It’s better to follow large trades for direction than to read the Fed tea leaves, and this large trade says rates are going nowhere, reports Jay Soloff.

One of the big questions for the financial markets is where interest rates are going — in 2020 and beyond. The bond market has been in the midst of a 30-year + bull market that may or may not have ended recently.

On one hand, the labor market is strong and stock prices are at all-time highs. On the other hand, many other economic indicators are showing a slowing economy and there is still a huge amount of debt out there—public and private.

This week, the Federal Reserve’s Open Markets Committee (FOMC) met for the final time this year and agreed to leave the Fed Funds rate where it is. of the year. The language in the Fed statement indicated that are willing to be on pause for quite some time.

One trade I came across in the options market could give some clues about rate expectations next year. This trade was a large covered call position established in iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD). LQD is an extremely popular exchange traded fund (RTF), which tracks investment grade corporate bonds.

The trade itself was comprised of 750,000 shares of LQD versus 7,500 January calls. The shares were purchased for $127.60, while the January 128 strike calls were sold for 65¢. That means nearly $500,000 was collected in premium.

In terms of yield, the trade generates a half percent in just over a month. Now that may not seem like a lot, but there are a few things to consider. First off, LQD is a very low volatility ETF, so options premium is low. What’s more, if you annualize this trade, it works out to almost 6% on the year, which isn’t bad in an ultra-low rate environment.

Furthermore, LQD does pay a 35¢ dividend during the period of this trade. Since the dividend will be collected by the trader (the shares were purchased as part of the trade), that raises the yield to 0.8%.

Because the calls were sold at the 128 strike, the trade can also earn another 40¢ of stock appreciation. Meanwhile, the 65¢ collected from the calls provides some decent downside cushion through January expiration (down to $126.95).

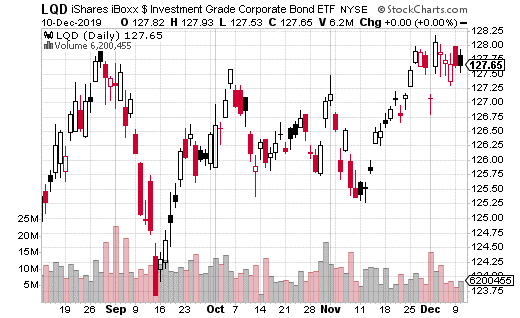

This ETF doesn’t move all that much over the short-term. As you can see from the chart, the entire range for the stock price since October is roughly $125.50 to $128. This is definitely a low volatility instrument.

A covered call like this one is neutral in its outlook. There is some upside potential built in, along with some downside cushion. Whoever made this trade doesn’t expect a lot to happen with corporate bonds in the next month.

Of course, corporate bonds are heavily influenced by the Fed Funds rate. This suggests the Fed is going to stay neutral on rates at the start of 2020, as it indicated. This trade would also be an easy thing for you to emulate in your portfolio, especially if you already hold LQD for your portfolio’s corporate bond exposure.

Jay Soloff is the Options Portfolio Manager at Investors Alley. He is the editor for Options Profit Engine, an investment advisory bringing you professional options trading strategies, with all the bells and whistles of Wall Street, but simplified so all you have to do is enter the trades with your broker.