There is a difference between low-risk trades and no risk trades; the difference is low-risk trades exists, explains Alan Ellman.

Covered call writing is a low-risk cash-generating strategy. It is not a no-risk strategy. As we become educated and master the three-required skills: stock selection, option selection and position management, it is understandable why our members try to figure out strategies that can convert low-risk to no-risk. Here is a common inquiry I receive from some participants of our sophisticated community:

Can we create a no-risk strategy by selling an in-the-money strike that generates a time value return that meets our goal, say 2%, with substantial downside protection, say 4%. Then, if stock price drops by 4%, we close our position and keep the 2% profit without losing any money?

Real-life example using PayPal Holdings, Inc. (PYPL)

On April 1, 2019, here is the option chain for one-month expirations for PYPL with the stock trading at $103.84:

PYPL Option Chain 4-1-2019

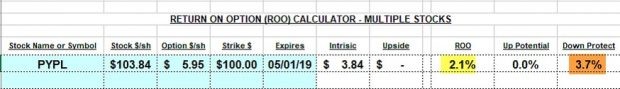

The $100 in-the-money strike shows a bid price of $5.95. Let’s feed this information into the multiple tab of the Ellman Calculator:

The Ellman Calculator: PYPL Calculations

Note the following:

- Yellow field: Initial time value return is 2.1%,

- Brown field: Downside protection of the initial time value profit (not breakeven) is 3.7%

- We are guaranteed a 2.1%, one-month return as long as share value does not decline by more than 3.7% by expiration

Summarizing the “no-risk” hypothesis

The proposed strategy suggests that once the stock value declines by 3.7%, we immediately close our position for a (near) 2.1% profit.

Fallacies in the strategy…there is no free lunch

First, there is a rare, but possible chance of a price gap-down of more than 3.7%. I say rare because, if adhering to our methodology, we are avoiding earnings reports, the most common reason for a gap-down. But unexpected bad news can rear its ugly head and result in such a drastic price decline.

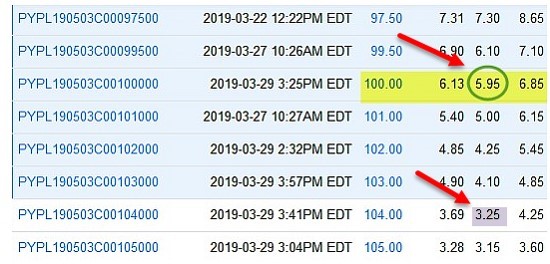

The main fact that is neglected in this theory is that we will incur a time value cost-to-close. When the trade was entered, the $100.00 strike was in-the-money compared to the $103.84 cost-basis. As share price declines, that $100.00 strike will move towards at-the-money (near-the-money). By definition, at-the-money strikes have a higher time value component than in-the-money strikes…just check any option chain on any stock. Let’s review the option chain for PYPL once again, this time comparing the time value component of the $100.00 in-the-money strike and the $104.00 near-the-money strike:

PYPL ITM and OTM strikes

Note the following:

- Yellow field: Shows a bid price of $5.95 for the in-the-money strike. After deducting the intrinsic value component ($3.84), we calculate the time value component to be $2.11 ($5.95 – $3.84)

- Brown field: The time value for the near-the-money $104.00 strike is $3.25, 54% higher than the in-the-money strike

Theta factor

The above strike comparison occurs at one point of time but the comparison would more accurately be evaluated at two points in time, trade initiation and when trade closure is being considered. This is because the time value will be eroded to some extent by Theta. However, Theta will not detract from the fact that we are incurring a time value cost-to-close and the trade will therefore not be no-risk. The actual risk can be quantified as follows:

Risk = [(Breakeven – lesser stock price) + time value cost-to-close)]

Let’s say share price drops to $96.89, a dollar below the breakeven ($103.84 – $5.95) and the cost-to-close is $1.50. Our loss would then be $1.00 + $1.50 = $2.50 per share + trading commissions. If share price drops to precisely breakeven, our loss would be the time value cost-to-close $1.50 in this hypothetical + small trading commissions.

Discussion

There is no such thing as a legal risk-free investment, when our goal is to achieve higher than a risk-free return (Treasuries, for example). The reason we are receiving these higher returns is because we are willing to incur some degree of risk. By mastering the three-required skills, we will become elite covered call writers and should beat the overall market on a consistent basis. In the above example, we will use our exit strategy to mitigate losses and, in many cases, turn losses into gains.

Use the multiple tab of the Ellman Calculator to calculate initial option returns (ROO), upside potential (for out-of-the-money strikes) and downside protection (for in-the-money strikes). The breakeven price point is also calculated.