Let’s just imagine that is correct—the earth has entered a cooling cycle. If that proves true, and you buy and hold commodities, your wealthy grandchildren will thank you for being a “climate denier,” writes Jack Crooks of Black Swan Capital.

Quotable

“The friend of the present order of things condemns all political speculations in the gross.”

--Thomas Malthus

I don’t want to jump into the debate whether or not there is “global warming,” the old phrase; the new doublespeak phrase is “climate change.” (Gee gosh, the climate changes? Shocking!)

I realize even suggesting there is a debate identifies me as a “climate denier,” one who should be burned (ironically) at the stake. As much as Europeans hate to hear this, there some uncultured rubes such as me who remain skeptical of “climate science.”

And in fact, even a Google search will show there are “accredited” scientists who also remain skeptical. (I am sure Google will do what is right and expunge such heretics from its search engine as quickly as possible. Winston Smith, truly a model of efficiency at the Ministry of Truth, would have already taken care of that.)

But by some accounts, Martin Armstrong’s summary below to be exact, the globe is cooling. And that factoid, should it be a factoid, means this: long-term investors should be buying commodities.

“This year will be much colder for Europe than the last three. It will also be cold in the USA. We are in a global cooling period and all the data we have in our computer system warns that the earth is turning cold not warm. This will manifest in a commodity boom in agriculture as shortages send food prices higher. We will see the first peak in prices come 2024 after the lows are established on this cycle.

“Every time the climate has warmed, that has been the great advances in civilization. I have warned that when the temperature has risen, that is when civilization expands – not declines. When the planet turns cold, that is when everything goes into decline. Global cooling results in a reduction in the population and a rise in disease mostly caused by an increase in famine.”

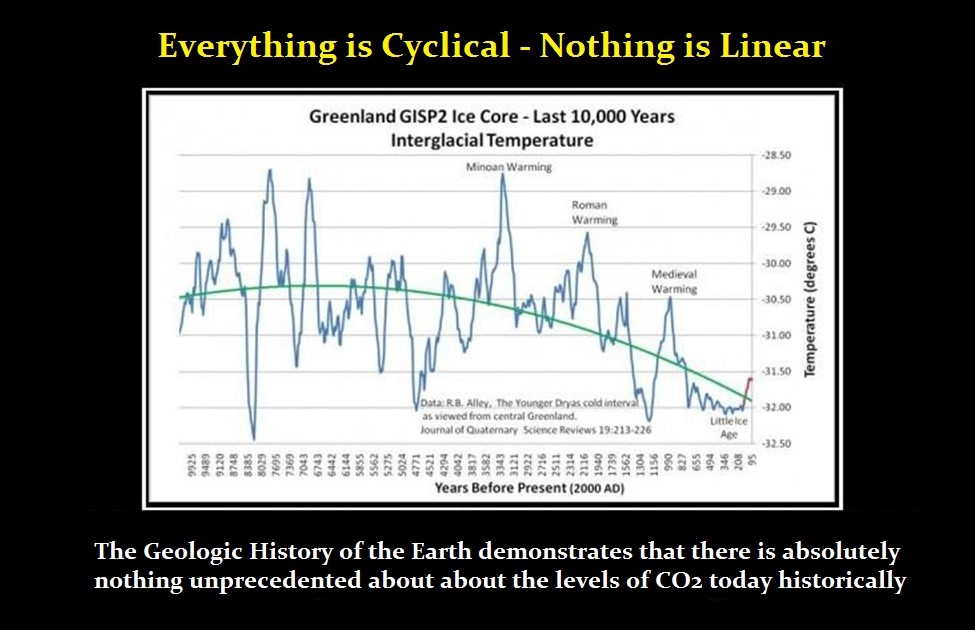

Armstrong also shared the chart below with his readers. Just 10,000-years global temperatures, that’s all:

I am glad they didn’t leave it to me to figure out that stuff. I have trouble guessing price action over the next ten minutes most of the time.

So, in that vein, let me share yet another reason you may wish to consider buying commodities which has nothing to do with the earth’s climate change, but much to do with the market’s climate change—the Stock/Commodities index peaked right on schedule.

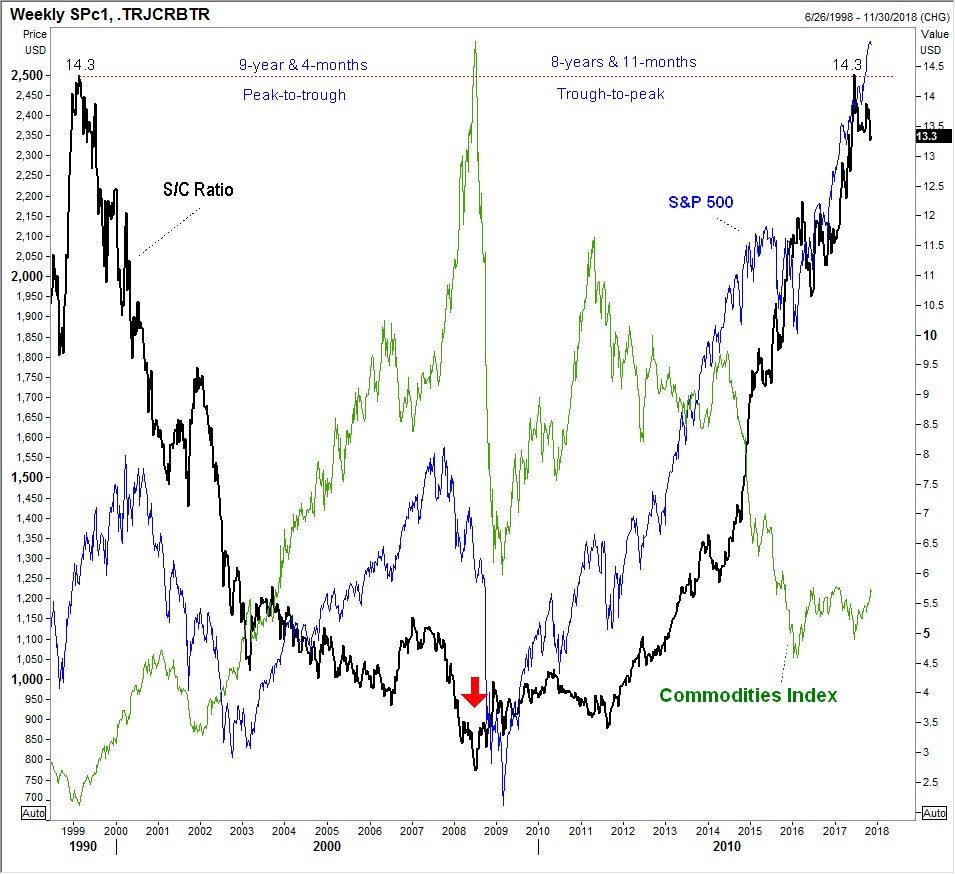

In the chart above, which we have shared a couple of times over the years in Currency Currents, compares the following price series:

- S&P 500 Futures Index (blue line)

- Thomson/Reuters Commodities Index (green line)

- Stock/Commodities Ratio (black line)

Thus: The Stock/Commodities Ratio (S/C) peaked at 14.3 in March 1999 (stocks outperformed commodities); it fell to 2.7 in July 2008 (commodities outperformed stocks); it peaked at 14.3, yet again, in October 2016 (stocks outperformed commodities).

Yup, time for commodities to outperform stocks.

After rallying to an exact swing high of 14.3, which was traced out 17 years and seven months ago, the S/C ratio couldn’t get through that resistance and is heading lower. Is it a coincidence that 14.3 is again the peak?

Obviously, one won’t know without the gift of hindsight whether 14.3 will be the peak for the S/C Ratio in this cycle, but I am willing to bet it is. Why?

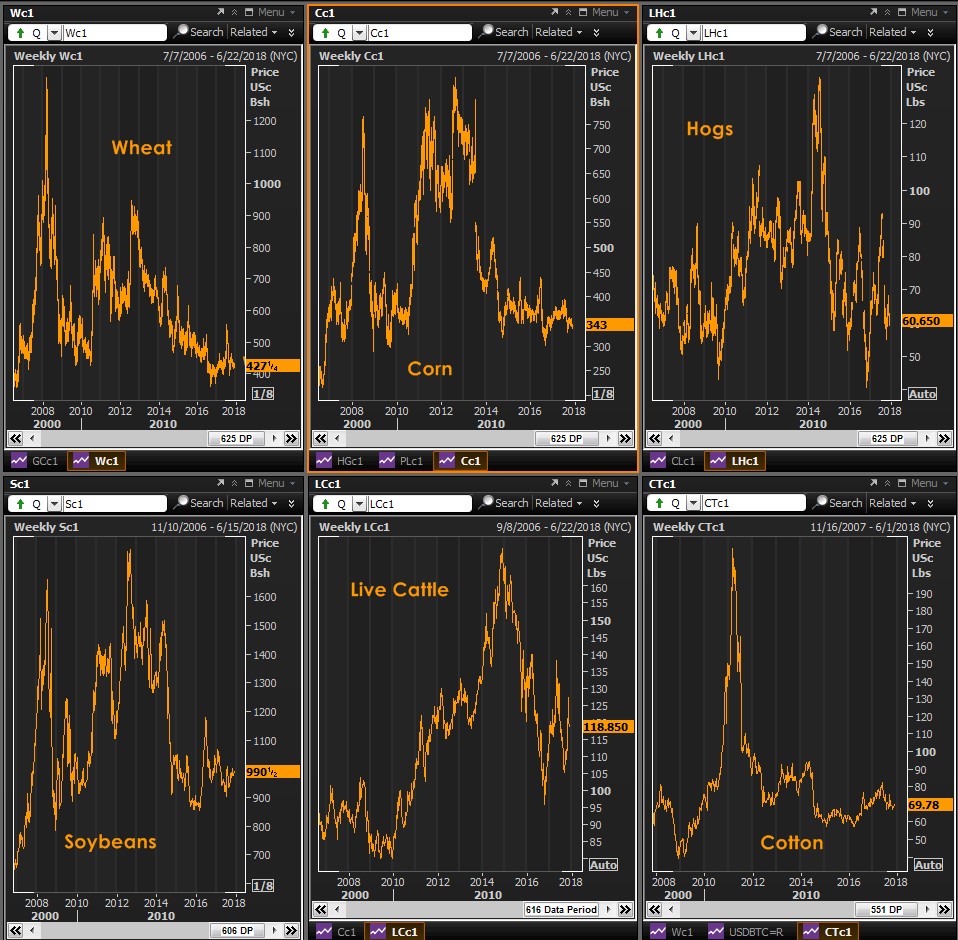

Most major food commodities (or things grown) look cheap. Some examples of major food commodities (and cotton) weekly view going back to 2008, which was the “credit crunch bottom and the trigger for the change in trend of the S/C Ratio:

Let’s just imagine for a moment Mr. Armstrong is correct—the earth has entered a cooling cycle. If that proves true, and you buy and hold commodities, your wealthy grandchildren will thank you for being a “climate denier.”

Watch Jack Crooks present Black Swan Foreign Currency Trading at TradersExpo Nov. 3, Las Vegas, here

View Currency Currents, commentary, and analysis at Black Swan Capital here…