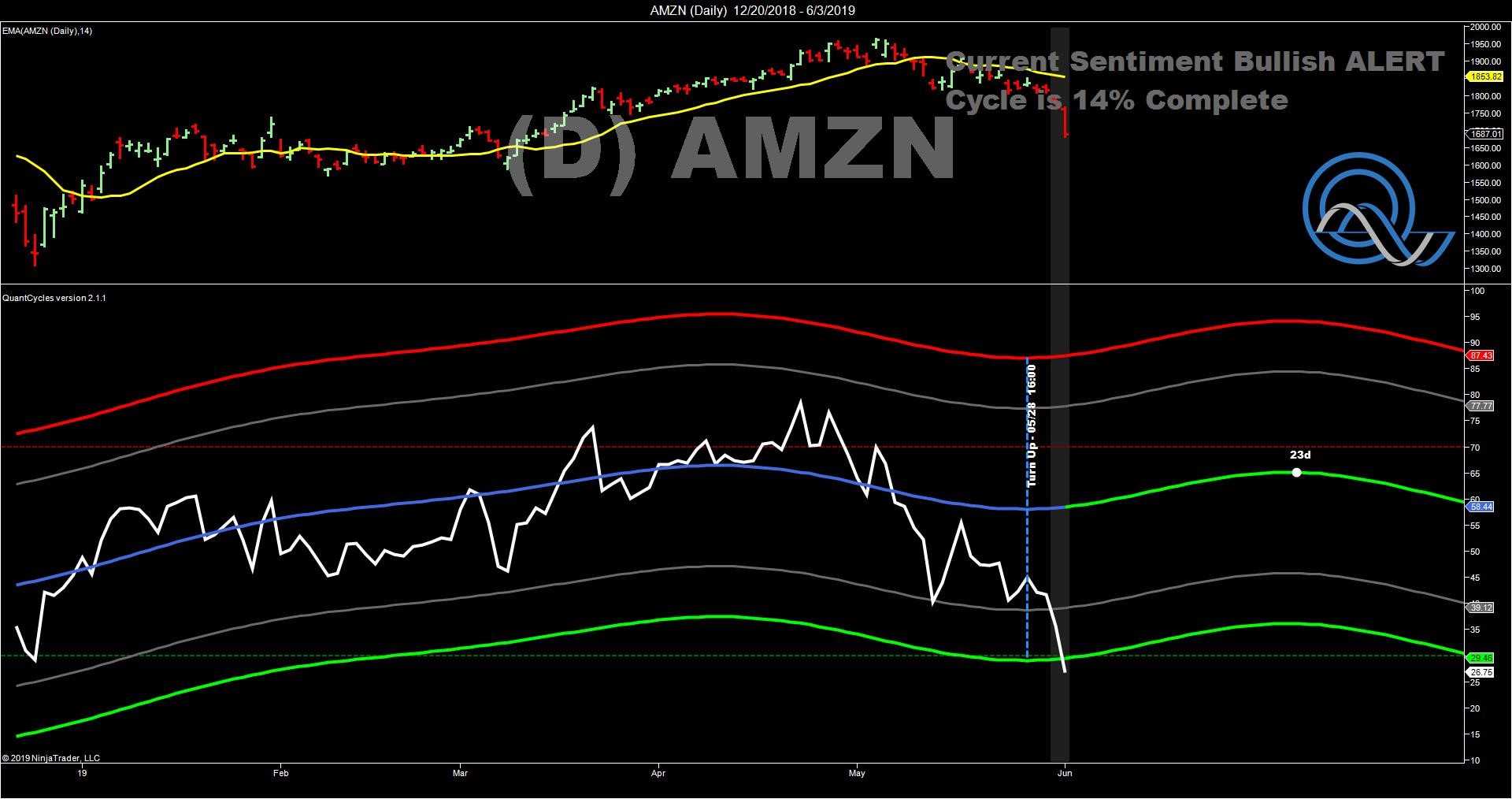

Amazon (AMZN) made a multi-month low earlier this morning following the report of the investigation. The weakness in Amazon over the last several weeks has pushed it to near oversold territory in our weekly QuantCycles Oscillator (see chart).

This weakness, tracking broader equity weakness, came in the midst of a bullish projection in the oscillator. That upturn is expected to persist for several more weeks.

The more immediate selloff due to the investigation has pushed the shorter-term QuantCycles charts into oversold territory just as they are turning higher (see charts).

As you can see both the daily and four-hour charts are oversold and have recently turned bullish.

This looks to be a tremendous buying opportunity. The investigation is not likely to create any near-term charges, so after the shock is over, a rebound is likely. In fact Amazon is already trading $30 above overnight lows.

John Rawlins described the value of the QuantCycles Oscillator recently at The Orlando MoneyShow.

The QuantCycles indicator is a technical tool that employs proprietary statistical techniques and complex algorithms to filter multiple cycles from historical data, combines them to obtain cyclical information from price data and then gives a graphical representation of their predictive behavior (center line forecast). Other proprietary frequency techniques are then employed to obtain the cycles embedded in the prices. The upper and lower bands of the oscillator represent a two-standard deviation move from the predictive price band and are indicative of extreme overbought/oversold conditions.