Exit strategies for our covered call writing and put-selling portfolios allow us to mitigate potential losses and enhance gains to even higher levels. Previously, I detailed my 20% and 10% guideline exit strategies for both covered calls and put selling. Although the name is the same, the circumstances are different for each strategy and this article will highlight those distinctions.

Covered call writing with the 20%/10% guidelines

We are in two positions: long stock + short call. Every exit strategy starts with buying back the option. After entering the covered call position, if the stock was sold first (most brokerages would not permit this for retail investors), it would leave us in a risky naked short-call option position. Therefore, we first buy back the option on a declining share price when the option price reaches 20% of the original sale price in the first half of the option contract or 10% in the latter half of the contract.

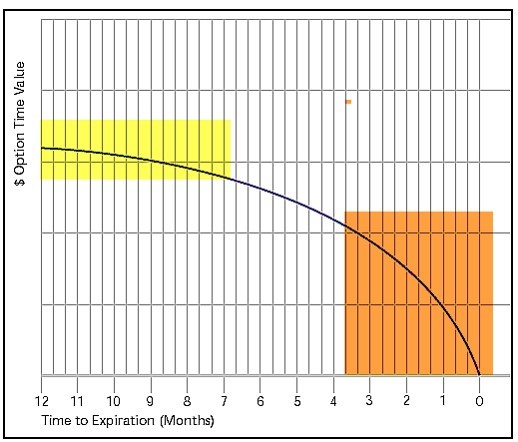

If the option was sold for $2.00, the thresholds to close would be 40¢ or less and 20¢ or less, respectively. The rationale for the change in threshold relates to Theta or time-value erosion, which dictates how much money we are willing to spend to close the short call. We have a much greater opportunity to benefit from time-value credits early in the contract compared to later in the contract when time value declines exponentially as depicted in the chart below:

Theta and Time-Value Erosion of Our Options

For covered call writing, the 20%/10% guidelines relate to a declining share price.

Put-selling with the 20%/10% guidelines

We are in one position, the short put. We have the 3% guideline if share price declines and the 20%/10% guidelines if share price rises exponentially. Option value will fall if share price rises. If option value declines to the point where we can retain 80% to 90% of the original time-value profit early in the contract, we can close the short put position and use the cash that previously secured the original put sale to enter a new put position and generate a second income stream in the same contract period with the same cash investment.

This is analogous to the mid-contract unwind exit strategy for covered call writing. Here is the hypothetical example I used in my book, Selling Cash-Secured Puts.

- Stock trading at $51

- Sell the $50 out-of-the-money put for $1.50

- Cash required to secure the put trade is $4850.00 ($5000.00 – $150)

- Initial return is $150.00/$4850.00 = 3.1%

- In the first half of the contract, the share price accelerates to $57

- The $50 put premium value declines to 30¢ or 20% of the original put premium

- Buy back the $50 put retaining 80% of the original put profit

- Use the $5,000 per contract cash (less put premium) to secure another put position which generates more cash than the cost-to-close the original one

Discussion

The 20%/10% guidelines apply to both covered call writing and selling cash-secured puts. Since option premium is directly-related to share price movement for covered call writing and inversely-related for put-selling, the strategy is used to mitigate losses in the former and enhance gains in the latter.

Use the multiple tab of the Ellman Calculator to calculate initial option returns (ROO), upside potential (for out-of-the-money strikes) and downside protection (for in-the-money strikes). The breakeven price point is also calculated. For more information on the PCP strategy and put-selling trade management click here and here.