Despite signs economic weakness, bulls remain in control, writes Joe Duarte.

We are all day traders now, by default, whether we close out all positions at the end of the day or keep them open overnight. That’s because the market is now trading on a day-to-day basis, focusing on news headlines, earnings reports and economic data. Thus investors who focus on stock picking and keep their focus on how positions respond to daily events continue to make money as long as they are willing to ride out the intraday bumps and grinds of price activity fueled by robot trading algorithms and their instant response to the ebb and flow of orders throughout the day. Therefore, until proven otherwise, U.S. stocks remain in a strong uptrend with the major indexes making new all-time highs last week and all indicators suggesting higher prices are ahead.

Interestingly, despite some economic data which suggests the economy may be slowing – see the internals of last week’s stronger than expected GDP report — stock prices are in their own world, being supported by the tendency of shares to rise in the third year of the presidential cycle, the neutral stance of the Federal Reserve on interest rates, and a better than expected earnings season. And while this bull market continues to defy all expectations and is extending its record as the longest in history despite constant calls from bearish advisors for a crash and an economic recession, one thing remains paramount; success is still based on picking the right stock at the right time.

Why Stock Picking Matters: TXN vs. XLNX

Of course, nothing goes up forever, and this bull market will end at some point. Yet, the key to trading success in the present is to manage the urge to sell every time the market takes a scary 1% intraday price dip and to stay patient. Accordingly, money in this market is moving toward those investors who focus on the present and the near term while investing in companies that run their business soundly.

A perfect example of this approach is seen in shares of Texas Instruments (TXN), a stock I recommended earlier this year, and which is up more than 10% since then while delivering routinely rising dividends along the way. Moreover, although the company has been warning about a general slowing in demand for semiconductor chips for several quarters, taking a page out of the Steve Jobs expectations management handbook, TXN once again brought in a better than expected earnings report and the stock remains in an uptrend (see chart).

Compare the shares of TXN to those of its flashier rival, Xilinx (XLNX), a stock which was up smartly all year but dropped more than 20% after delivering record earnings and being ahead of schedule on its 5G chip deployment strategy while revealing an aggressive business expansion model.

Unfortunately for XLNX and its shareholders, its sin was that it missed its earnings estimates by 2¢, even though it beat its revenue estimates. XLNX sumk because algos don’t like companies that miss estimates, and they don’t care about the next 12 months.

The take home message is that Xilinx was priced for perfection and it didn’t deliver up to the market’s expectations. When the selling started, the algos accelerated the underlying trend and the stock sold off. Conversely, when TXN shares initially dipped after its earnings report, dip buyers came in the next morning. The algos accelerated that trend and TXN moved to a new high.

This is a market where high priced, high P/E stocks are dangerous, especially during earnings season or when news is released, as the algos accelerate the overall market trend. When sellers come in to a stock, the algos sell more and the cycle accelerates. Eventually human sellers stop selling, human buyers disappear and the algos are left in a downward spiral. When the algos pull away, the stock starts to recover, or at least stops falling for a while, which is why XLNX bounced at the end of the week.

And although XLNX’s crash may prove to be a buying opportunity, in this type of market it’s best to either avoid high flyers like XLNX after big gains or to use options as a way to manage risk.

Bullet Train

- Calendar: The Federal Reserve meets on Tuesday and Wednesday. The April Employment report will be released on Friday. 150 companies in the S&P 500 will report earnings this week including GOOGL, AAPL, GE, MCD, and QCOM. China-U.S. trade talks resume. Chinese PMI data and U.S. personal income and spending data along with U.S. pending home sales, ISM manufacturing and non-manufacturing data plus consumer confidence round out the major calendar events.

- Big Picture: The bull market is still grinding its way higher as the third year of the Presidential Cycle is traditionally bullish for stocks. The U.S. economy is showing signs of slowing growth, but this may be fleeting, and no one seems to care right now. Watch the politics in Washington for strange events.

- Risk: Watch earnings, the Federal Reserve, economic data and U.S. China trade talks.

- Market Behavior: The uptrend may be accelerating in the short term. Intraday dips bring in buyers. Stocks that miss their earnings are being clobbered; those that beat are exploding to the up side.

- What to do: Stay patient. Expect intraday volatility. Continue to use options for high priced stocks but remain selective.

Market Breadth Says Higher Prices are in the Works

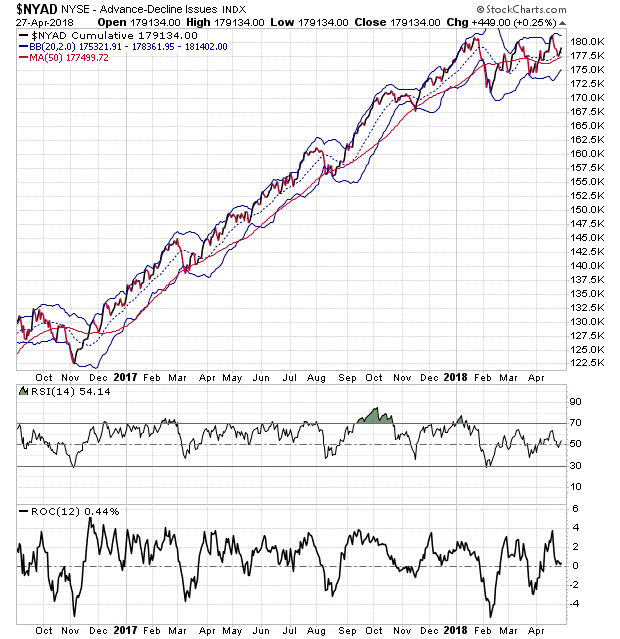

The New York Stock Exchange Advance-Decline line (NYAD) remains the most accurate indicator of the market’s trend since the 2016 presidential election. As I noted last week, the market was due for a pullback, which we saw early in the trading week. But as has been the case lately, any weakness is short lived as dip buyers emerged and NYAD moved to another new high as on April 26.

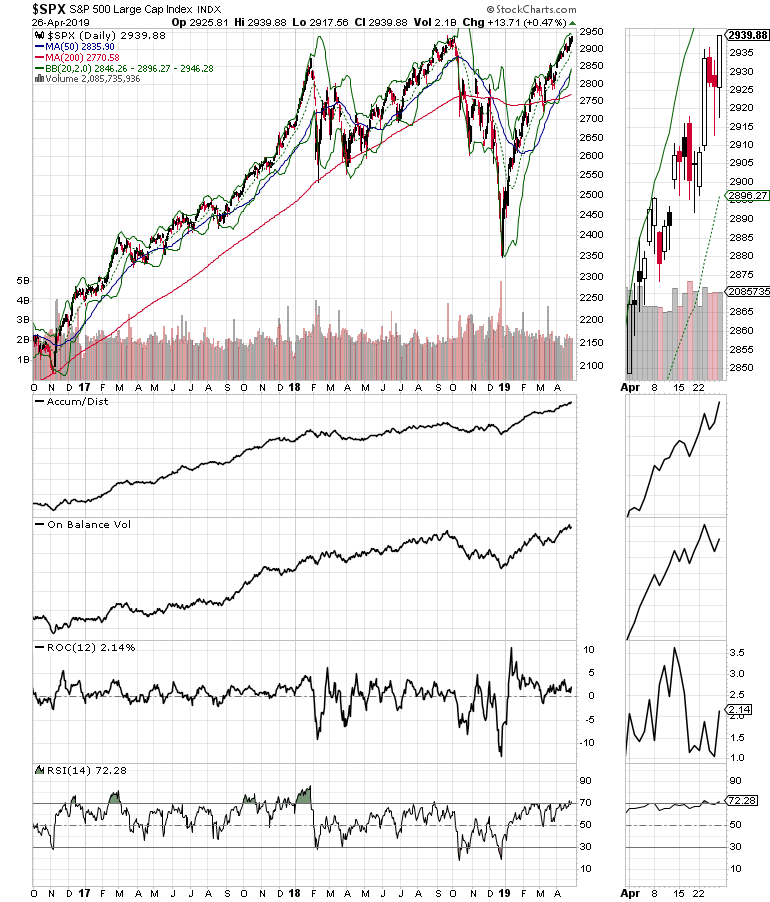

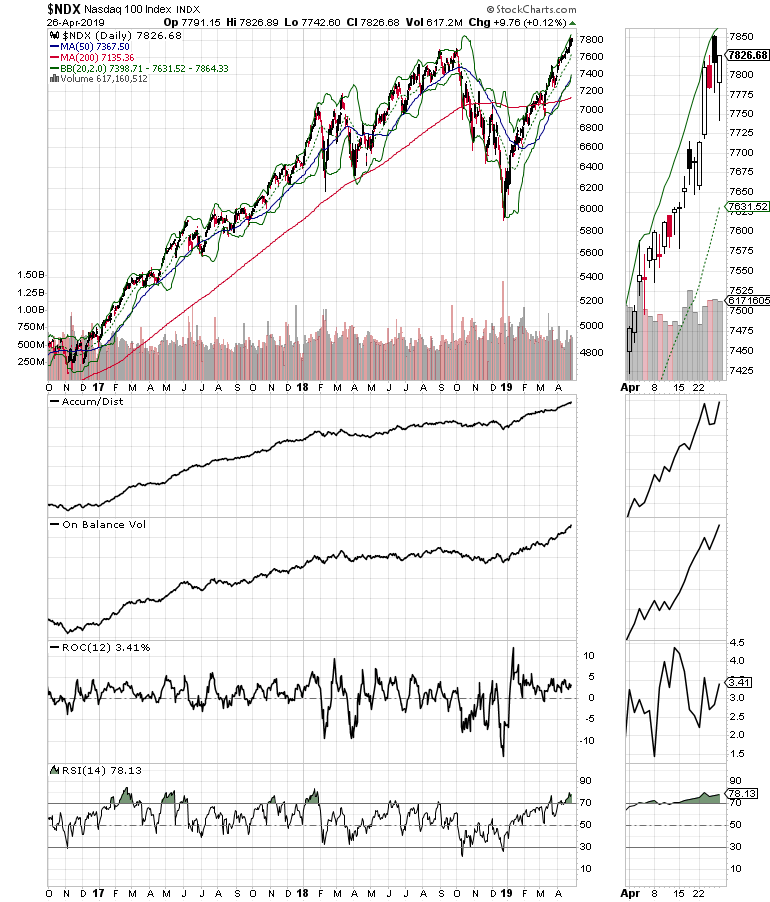

The S&P 500 (SPX) and the Nasdaq 100 (NDX) indexes made new highs last week. The new highs were fueled by oversized gains in stocks which beat earnings expectations whose advances were able to overshadow those whose shares imploded on bad earnings news.

Contrary to the action in the prior week, SPX was able to deliver a new high on Friday although the overall momentum indicators for NDX remain robust.

Stay Patient & Be Selective

It’s getting harder to find stocks to buy in the broader market, which could be a sign of a slowing in the market’s rise or even a real correction. However, it is also possible that money flows into technology stocks may not suffer as much as other areas in the broad market.

In this type of market there is no need to be in a hurry in the short term. If prices do pull back, then we can use support levels such as the 20- and 50-day moving averages, when they hold, as places to re-enter stocks at lower prices.

Otherwise, we stick with what’s working and see how things develop. And of course, earnings season is just getting started, which means that the market’s daily trading pattern will be highly influenced by both earnings’ news and individual company guidance.

Stocks Remain in Uptrend despite Naysayers

Perhaps the best characteristic of this market is the large number of non-believers that remain. Of course, it can’t go up forever, and it won’t. But right now, momentum to the upside is being fueled as much by the never ending negativity of the bears. At some point, even the biggest bear of them all, whoever that is at the moment, will throw in the towel. Then, things will stop being different and the bear market will come. That point is not evident yet.

Joe Duarte has been an active trader and widely recognized stock market analyst since 1987. He is author of Trading Options for Dummies.

His new book, released on May 7, 2019 “The Everything Guide to Investing in your 20s & 30s” is released on May 7.