Later this Summer we get more than the typical realignment of portfolios in the ETF and Index realm. It’s primarily because of introduction of new sector funds and reclassification of majors now in IT, which now will be called communication stocks, writes Gene Inger.

Foremost among these are Facebook (FB) and Google (GOOGL), not that I agree with that label but it’s coming. Money managers are compelled to readjust accordingly; but they do have choices. Choices relate to preferences and proportionality.

Forbes: Winners and losers in the coming telecom-tech shake-up.

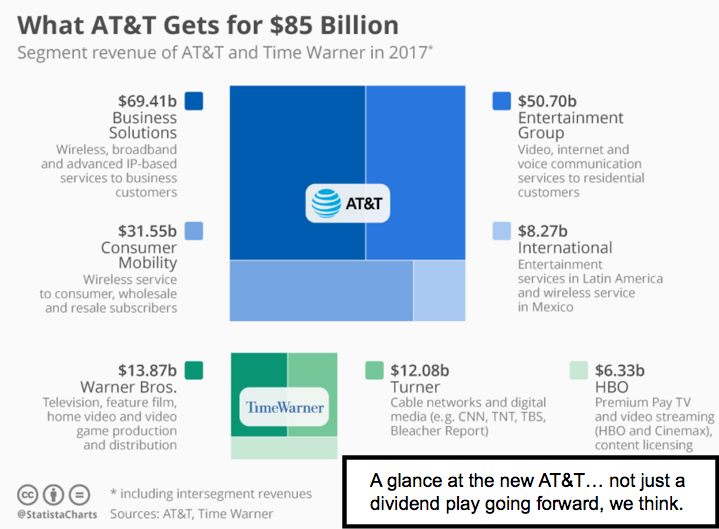

This could get real interesting; since those two stocks will join a sector that is somewhat dominated by AT&T (T) and Verizon (VZ) presently.

A common view is that managers will offload the two latter for the new entrants. I disagree with that. Really? How about the possibility that investors (managers) will increasingly focus on the funds where the action is?

If that happens, money could exit the IT area somewhat, when Micron (MU), Microsoft (MSFT) and Intel (INTC) become dominant, although those particular issues might remain fairly stable and increasingly focus on Communications ETFs or similar, and thus enter what could be viewed as a bifurcated segment.

Why bifurcated? Because Verizon and AT&T (for now) are low multiple as well as perceived conservative with dividend consistency as the focus. Hence the pools in those funds aren’t as large. I suspect that changes with Google and Facebook coming in.

It might have a slightly bearish impact on price action for Google and Facebook (with serious valuation issues already). It might be uplifting for one former telecom more than the others. That’s obviously AT&T and who knows what Verizon will do next, but they must do something more significant.

At the moment, if you were a money manager and balancing required you to reallocate out at all (while I think most really would want in), I suspect you’d hold Google over Facebook, but also retain AT&T over Verizon, because of everything we’ve pointed out all week. (It also means total return of dividends and potential price appreciation being greater.)

More commentary by Gene Inger on AT&T, Time Warner and media stocks on MoneyShow.com:

After overhang trade in AT&T, what to expect in valuation.

What traders should know about media play and net neutrality reversal.

How new AT&T could be a Hold, or Buy on weakness if dividend shrinks.

View Gene Inger’s trade ideas on AT&T and LightPath, how millennials can get started investing and how he’s a pioneer in financial broadcast journalism here

Recorded at MoneyShow Las Vegas May 14, 2018

Duration: 4:10.