Markets aren’t even close to an all-time high, on a valuation-adjusted basis. Strong earnings are a fundamental of this bull market, asserts Jim Woods in his Successful Investing newsletter.

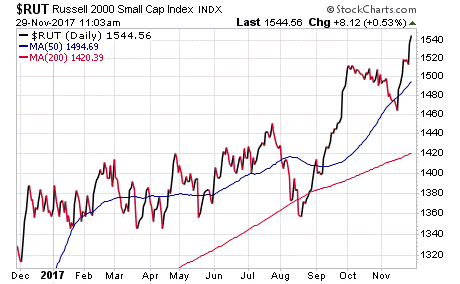

The stock market is on fire. On Nov. 28, stocks surged about 1% nearly across the board, with the Dow Jones Industrials (DJI), S&P 500 Index (SPX) and Russell 2000 Index (RUT) each vaulting to yet another respective all-time high.

Given the relentless race to all-time highs we’ve seen this year, it’s more than logical to ask ourselves if the market is overvalued. Well, by just about any metric, including price/earnings (P/E) ratio, Cyclically Adjusted Price to Earnings (CAPE) ratio, etc., the market is at historically high values.

But is the market really overvalued?

I was speaking about this subject with my predecessor, Doug Fabian, recently, and he offered me an interesting assessment of this overvalued question, courtesy of his firm, Mercer Advisors.

Doug pointed me to a client note written by Donald Calcagni, chief investment officer at Mercer. I found this commentary compelling, and I wanted to share a bit of it with you this month.

In his note, “Is the market really at an all-time high?” Calcagni begins by acknowledging the concern that investors have about high valuations. However, he strongly challenges the claim that markets are really at all-time highs from a valuation perspective.

As Calcagni writes, “On a valuation-adjusted basis, markets aren’t even close to an all-time high. That zenith, based on the forward price-to-earnings ratio, was reached in late 1999 when the S&P 500 Index peaked at 25 times forward earnings. Today, the S&P is trading at 17.7x forward earnings. Said differently, the S&P 500 Index would have to rally 41% from where it closed on September 30, 2017, to reach parity with its late-1990s valuation -- and it would have to do so with no corresponding increase in earnings since an increase would offset any rise in the price of the market index.”

It is the earnings component here that Calcagni thinks is key, and he goes on to write, “And therein lies the real reason equity markets continue to rally -- earnings. Cash flows, specifically earnings, drive stock prices. What’s fueling the market is economic expansion and a corresponding increase in earnings. Unemployment is low, wages are rising (slowly), the economy continues to expand (albeit at a below average rate), and consumers are in good shape financially (who, collectively, are responsible for nearly 70% of all economic activity). Subsequently, the S&P 500 Index is on track to post record earnings in 2017 of $130.88 per share. Earnings are projected to come in a full 9.47% higher than 2016. This growth in earnings is keeping market valuations in check.”

I’ve written about earnings being a sort of unsung hero in this age of the Trump pro-growth hope rally, as earnings haven’t gotten the respect they deserve.

And despite acknowledging the strong earnings picture, I admit that I have sometimes fallen into the trap of becoming too focused this year on the political market drivers going on in Washington.

And while politics and the Trump pro-growth agenda have been the biggest tailwind pushing stocks higher, very good earnings growth also has been the fundamental lynchpin of this bull market -- and this is a fact we must all seat firmly in our minds as we consider this market.

Subscribe to Successful Investing here.