What I see: Higher growth (earnings maybe more than 15% higher), a bit of rising inflation, a baby bear correction, and of course the moaning coming from those wrongly interpreting the trade moves. Talking beats preparing for war, says Gene Inger of The Inger Letter.

Anniversary aggressiveness actually sustains the old bull, which of course only revived in 2016, because of Donald Trump’s victory. That’s important because 2017 was reasonably the best year of the entire bull upward saga, aside coming off the 2009 lows, when we suggested just reversing many of the short-sales suggested since calling for a disaster that I named an Epic Debacle coming in 2007-2008.

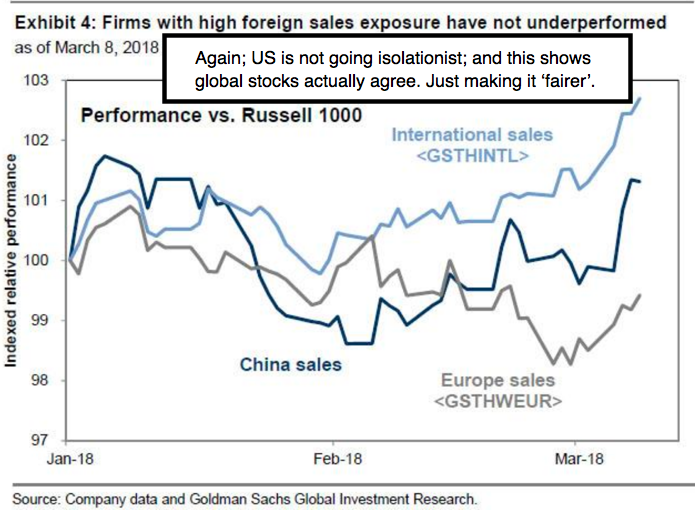

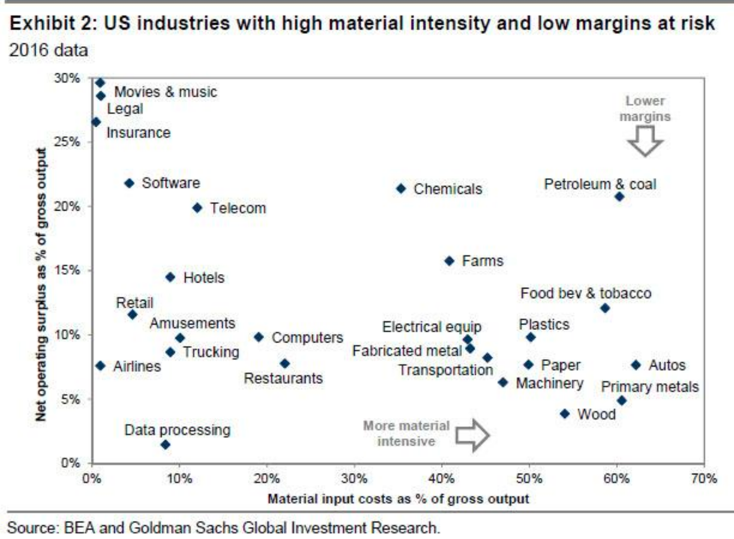

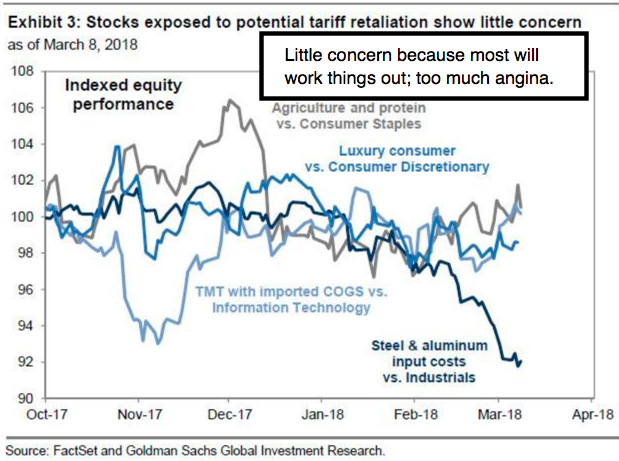

Now, it’s not necessarily clear sailing ahead, as we’ve traversed many problems that troubled the market this year. The most important may be drawing a lot of productive age workers back into the workforce, without overt wage increases analysts worried about. The tariffs are negotiating tools for better trade deals; they are not true reflections of an isolationist America and they exaggerate even what Trump intended (which might be unorthodox, but rewards those who play fair and punishes those who persist in undermining our industries).

As I said the day before the election: if you love or even hate Trump, if he wins hold your nose and go long the market; it will soar to the moon. It did and now we’re having alternating swings as the S&P 500 (SPX) orbits the moon (yes NASDAQ is at a new high for unsurprising reasons noted lately).

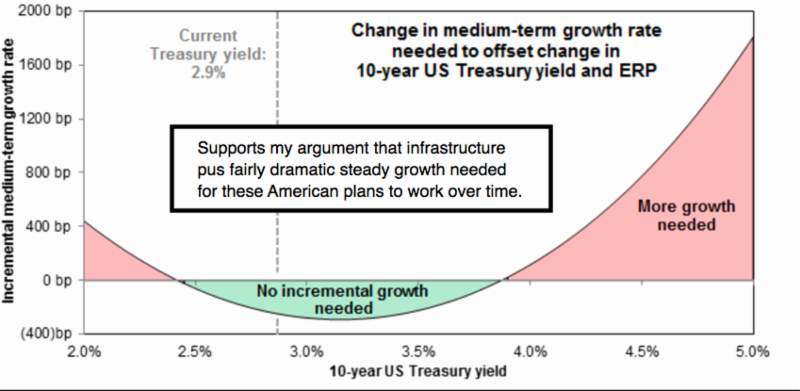

As the market discounted this, it can have headwinds, not just from a Fed eager to offload their balance sheet, and normalize monetary policy.

So, it’s a mistake to be complacent here even though I don’t see recession, and it’s possible for the economy to move forward for years (barring any serious rate hikes and having nothing to do with media nonsense).

Taking the high road

So if this sounds bullish on the economy so be it. I’ve previously stated a belief (also the first comment made at the New York TradersExpo presentation), that we’re not going to have a recession this year. However, unlike the crowd that suggests a slipping economy, high debt impinging growth, as well as a collapsing stock market, I actually take the opposite path.

That is a view of a multiyear transformation of America’s economy that is absolutely core to the president’s policy initiatives and to the survival of this capitalist nation within context of its role in the global economy too.

It happens to concur with the belief we will see higher-wage inflation creep; which the market shrugged-off Friday in relief it hasn’t kicked in yet. But it will and that matters as do Fed rate trends for the longer-term.

Our view, having been to the moon bullish if Trump won (and we had a slight dip thereafter giving the opportunity) is that we got to the moon, of course.

So, since we’re unlikely going to Mars yet (ask Elon when that's scheduled next year) I’ve suggested we get corrections (maybe a baby bear). But not a catastrophe in the market that permabears constantly are calling for.

Among those that we had shorted and a few never saw those higher levels again were Merrill Lynch at 84; Bank of America in the 50s and Las Vegas Sands at well over 120 as I vaguely recall.

On the comeback ideas focused on basic assured survival stocks; like Ford at 1.25 (yes); or Chevron at half these prices, or basically anything. Apple, Facebook and so on came later.

In-sum: like now as stock markets advance, optimism should gradually decrease about stocks; and in this case, even as it increased about the actual economic prospects. The old bull was driven by Fed monetary panic...I mean policy...and that became Quantitative Easing. That’s not what’s driving this market, nor will drive it, going forward.

In fact, the Fed’s now a threat to perpetuating the move and can inhibit things. Yes, remember, you can have a growing economy while equities slack off. Classic free trade advocates (like the Wall Street Journal, or Goldman Sachs, or other globalist proponents, liken Trump to Herbert Hoover; and that's ridiculous.) had good ideas that didn’t kick-in quick enough, so you'll never know the alternative as an outcome. The classic guys don’t want to interfere with trade at all. Trump agrees and is not an isolationist.