Just because the Fed indicated a pause in its tightening cycle doesn’t mean that it has reversed course, note Bob Savage.

The long-line of unwanted gifts returned after the holidays has already happened in the United States and Europe, but for China it’s another story. The return of China to markets has been greeted with rising hopes for U.S.-China trade talks in Beijing, more stimulus from the government and more global growth spillovers.

The push ahead for risk met a few headline glitches with the UK being the focus as its GDP fell in December and its monthly data highlighted the concerns that led the Bank of England to flip on its forecasts and rate path. More returns in equities don’t mean more pain in bonds as this is a week for geopolitical uncertainty ending with the risk of a U.S. government shutdown Friday.

China Lunar New Year retail sales rose 8.5% year-over-year to 1.005 trillion yuan, linked to foods, electronics gifts – but still the lowest rate since 2011. Sales in 2018 were up 10.2%. Tourism was up 8.2% to C513 after a 12.1% gain in 2018 with trips up 7.6%. The China Economic Information Daily suggested 1Q GDP is set to reach 6%.

The EUR/USD dip below 1.13 despite U.S. politics underscores the problems with rates driving Foreign exchange. The GBP/USD relationship is still worth watching given the failure of the recent breakout. On the day, the FX markets were all about safe-haven reversals with Japan on holiday and a test of the 110.20-40 resistance underway. For the Swiss franc it was a mini-flash crash as 1.0070 led to a stop fest test of 1.01 which quickly reversed. The world of FX and thin markets may be telling us something larger and more important about risk-on and off for today watching .9925 for troubled returns.

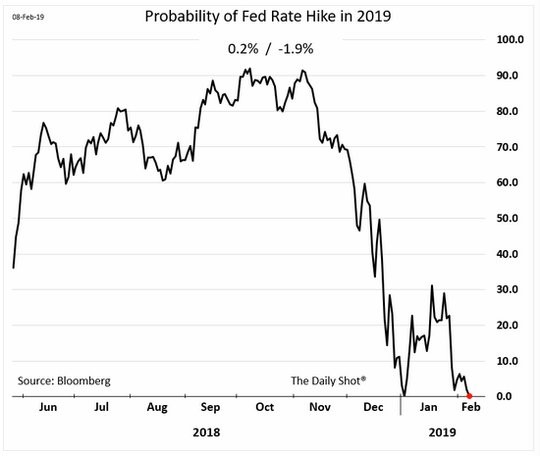

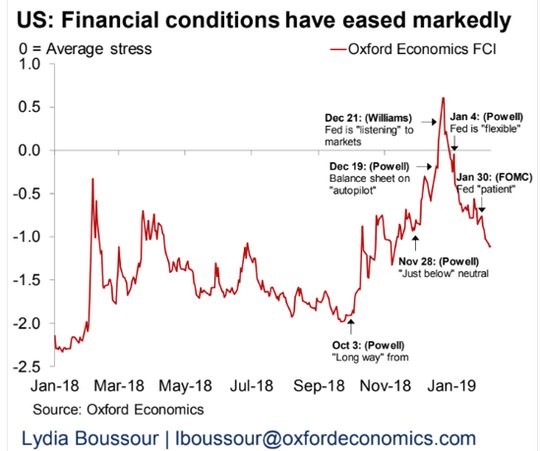

Is the market confusing FOMC patience with financial conditions?

The return of China to markets mattered more than the news today. The push up in China shares helps spur talk that U.S.-China trade talks will come to a deal before the March 1 deadline. Whether that happens is clearly in play and the driver for volatility. The risk-off and on games are not easy to play and the only thing that really changed from last week was mood with the view that financial conditions drove the FOMC to shift to a patient stance, but perhaps the markets are over estimating the willingness of Fed Chair Powell to push equities dramatically higher.

Just because the Fed indicated a pause in its tightening cycle doesn’t mean that it has reversed course. The off-set of a S&P500 gain is that the financial conditions move too much and make the FOMC uncomfortable. This is going to be the key for moderating markets this week.

What Happened?

- China January FX Reserves rise $15.2 billion to $3.088 trillion after $11bn gain – more than the$9.3bn expected – biggest jump in a year. The gain was mostly due to non-dollar currency gains and asset price appreciation. The CNY gained 2.6% against the USD in January. The value of China’s gold reserves rose to $79.319 billion from $76.331 billion at the end of December.