Alan Ellman discusses when it is appropriate to buy back profitable short options.

Recognizing successful covered call writing trades is just as important as executing them. On Jan.17, 2020, subscriber Mark wrote to me about a covered call trade that he was analyzing with SolarEdge Technologies, Inc. (SEDG). He was concerned that if he bought back a deep in-the-money call, he would suffer a significant loss.

Mark’s trade

- Dec. 27, 2019: Buy SEDG at $94.27 and sell-to-open the Jan. 17, 2020 $90 call at $6.30

- Jan. 17, 2020: SEDG is trading at $104.85 and the cost-to-close the Jan. 17, 2020 $90 call is $14.90

Mark was concerned that if he closed the short call to retain the shares, there would be an option loss of $8.60 per share ($14.90 – $6.30) or $860 per contract. Let’s first look at how the trade was structured and see if it can be categorized as successful both before and after closing the short call.

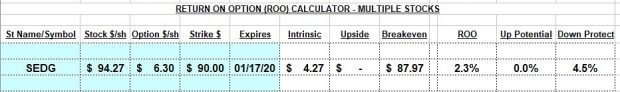

SEDG initial calculations

SEDG Initial Calculations with the

Ellman Calculator

The calculations show a maximum return of 2.3% with downside protection of 4.5% of that initial time-value profit. On Jan.17, that maximum return is realized prior to closing the short call.

Will closing the short call result in a substantial loss?

At expiration our shares can be worth no more than $90 due to our contract obligation. Let’s use the “unwind Now” tab of the Elite version of the Ellman Calculator to see the time-value cost-to-close the $90 short call:

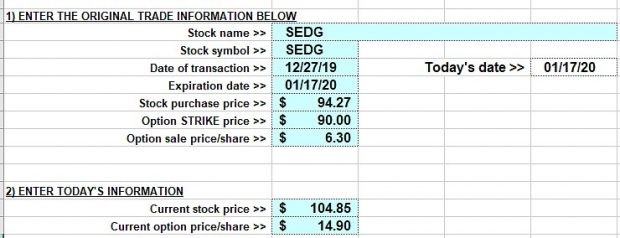

SEDG unwind- information entered

Elite Calculator: Unwind Information Entered

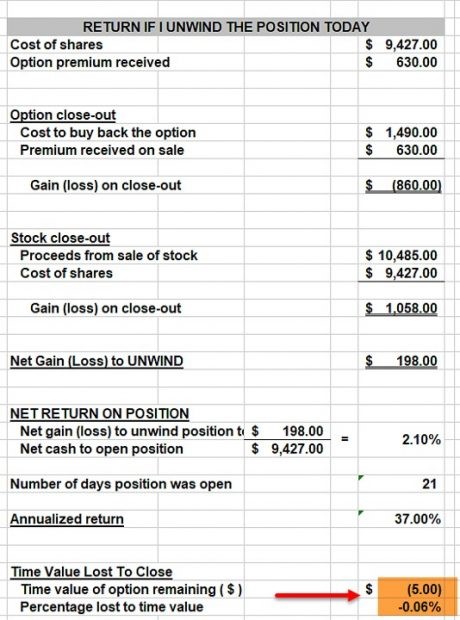

SEDG unwind- calculations

SEDG Unwind Calculations

The brown field highlights the fact that the actual time-value cost-to-close is a mere $5.00 per-contract or 0.06%. The bulk of the $14.90 cost-to-close is intrinsic-value which is negated by increase in share value once the original contract obligation is removed.

Discussion

If you have gained close to the maximum from a short option, it is best to book profits and take risk off the table. There is nothing worse that turning a winner into a loser because you chose to milk the last few drops of premium. Mark executed a successful trade where the maximum return was realized. If the short call is closed prior to expiration, the actual time-value cost-to-close is a miniscule 0.06%. Nice going, Mark!

Use the multiple tab of the Ellman Calculator to calculate initial option returns, upside potential (for out-of-the-money strikes) and downside protection (for in-the-money strikes). All the different covered call strategies listed above are explained in full on the Blue Collar Investor Website.