With central banks pumping money into the financial system like there is no tomorrow, rising domestic and geopolitical tensions and the U.S. stock market continuing to churn higher, it’s best to simply follow the money, writes Joe Duarte.

The usual worry list, starting with the U.S.-China trade war continues to evolve with threats by the White House on Sept. 19 about raising tariffs to 100% followed by product exemptions on Sept. 20 and an early departure from Washington by China trade representatives. Meanwhile the Federal Reserve lowered interest rates and, just to make trading more difficult remained vague about its future moves.

Across the world, the attack on Saudi Arabia’s oil infrastructure may be developing into a long term worry as news emerged late in the week of an unspecified increase in U.S. troop deployments into the Middle East. This one dynamic could add significant uncertainty to the markets as the lack of information and details on the situation beyond vague allegations about Iran being responsible are likely to fuel price volatility.

In this market, it’s not difficult to get caught up in the daily news influenced price grind. But it is imperative to remain calm, as complex adaptive systems are dynamic and are always on the move.

herefore, even though daily volatility can be frustrating, the central concept here is that the financial markets are not operating in a vacuum. Indeed, they are a part of the Markets-Economy-Life (MEL) system, where the financial markets, the economy, and people’s daily lives meet.

Last week’s housing data is proof of that notion as mortgage demand from buyers jumped 15% year over year while mortgage apps for refinancing fell, just as market interest rates rose. I’ve been watching housing carefully for signs that people with money in their pockets were waiting for the right set up to act. So, until proven otherwise, the most recent housing data is likely an indication that such a move may be starting. And if it is not impeded by external events, we could see this trend remain in place for some time as interest rates remain low, as long as the economy remains stable.

Furthermore, the money in housing seems to be moving more aggressively into newly built homes with the latest amenities, delivering a 33% increase year over year increase in this segment as homebuyers are avoiding expensive existing homes with the potential for high remodeling and maintenance costs. This seemingly persistent trend is likely to favor homebuilders such as KB Homes (KBH) and DR Horton (DHI), whose shares delivered chart breakouts and a new 52-week high for the week ending on Sept. 20.

Horton delivered an upbeat quarterly earnings beat for its most recent quarter and offered positive guidance while increasing its already leading market share through purchases of local builders while announcing a $1 billion stock buyback program. Furthermore, the company reported that demand for new homes remains high while supply remains tight, which it has transformed into steadily rising gross margins and net income.

For its own account, KBH, whose earnings come out on Sept. 25, continues to focus on building gated communities in prime locations and is focusing on smaller single family energy efficient homes or townhomes targeting convenience and price conscious consumers. In its previous earnings report, KBH delivered a 15% year-over-year growth rate in new home orders while lowering its debt and increasing the number of communities in which it offers homes to potential buyers. If recent home sale data is indicative of where KBH’s sales have gone, it would not be surprising to see a decent, if not a blowout quarter.

The bottom line on housing is that supply, demand, and demographics — Millennials coming of age, albeit in their mid-30s, and boomers looking to downsize — are on the side of the builders who can deliver affordable modern homes in accessible locations. With builders being increasingly in tune with these issues, if mortgage rates remain reasonable and barring a major economic downturn, homebuilders may be in their own sweet spot for the next few quarters.

Market Breadth Takes a Pause

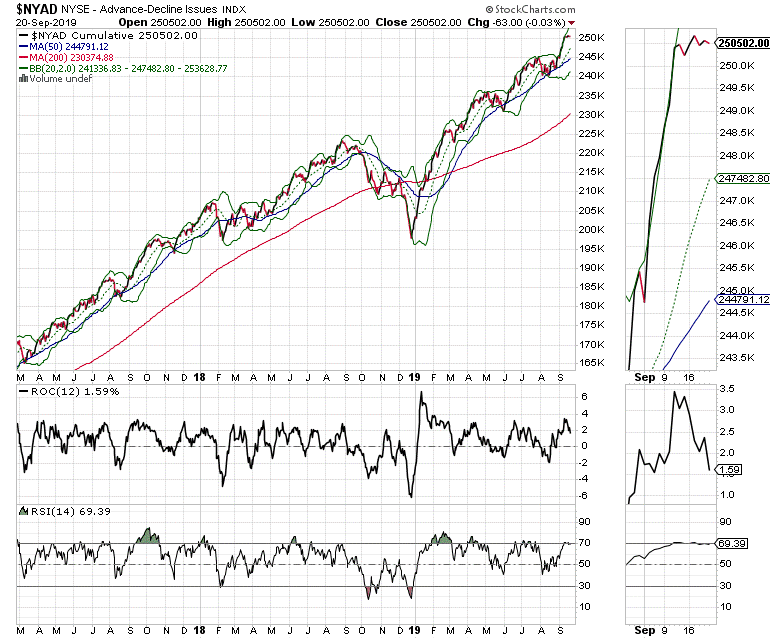

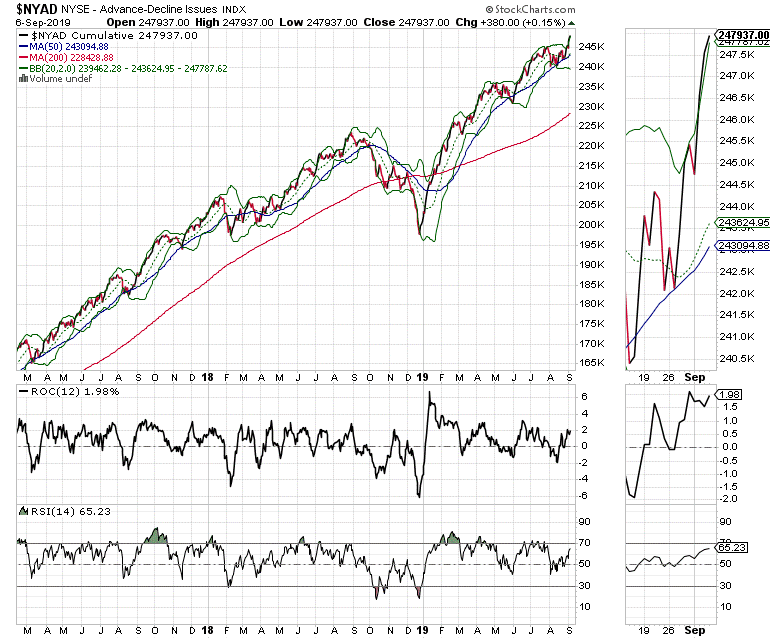

The market’s breadth, as chronicled by the New York Stock Exchange Advance-Decline line (NYAD) took a pause last week after scoring a series of new highs (see chart). Therefore, the bulls are still in the game. Nevertheless, given the daily geopolitical issues of the moment, we have to see what happens in the next few days before making further decisions.

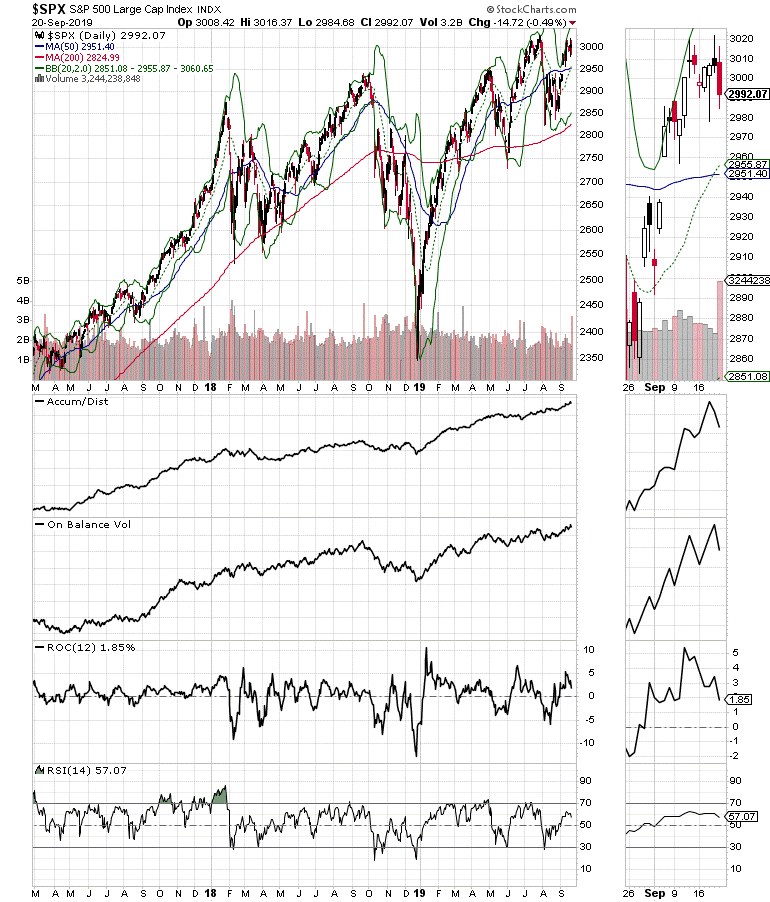

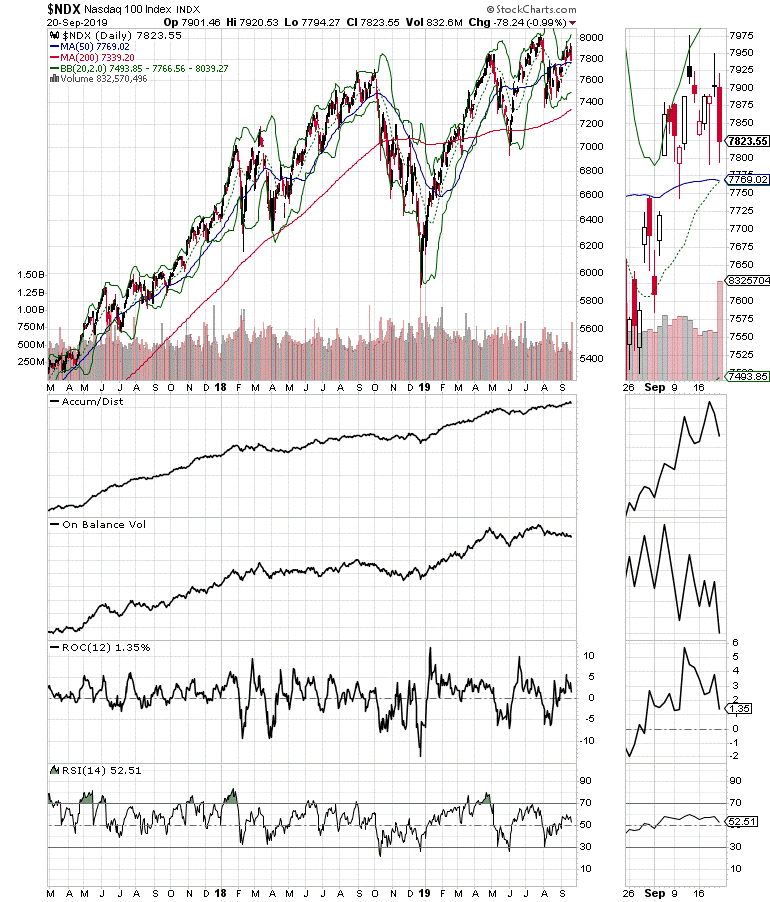

Meanwhile, the S&P 500 (SPX) is still range bound between 2050 (50-day moving average) and 3020, while the Nasdaq 100 (NDX) is showing some apparent signs of weakness (see chart).

Of specific concern on NDX is the rolling over of the On Balance Volume (OBV) indicator which is a sign that money is moving out of the index. As a result, it’s important to parse through NDX to make sure that we don’t throw all tech stocks out with the bath water.

The S&P 500 (SPX) and the Nasdaq 100 (NDX) indices both ended lower on Sept. 13 but had rallied for the prior several days. Both indexes are within reach of their all-time highs.

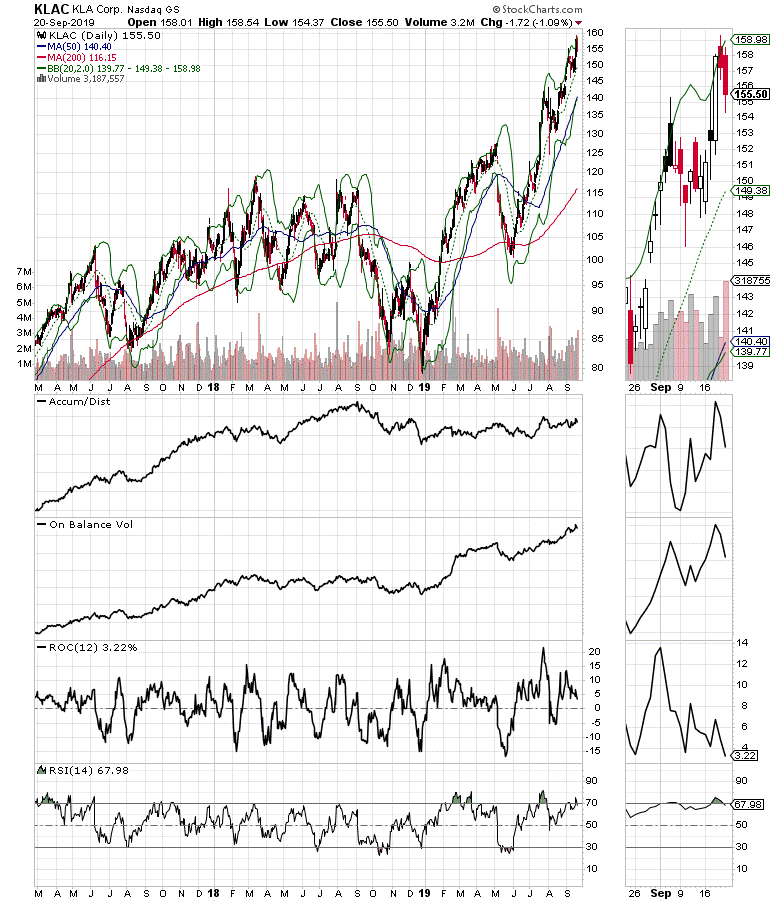

And a look inside the index shows that old tech stocks, such as KLA Corp. (KLAC), a major producer of semiconductor manufacturing equipment is within striking distance of its recent high (see chart).

In contrast, the old FANG darling Netflix (NFLX) has broken down completely. My point is that before turning completely bearish on technology stocks, it makes sense to look at individual stocks inside NDX before making decisions.

By the same token, SPX is holding up better than NDX because of sectors such as housing which are holding up at the moment.

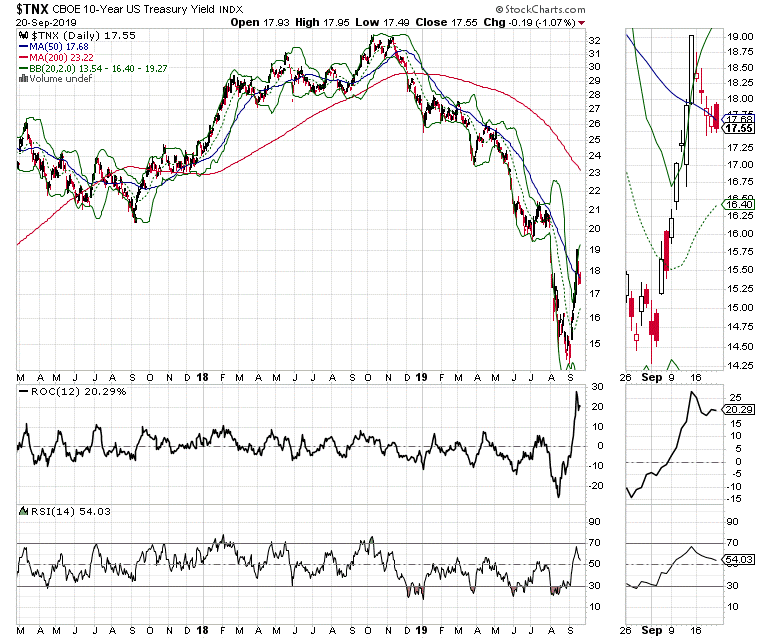

Furthermore, the Fed’s rate cut had an effect on what seemed to be a runaway reversal in the U.S. Ten Year Treasury note yield (TNX), which shot up to 1.9% before reversing. Much of what happens in the market and the economy over the next few months will depend on how the bond market adjusts to the current global economic and political situation.

Keep Your Eyes Open and Follow the Money

The stock market is clearly at a decision point and the world has an infinite number of balls in the air, many of which could crash at any moment. Moreover, given the increasingly jumbled state of affairs, a period of significant price volatility could start at any moment.

Nevertheless, despite the daily news, markets are all about interest rates and money flows. In other words, the eventual price action is directly related to whether the market cares more about low rates than actual economic growth rates and geopolitics at the moment.

I own DHI, KLAC, and KBH as of this writing.

Joe Duarte has been an active trader and widely recognized stock market analyst since 1987. He is author of Trading Options for Dummies, and The Everything Guide to Investing in your 20s & 30s at Amazon. To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit here.