When the red light flips on the car dashboard you are supposed to pay attention and get the vehicle checked out, writes Bob Savage.

When the red light flips on the car dashboard you are supposed to pay attention and get the vehicle checked out. Similarly, when the leader of the global recovery stalls, it’s a red alert for all risk position across assets – note China equity indices fell 4% last night.

The reversal of equities this week culminated today with the China trade surplus shrinking, its exports falling more than 20% and imports dropping as well. Talk that the US-China trade deal will take more time added to the weight of the report driving down Chinese equities for the first time in five days and hurting markets globally.

The other story was that China is back to monitoring grey-market margins and is punishing some lenders for channeling money into stocks. Things got worse with Europe as German factory orders added to the gloom that ECB Draghi already spread yesterday. The reaction of markets to the ECB’s targeted longer-term refinancing operations (TLTROs) was disappointing even as the central bank is the first to act to respond to global growth weakness. The fear that monetary policy is out of bullets and that fiscal is the only gun left working remains.

This brings the market back to the US and its divergent growth hopes putting the jobs release again into the spotlight. While few would argue U.S., jobs are anything but a lagging indicator – they still reflect the underlying economy and so the risk-off mood may temper if growth holds – i.e. if jobs are above 150,000, wages are steady to higher and job participation rises. The markets are waiting to see the FOMC reaction function to the data and to the ECB and foreign growth doubts. This puts the barometer for risk shifts back to the USD, which is watching 98 for a confirmation of bigger divergence and more confusion. Safe havens like the Japanese yen and gold are back bid and may be also going higher with the USD after 8.31 am.

Are emerging markets the next shoe to drop?

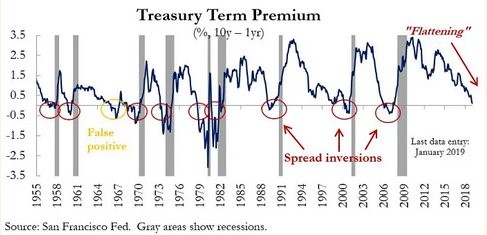

As China goes, so goes emerging markets. That is the usual wisdom, is this time different? The two biggest risks for Q2 maybe in China moving to QE and the United States moving to intervene in the dollar. The hope that the FOMC can prevent a broader global crisis in growth from spreading is not a strategy. The limits of monetary policy are showing through from the ECB yesterday. What is needed in Europe is fiscal stimulus. The measure of all growth fears remains the shape of the yield curve. For Europe with negative rates and QE, this remains positive but forced, like that of Japan. For the United States it’s still not at the level where Powell will blink like Draghi.

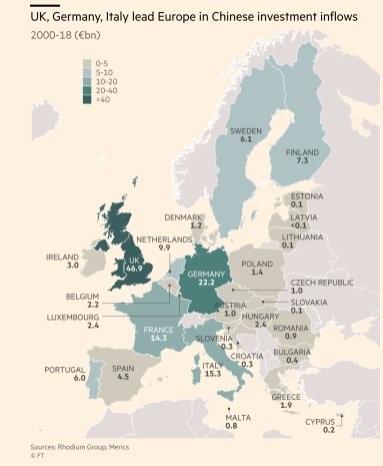

When it comes to fiscal stimulus, the United States has already acted, Japan seems to be going in reverse with the VAT plans and that leaves the messy politics of Europe to consider. The role of China and the Belt-Road plan is clearly part of the story as well – if you can’t locally spend, take the money from Foreign Direct Investment. As the WSJ quips today, “investors would be better off analyzing the output of China’s 13th National People’s Congress than that of Europe’s monetary policy makers.”