Market rally is showing some positive signs but too early to call bottom, reports Marvin Appel.

The S&P 500 Index jumped 3.4% Wednesday and is now more almost 23% above its March 23 closing low. Perhaps the market likes that Bernie Sanders dropped out of the Democratic primary, freeing up Joe Biden to pivot more to the center to attract swing voters months before the party conventions.

The 2000-2003 and 2007-2009 bear markets also had bear market rallies of this magnitude, but before that you have to go all the way back to the 1930s to see this sort of action punctuating bear markets. It would be unusual to see such a sharp decline as occurred from Feb. 19 to March 23 without some sort of retest of the low. Even the crash of October 1987 saw a retest in December.

It is also hard to reconcile the notion of a bear market limited to a drawdown of just 34% in the face of unemployment projected to jump to anywhere from 12% to 30% ,and an economic contraction projected to be more severe than anything seen since the 1930s.

Maybe the Federal Reserve and Federal stimulus plans are so impressive that the markets expect success and a “V”-shaped economic recovery to begin in a few months. Personally, there are many activities such as air travel, theater, eating at restaurants and shopping at malls that I plan to curtail until a vaccine becomes available more than a year from now.

I have also learned that my business functions very effectively with our team working remotely and therefore see a long-term future operating out of much smaller quarters. Many of the people I speak with feel similarly. Now think about the many small business similarly situated with 10 or fewer employees working out of expensive downtown office spaces and extrapolate that sentiment to the millions of jobs in the tourism, restaurant and retail industries and it is hard to see how rapidly the economy can bounce back.

Of course there should be offsetting job gains in public health, health equipment and supply manufacturing, grocery stores and home delivery services but on the whole it seems likely that there will be significant net job losses that will take years for the economy to adapt to.

That doesn’t mean there won’t be good trading opportunities. For the intermediate term (weeks-months), there are signs that risks in the stock and high yield bond markets are as much to the upside as to the downside. Chief among the bullish indications is that corporate high yield bonds are in an uptrend, evidenced by the buy signals for the funds we follow in the newsletter portfolios. It hasn’t been foolproof, but historically there has been a strong tendency for stocks to do well (or at least avoid disaster) when high yield bond fund timing models are on buy signals. We have taken high yield and floating rate bond fund positions for clients in anticipation of an intermediate-term opportunity as there was in late 2008. In our experience it has been safer to try to catch bear market bottoms with these funds than with equity ETFs such as SPY.

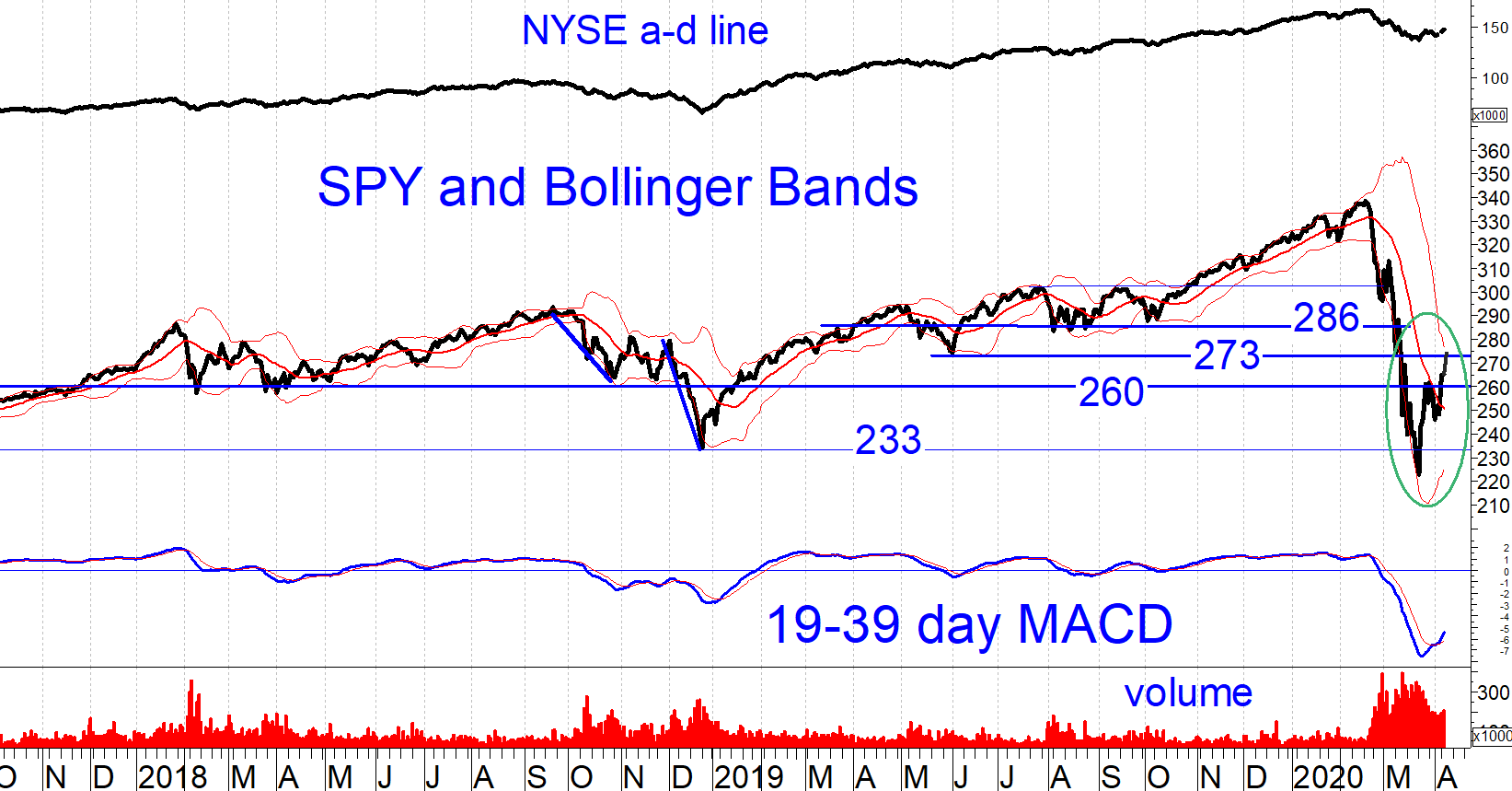

Today’s rally brought the S&P 500 SPDR (SPY) to its upper Bollinger band. This should be a resistance area (around 273), which is also where SPY found support last May. (See chart below.) It is bullish that SPDR S&P 500 ETF Trust (SPY) crossed above its middle Bollinger band on the second attempt.

The Moving Average Convergence/ Divergence (MACD) indicator is oversold and has generated a buy signal, but one that is unconfirmed by price action. Ideally, we would want to see a second crossing of MACD above its signal line and to see the price oscillator form a double rising bottom. But sometimes the market fails to oblige us and instead goes straight up as it did after Dec. 24, 2018. I do not believe that this will be one of those times.

Sign up here for a free three-month subscription to Dr. Marvin Appel’s Systems and Forecasts newsletter, published every other week with hotline access to the most current commentary. No further obligation.