There will be occasional headlines which send the market down, but the risk of a trade war is lower than in February because back then we didn’t know how the Chinese would react to Trump’s proposals, writes Don Kaufman.

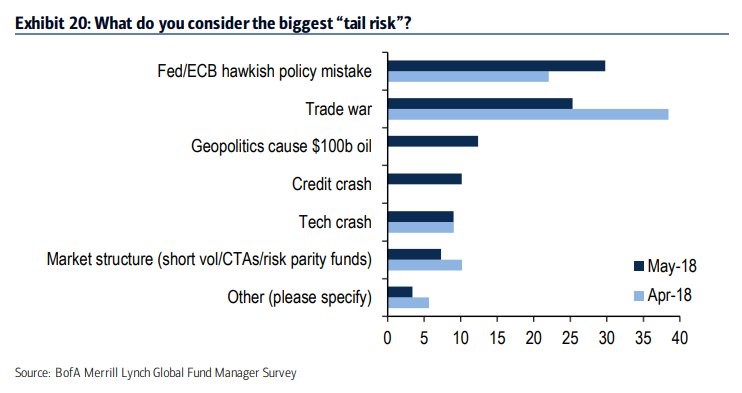

In this article, we’re going to look at a Merrill Lynch survey to review where money managers see the stock market going. The chart below shows a list of the biggest tail risks money managers see facing the market. The term tail risk is up for interpretation, but I see it as an issue that’s unlikely, but can cause a bear market. The biggest risk has the highest expected value which is the negative affect times the probability of it occurring.

The interesting aspect of this list is that the risk of a trade war fell from April to May which was proven to be incorrect Friday as Trump stated he doubts the China trade negotiations will succeed, which sent the market lower. The whole quote was: “Will that be successful? I tend to doubt it. The reason I doubt it is because China’s become very spoiled.”

This situation is still fluid even though the market has generally become less volatile compared to February. I think with this point Trump was simply posturing ahead of the final negotiations. This is probably why the selloff was only modest.

The latest news on the negotiations is China has offered Trump a $200 billion reduction in its trade surplus with America. I think this is good for the market because it signals the negotiations are progressing. The overall market wants to avoid a trade war.

The specifics of the deal will affect individual sectors, but it won’t cause a bear market. The White House didn’t respond immediately to this offer, but the U.S. goal has been to reduce the trade deficit with China by at least $200 billion by 2020.

The deficit with China was $375 billion in 2017. The pace has quickened in the first three months of the year, as the deficit has been $91 billion compared to $79 billion in Q1 2017. Essentially, this means America wants the trade deficit to be cut by more than 50%. The details of how this will get done are pesky because U.S. factories and farms will find it difficult to produce enough goods to meet the goals.

The best summary of the situation is to say the details are now being hashed out.

Also, the U.S. will shrink the deficit, but likely by less than Trump wants. The fewer tariffs and regulations put in place to meet this goal, the better for business. One potential risk is overproduction right before a recession. If the White House pushes firms to produce more than they should to meet a somewhat arbitrary goal, when there’s a recession in 2020, there could be even more unsold inventory that needs to be marked down than there normally would be.

Biggest tail risk: Fed/ECB mistake

Because the risk of a trade war fell, the risk of a central bank policy mistake has now moved into first place as the biggest risk the market faces. I don’t agree with this because the market is actually more hawkish than the Fed.

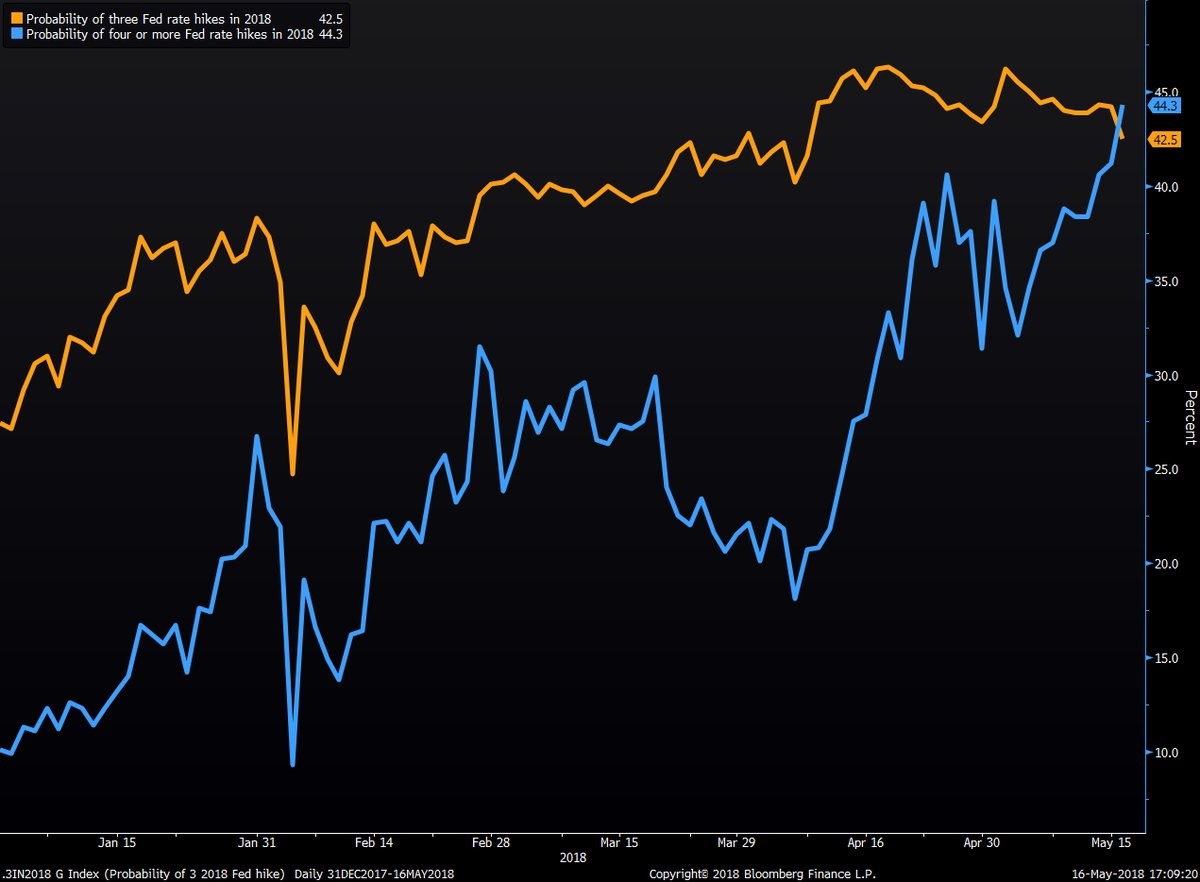

In my opinion, a mistake is when the Fed gets ahead of the market and hikes rates more than expected. This would shock the market and cause stocks to fall.

As you can see in the chart below, the market now assigns a higher probability to four or more hikes than three hikes in 2018. This means the market is more hawkish than the Fed because guidance is for three hikes.

How can the market be shocked if the Fed shifts to four hikes if that’s what’s expected? You can argue that anytime the yield curve flattens, the Fed is making a mistake, but the ramifications won’t show up until the yield curve inverts and the economy starts to decelerate.

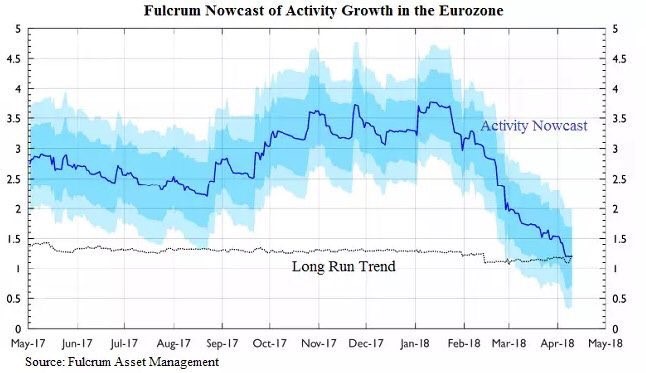

The ECB is in a much tougher situation than the Fed because the European economy is weakening and inflation is moving further away from the target while the central bank wants to normalize policy. After years of trying to normalize policy, the ECB is having a tough time taking away the punch bowl.

The risk of easy policy has always been the inability to remove it. We are now at that moment. It’s possible that the ECB waited to long to do so.

As you can see from the chart below, the European fulcrum nowcast shows the economic activity in the EU has fallen sharply from above 3.5% to slightly above 1%. The growth is now at the long run trend.

The ECB has slowly tapered bond buying, but maybe a faster approach would have been better. Personally, I always wondered how this all would take place before a recession if the unwinding is taking so long. I’ve always remarked that the Fed wouldn’t get to the $2 trillion-$2.5 trillion balance sheet goal by 2021-2022 without a recession occurring.

With the ECB lagging, it has a higher chance of failing to normalize policy. With all of this being said, I don’t know if an ECB policy mistake would cause a bear market. The bigger issue is the economic slowing which the ECB isn’t causing.

Bigger risks not listed

These risks aren’t the only tail risks facing the market. Even though the list claims $100 oil caused by geopolitics would be an issue, I’d want to know what the geopolitical situation was because that’s a bigger issue than high oil prices.

Student loan debt is a huge issue which could get worse if the labor market weakens as the graduates can barely survive with a job. Not having a job and owing $50,000 in debt is a catastrophe.

Finally, hacks and data breaches are big risk to the market which aren’t priced in. We’ve already seen the Experian, T-Mobile, and Target hacks among others do damage to firms. If there was an even bigger leak possibly within the government, it could destabilize the market.