A look at commercials vs. speculators by Andy Waldock.

We don't have any new trade for the Weekly COT Signals. We do have several open positions profitably running our way. We'll focus on updating our current holdings and locking in some gains.

Beginning with our oldest position

We bought December live cattle on Sept. 16 and the market has closed higher every week since our entry. This position has accrued more than $6k in open position profits, and the market has pushed through the forecasted resistance at 113. This exceptionally large, fast, and easy trade should be cashed in with a, "Thank you" to the markets.

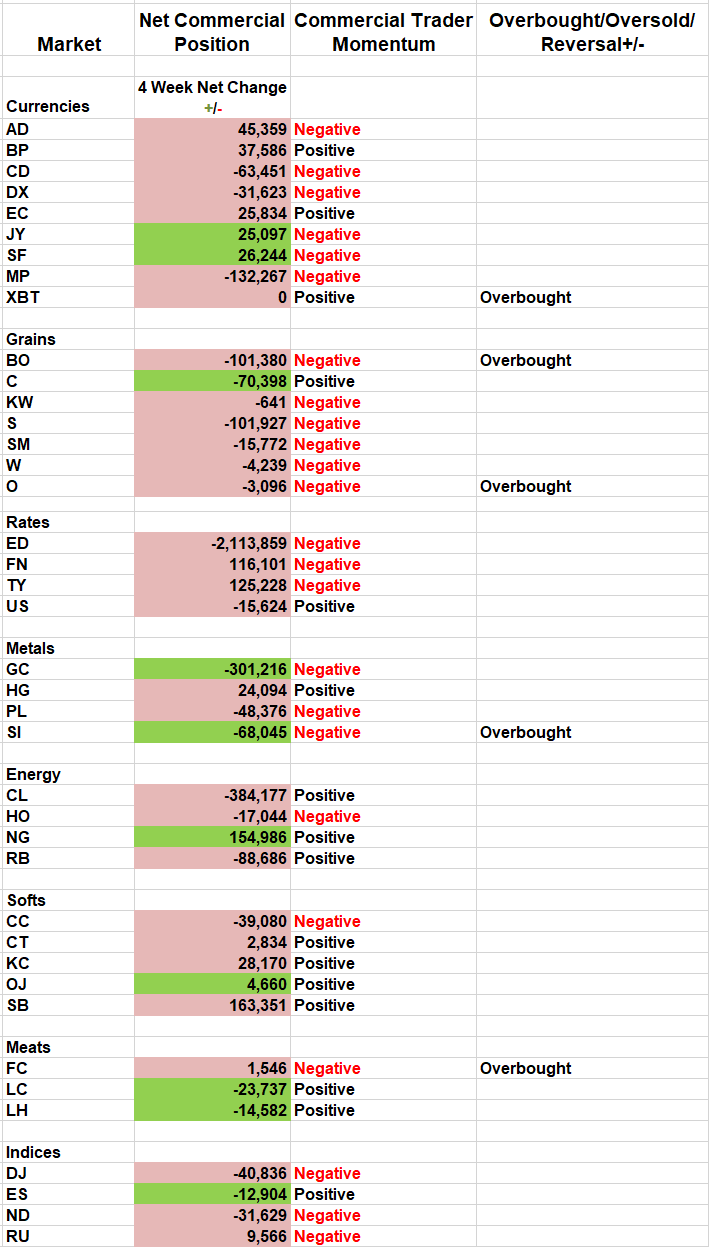

The currency markets have turned, as predicted in our Oct. 14 letter, and revisited on Oct. 21, "Rather than guess, we'll follow the commercial traders' lead and the methodology that got us long the euro and short the U.S. Dollar heading into last week." The commercial traders are still of the same mindset, and we'll follow along. Raise the protective sell stop in the December euro currency to 1.1080. Look for a target around 1.1350.

Lower the protective buy stop in the December U.S. Dollar Index to last week's high at 97.80. Next week's target is 95.50. Traders with a more extended outlook may want to hold until the market reaches deeper support around 93.75.

Moving to our letter of Oct. 21: Raise the protective sell stop in the Kansas City wheat to $4.10. This market looks like it's out of gas. Squeezing out a profit above last week's high of $4.3725 seems like it would be the right exit.

Natural gas has rallied sharply. Commercial traders set a rolling 52-week net long high heading into last week's trading. We expected this to fuel the reversal and leave the speculative shorts scrambling. We have about $2,500 in this trade, and it was the broadest weekly range since early this year. Time and percentage-based returns of more than 10% from our entry in two weeks suggest the profit should be taken.

The December cocoa market found support at the long-term weekly averages. There's a small profit in our short position. Take it, as a close above $2,600 per ton triggers a breakout, higher.

Finally, from last week's newsletter, lower the Canadian dollar protective buy stop to .7650. Our near-term target is .7525. The setup for this Canadian dollar trade combines seasonal, fundamental, and classic technical analysis very similar to the Canadian dollar trading strategy presented in our July 23 letter, "Treasuries and Loonie Looking to Reverse."

Register to see all previous Weekly COT Signals.

Here is what Andy had to say about seasonality and the COT Report at the TradersEXPO New York. Visit Andy Waldock Trading to learn more. Register and see our daily and weekly signals archive for entries and stop loss levels sent to our subscribers.