As you may know by now, normally with my stacked profits strategy, I target anywhere between 50% to 150% to 200% winners on the regular. Now the great ones are 300%+ winners. But on a regular basis, singles and doubles (like this one), are great, says Danielle Shay.

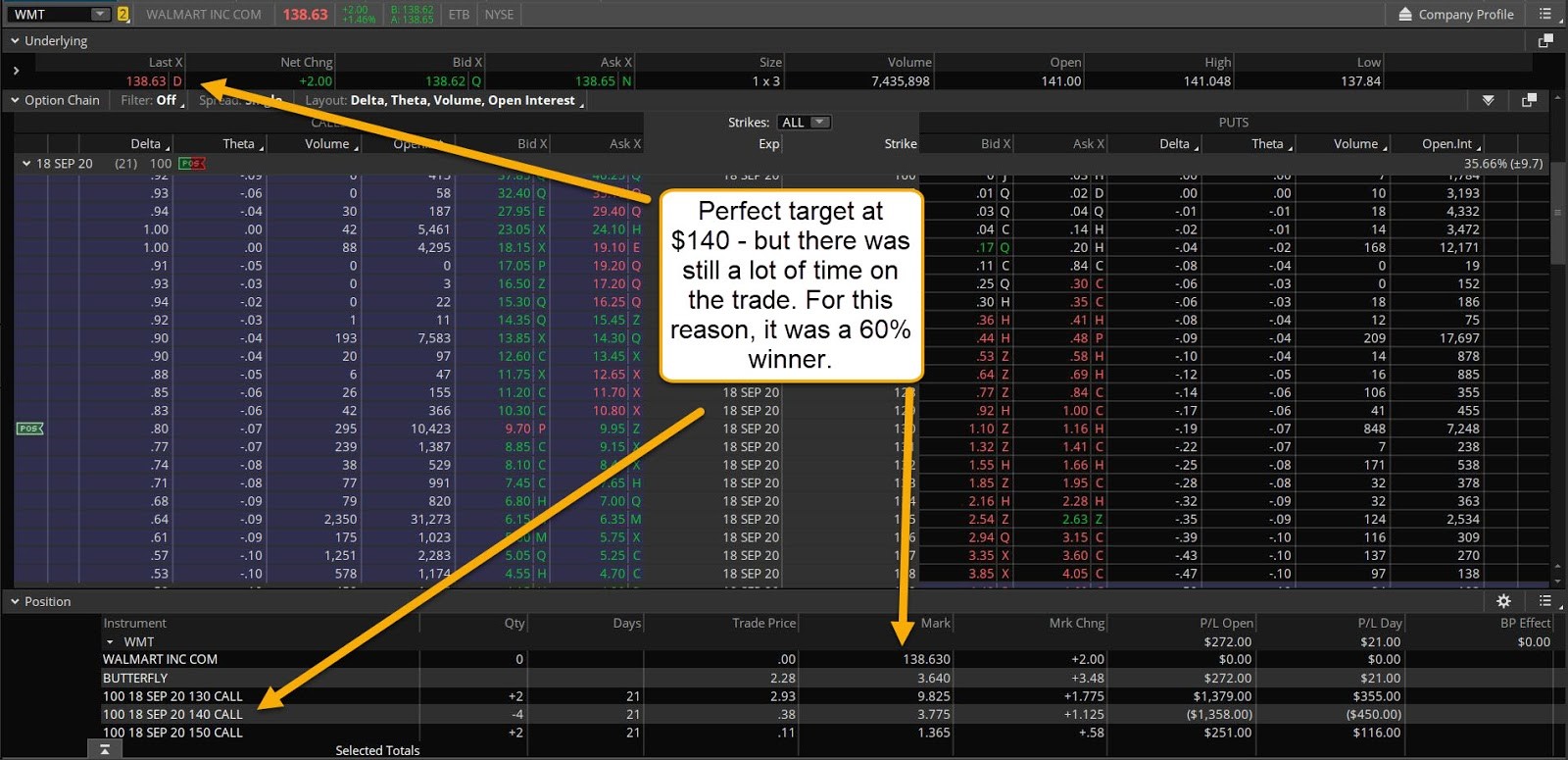

So, here’s a 60% winner using my stacked profits strategy, which played out within my Stacked Profits Mastery.

Let’s look at Walmart...

Why Walmart?

- This is an ecommerce winner: (specifically an ecommerce, Covid winner.) Why does this matter? Because right now the only stocks that’re trading higher are companies that are making money throughout and despite the pandemic. Walmart specifically has grown substantially in their e-commerce segment, and they’ve seen a rush in demand overall.

- It’s in the Consumer Staples Sector: This sector is a favorite of mine. An overall rule of thumb for me is that I like to look at a variety of sectors, then narrow it to ones that are moving, then narrow it to trading stocks within those moving sectors. This comes from my Phoenix Finder strategy and methodology.

But just because you like a ticker because it’s an e-commerce stock or a staples stock, doesn’t mean it’s good to get in and out at any given time.

So Why Now?

It had earnings and after earnings it came back to settle down. I love looking for a ticker that’s had earnings and the hype is already over. Why? Well, typically what’ll happen after that is it’ll consolidate for a few days or a week…and that gives you an opportunity to get in.

That’s what I did with Walmart.

It had earnings, settled down, consolidated into a squeeze, and then boom…

We got the Turbo VZO Indicator triggering to the upside, and a really nice volume buy. Then Walmart was off to the races and traded up to 141.

How I Traded It

If you know my Stacked Profits strategy, you know that I like to use butterflies specifically. So I placed a butterfly targeting the $140 price point.

Now I’ll be honest with you about something that surprised me with Walmart…

Is the fact that it was up 6% in one day. That’s very abnormal for Walmart’s stock, and for that reason I didn't make as much as I could’ve, but I still made 60%.

How?

I used a butterfly and got into it for $2.28 (a nice, cheap trade for a smaller account), and targeted the 140 strike. So, my target was perfect. The only thing that wasn’t perfect was my timeframe. Sound familiar? It happens. I gave this trade about 24-25 days or so because the expected move wasn’t showing that it would be at 140 till mid-September.

But then news was released about Walmart and TikTok, and the stock shot up 6% in one day. So, it hit my target far sooner than expected.

So this is a situation where you get your target right, but the timing isn’t perfect…and that’s the one instance where you're not going to make as much money on a butterfly as you would on a long call. Since there was still 21 days of life on my trade, and the center strike (the 140) still had a ton of value in it, I didn’t make as much as I could've made with just long calls.

But I really can’t be too upset with this trade because…

- It’s still a 60% winner, which is consistent with what I target to make with each Stacked Profits trade.

- And Walmart doesn’t normally move like that…I mean 6% in one day on a staple stock like that. That just doesn’t normally happen.

I’d normally buy a long call on a much more volatile ticker, and save the butterflies for tickers, like Wamart, that traditionally don’t move that much. But I did want to give you an example of when it would’ve technically been better to have a long call on instead of a butterfly…

Which is why I generally ‘stack’ those two strategies together.