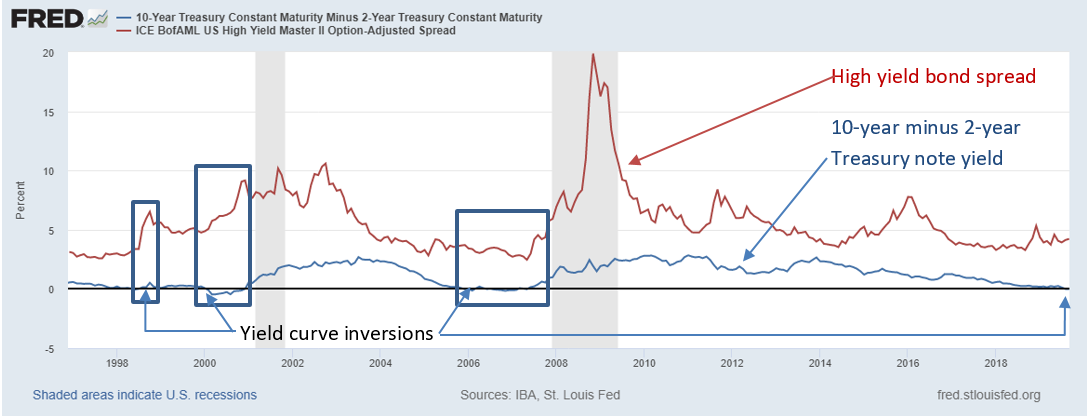

While many analysts have pointed to the yield curve inversion as an omen for a potential recession, the spread between Treasuries and high yield bonds does not confirm, reports Marvin Appel.

Bond market analysts have noted that short-term Treasury yields have fallen below longer term yields this year, an infrequent phenomenon known as a yield curve inversion that usually foreshadows a recession. In particular, three-month Treasury bill yields have been below 10-year yields since May. More recently, two-year Treasury note yields dipped below 10-year yields in August for the first time since 2007. Yield curve inversions have preceded every recession in the past 50 years and have inverted only once without a subsequent recession. For this reason, investors and policy makers are taking this bond market signal seriously.

On the other hand, the spread between the yields on high yield bonds and Treasury debt remains well contained, narrower than in December 2018 and much below levels reached in 2016 or 2011, not to mention 2008. When the bond market fears a slower economy, the spread between high yield bonds and Treasuries widens. Unlike the case of the inverted yield curve that is flashing its first recession warning signal since 2007, the high yield bond spread is neutral to bullish. Which signal should we believe?

The chart below shows that the timing of yield curve inversions and a rapid rise in high yield bond spreads has not been consistent. In 1998 and 2000, both bond market warning signals occurred at about the same time (circled in chart below). Similarly, high yield bond spreads started to widen rapidly in early 1989, at about the same time as the yield curve first inverted back then. On the other hand, the first yield curve inversion in 2006 preceded the start of a big rise in high yield bond spreads by more than a year.

Implications

Until high yield bond spreads break out above their Jan. 3 high of 5.44% to confirm the economically bearish implications of the inverted yield curve, I would not be worried about a recession (the spread is 4.23% as of Sept. 3). As a result, I am not worried about a significant stock market decline as long as our high yield bond timing models remain on buy signals.

For now, high yield bonds look likely to remain in a sideways trend at worst, allowing bondholders to collect the interest. We will be staying the course for our clients, paying attention to any changes in our intermediate-term timing models for stocks and bonds.

Sign up here for a free three-month subscription to Dr. Marvin Appel’s Systems and Forecasts newsletter, published every other week with hotline access to the most current commentary. No further obligation.