If new highs emerge, there has been no change in the game. Robots are still ruled by the old boss and buying the next dip is reasonable. If the market reverses investors should ask if there is a new robot boss, asserts Joe Duarte, MD of Joe Duarte In The Money Options.

Fans of classic rock are familiar with the Who’s famous lyrics – “meet the new boss, same as the old boss,” a clever play on words which simply means the more things change, the more they stay the same.

In this case, the boss would be the robot traders who have ruled the roost on Wall Street for the past few years and whether the same rules of robot trading algorithms – the old boss - are still in play or if there is a new boss who changes the game radically. Indeed, what happens over the next few days could well decide the next six to twelve months of trading activity.

Last week I noted stocks were ripe for a bounce, which has already occurred.

Yet, the most important issue for investors is whether last week’s price bounce signals that the market made a V bottom, a W bottom, or- if the recent lows fail to hold - a reaffirmation of a worse bearish trend.

A V bottom would mean that the February 9 bottom was the bottom and that last week’s rally was the beginning of a move toward the upper end of the recent trading range or even new highs for the S&P 500 (SPX).

If last week’s rally was the left side of a W bottom, the market will reverse fairly soon and head lower. However, in this case, the February 9 bottom will hold and become the momentum bottom. The second bottom in the W formation would be the panic bottom. Classic panic bottoms are usually very dramatic selling climaxes which usually feature lower volume than the momentum bottoms. After the panic bottom, which is a washout event usually heralded by headlines suggesting that the end is here, there is usually a very meaningful rally followed by a consolidation period.

Textbook technical activity unfolds

Robotic algorithms, more often than not, follow textbook trading tactics. Thus, it is not very surprising to see that the recent bottom or the subsequent bounce in stocks happened pretty much where anyone with bare bones knowledge of technical analysis would think that it could.

There are no guarantees in this world or this market, except that this has been the playbook for the past several years, and until there are signs that the game has changed, we take what they give us.

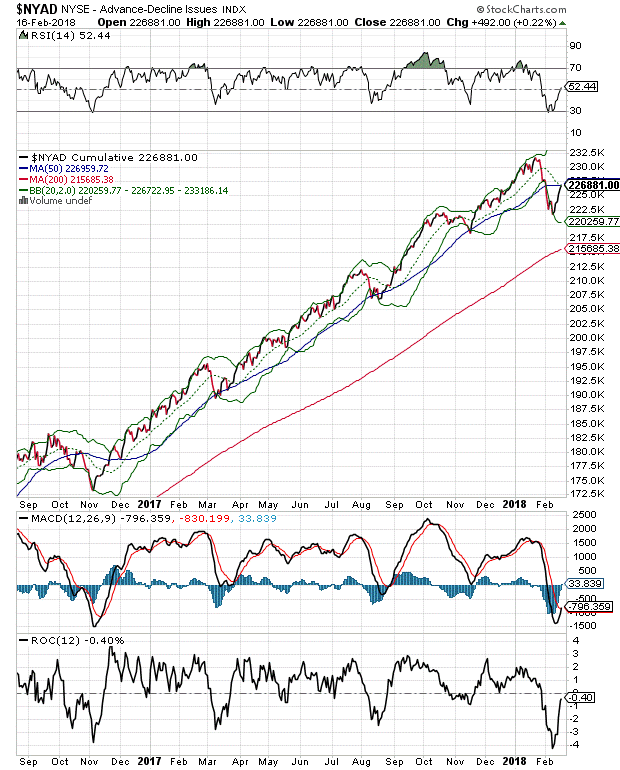

A perfect example of the technical thesis for the market is seen in the latest chart of the New York Stock Exchange Advance-Decline line, the most accurate indicator of the dominant trend in the stock market for the past 18 to 24 months.

The key to this analysis is the machine like precision of the five major bottoms in the NYAD since November 2016 – November 2016, the March, August, November 2017, and now February 2018.

Each major bottom and subsequent buying opportunity saw the same events:

--a major low, on or just at 30 for RSI,

--a major low and subsequent crossover in MACD,

--and a major low in the ROC. Thus, the takeaway here is that we are seeing similar events, and so far the market has bounced, just as it has every other time.

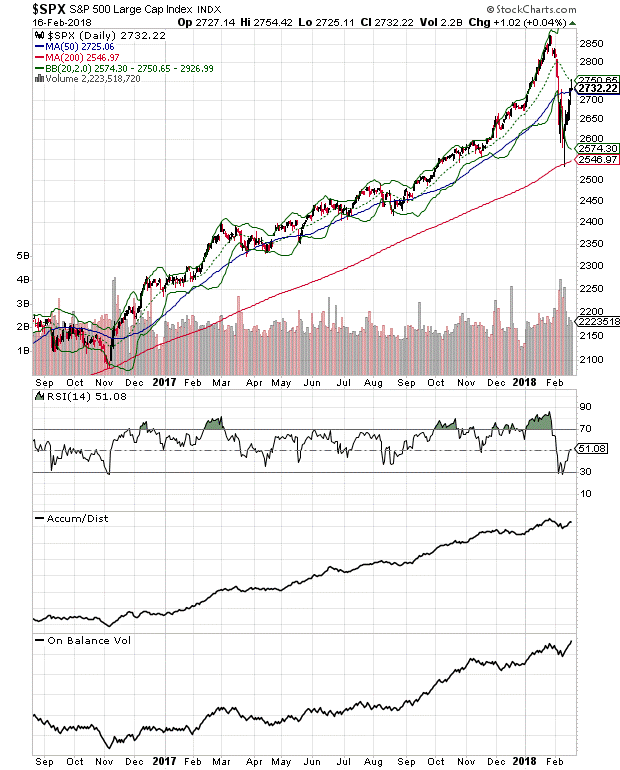

SPX follows NYAD script

While the NYAD is a bellwether for the market trend, the S&P 500 is a measure of price activity for stocks. First, note the close correlation between price bottoms in SPX and the NYAD since the November 16 presidential election bottom. Second, note the rally in SPX stopped just at the 20-day moving average, which is what would be expected under normal technical conditions.

And third, consider that unless there is a meaningful reversal of the short term uptrend, the price action in SPX is telling us that money is moving back into stocks. This is confirmed by the rise in the Accumulation – Distribution line (ADI) and the On Balance Volume Indicator (OBV).

To buy or not to buy the dip?

So far, the robots have performed similarly to their historical norms by following basic technical analysis tenets of support, resistance, and general trend development. Still, the stock market is now at a critical price juncture. If the rally persists and new highs emerge, there has been no change in the game – the robots are still ruled by the old boss – and buying the next dip is a reasonable choice. However, if the market reverses investors should question whether there is a new robot boss and a new game in town.

Joe Duarte is author of Trading Options for Dummies, now in its third edition. He writes about options and stocks at www.joeduarteinthemoneyoptions.com.