Diversification is one of the big themes I’ve been exploring in the Safe Money Report – not just diversification in terms of sectors and industries but across different asset classes. I recommend an allocation to the iShares 20+ Year Treasury Bond ETF (TLT) for 2024, writes Nilus Mattive, editor of Safe Money Report.

That is especially true when I look at a stock market that is nearing all-time highs in terms of valuation measures like the Buffett indicator – i.e. the total value of publicly-traded stocks divided by total US gross domestic product (GDP).

US Treasuries have been experiencing their biggest crash in history. Does that mean we can’t see more downside? Or that the market will rebound quickly? Absolutely not.

At the same time, I believe the brunt of the selloff is behind us already. Moreover, if the Fed ends up breaking something, that could spark quite a rally in longer-dated Treasuries as investors pile back into safe-haven assets. A combination of falling stock prices AND rate hikes would be like rocket fuel.

So the way I see it, now is a good time to dip your toe into that water with TLT. As the name suggests, this fund holds a mix of very long-term Treasuries…precisely the ones that have been hardest hit over the last several years.

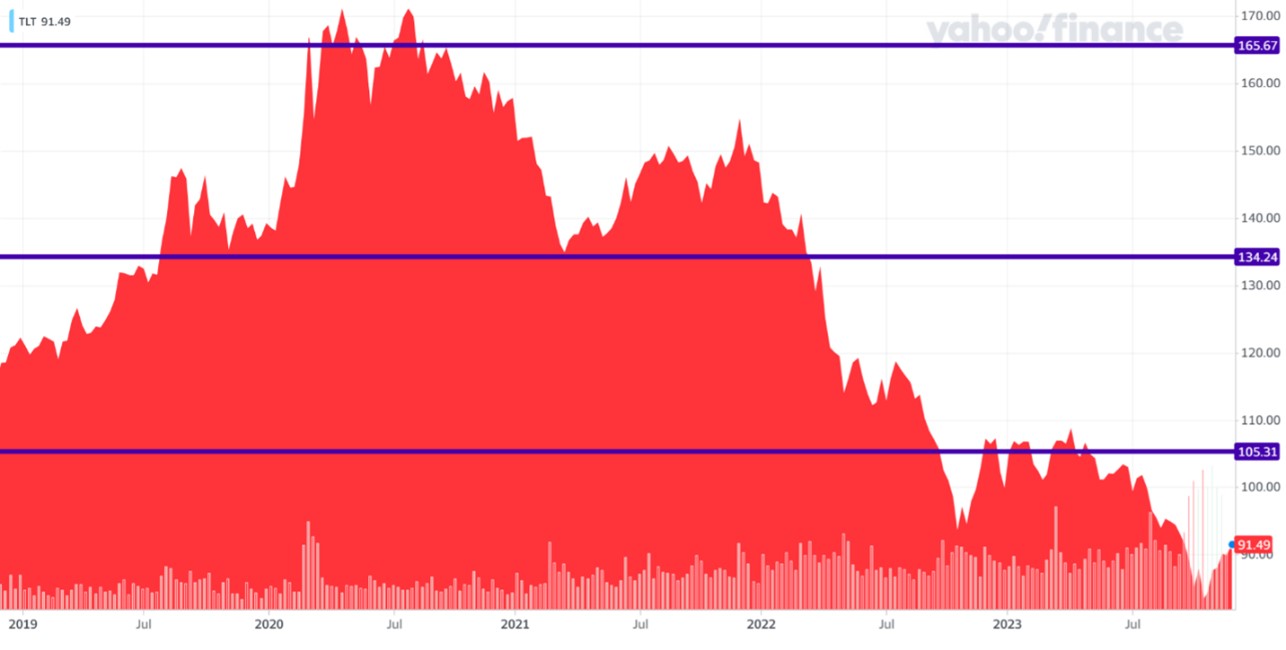

Take a look at this five-year chart of TLT and consider three different scenarios…

In scenario #1, long-term Treasuries simply return to the levels we saw throughout much of 2023. It alone implies roughly 16% in capital appreciation from the TLT’s late-2023 levels. Factor in ongoing income from the fund and you’re at roughly 20% inside of a year from some of the highest-rated government bonds in the world.

Under scenario #2, long-term Treasuries return to the general area we saw them at during “normal” times over the last five years. On the TLT, that would be a return to at least the 134 level – a 47% jump from recent prices. With bond income, you could be looking at a 50%+ return...again, from US Treasury bonds.

Meanwhile, scenario #3 is what I consider the “blue sky” situation – representing the best possible outcome for this particular investment. However, it’s based on a very realistic possibility – a major catastrophe that requires the Fed to go straight back to its near-zero interest rate policies in a hurry.

There’s no telling what the catalyst would be this time around. It could be another self-created asset bubble collapse and financial crisis, a bigger geopolitical crisis, or a million other possibilities. But it would represent a capital gain of at least 81% from recent prices…85% or more in total returns.