Nvidia has a supply problem. It can’t make enough of its prized graphics processing units to satiate demand. It is constantly creating new uses. Nvidia has been a rare entity: A good company and a good stock. Investors should buy pullbacks, writes Jon Markman.

Nvidia (NVDA) has a problem. Don’t worry, it has almost nothing to do with Uber.

This is a nice problem to have, for a few reasons.

The semiconductor company was born in 1993 when three friends—Jensen Huang, Chris Malachowsky and Curtis Priem—saw a market for high-end PC graphics.

he market was not big in the beginning.

The company grew slowly, adding patents and new processes through small acquisitions.

By 2000, those bits and pieces began to pay off. Nvidia was clearly making the best gear in the industry. It even secured a $200 million advance to supply graphics components for the Xbox, the Microsoft (MSFT) new game console.

Nvidia used the money to invest in its business. By December 2000, managers entered into an agreement to buy 3Dfx, the leading maker of 3D graphics technology. Exluna, a graphics rendering company, was acquired in July 2002. Nvidia bought MediaQ in August 2003, and iReady in April 2004. Both companies made internet networking software.

Then, it clicked…

The computational math required to render lifelike animated images in games had broad uses beyond entertainment. Nvidia was building a new, general-purpose computing system around graphics, simulated light and physics.

To make it all work, company engineers built a parallel computing platform called CUDA. The beauty of CUDA was it used both the GPU and the CPU, the traditional computer brain, to process data. Sharing the load led to exponentially faster processing.

Related story: Nvidia’s CUDA Could Become the Brains Behind Smart-Factory Systems

In February 2008, Nvidia acquired Ageia, the maker of the PhysX processing unit. The message was clear. Huang, the chief executive officer, was betting the entire business on GPUs, and the concept of deep learning.

It was a big bet. Deep learning is a form of artificial intelligence that relies on teaching computer algorithms to process images like the human brain. It was far from a solved problem. However, if it worked it could become the future of a new type of computing.

Huang estimates that the company has spent $10 billion since 2010 to develop deep learning and the high-end hardware needed to take advantage.

Developers have bought in. Speaking to an audience at the 2018 GPU Technology Conference in Silicon Valley last week, Huang said that, during the last decade the number of deep-learning developers has increased tenfold, to 1 million. And the complexity of the underlying code has increased 500X in just five years.

That is what is so exciting. The 2018 Investor Day slide presentation provides an insight to where the business is going.

For example, Nvidia’s data center business has increased threefold in just the last three years, to $1.93 billion. It now has its equipment at every major cloud computing network … and every major computer maker.

From Alibaba Cloud and Amazon Web Services to Huawei and Lenovo, its GPUs have become standard equipment. This is a market currently worth $50 billion — and growing.

On March 21, a self-driving Uber struck and killed a woman crossing a road in Arizona. As tragic as it was, autonomous vehicle development will continue.

Related story: Tragic Uber Crash Won’t Stop Self-Driving Cars

Nvidia makes a complete solution — with software, hardware, data collection and simulators, and an ecosystem of 370 automotive partners.

Nvidia is the dominant player in an addressable market of at least $60 billion.

Meanwhile, gaming — its second-oldest business — continues to grow quickly. Nvidia’s graphics card business grew to $5.5 billion in 2018, up 36%. And it has 70% of the market.

What investors may not know is the company is working on new markets.

This week, Nvidia signed an agreement with ARM Holdings, the company that designs the low-powered architecture behind every smartphone chip. Project Trillium will bring deep learning to ARM’s entry in the Internet of Things. This market amounts to billions of new connected devices.

Medical equipment is also on the radar. During the GTC keynote, Huang noted that companies that make medical equipment have shown tremendous interest in deep learning. Nvidia developed a software upgrade that will allow manufacturers to bring AI to existing hardware. Huang joked it has the potential to upgrade every piece of ultrasound equipment on the planet.

Don’t sell him short.Ten years ago, nobody imagined his graphics card business would be sought after by almost every automaker in the world.

Nvidia shares have pulled back off their recent high. Some investors are beginning to worry the company has lost its mojo. Nothing could be further from the truth. The AI story, and potential new applications are just beginning to unfold.

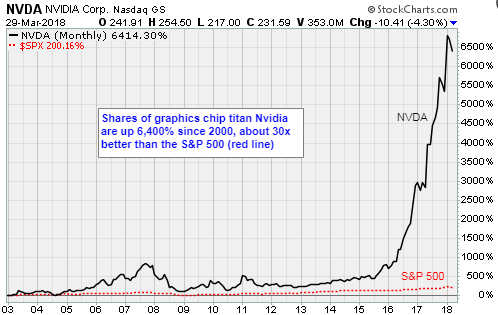

The stock may have to fall back to fill the gap at $200 from the January 2018 breakout. That would not be a terrible thing. We need to keep in mind, shares have risen 18X since they traded hands at $12 in November 2012. The 15-year average annual rate of return is 33.3%.

Nvidia has been a rare entity: A good company and a good stock. Investors should buy pullbacks.

Best wishes,

Jon D. Markman

P.S. My Tech Trend Trader members are sitting on a nice 232% gain in Nvidia right now — and that’s even with the haircut tech stocks have taken in the past two weeks. We’re using this pullback as a buying opportunity, not just in NVDA but also in all the market’s strongest tech stocks. Don’t miss out. Click here to join us.

Subscribe to Jon Markman’s Power Elite newsletter here

Subscribe to Jon Markman’s Tech Trend Trader here

Subscribe to Jon Markman’s Strategic Advantage here