One of the things many financial advisors and experts talk about is the importance for individuals to have some sort of an emergency fund, explains Konstantin Rabin of BestOnlineForexBroker.com.

The emergency fund represents a cash reserve, which people can access in times of financial emergencies. Here it is worth mentioning that there is no standard size of an emergency fund, which all financial experts can agree on. Every one of them has different opinions on the subject. Some of them might recommend just having $1,000, while others mention that one has to have at least three to six months’ worth of expenses in the savings account.

Once an individual determines the exact size of an emergency fund, it becomes much simpler to manage the household finances. What people can do here is to fully fund the emergency fund and only then move on to filling their trading or investment accounts. This set of priorities can help the market participants to keep their domestic affairs secure before committing capital to trade.

In addition to that, it is also important to mention that the size of the emergency fund should be adjusted from time to time to reflect the changes in individual circumstances, as well as to take into account inflation.

One does not have to do so at the end of every month, but it might be appropriate to make those adjustments at least once per year. After all, if an individual does not increase the size of the emergency fund, it will start losing its buying power to inflation and become less effective for dealing with financial emergencies down the road.

However, one of the most important questions traders might have on this subject is: do traders need an emergency fund? Since the market participants already have some amount of money saved up, is it not better to invest it all for better returns?

Well, the usual argument here goes that nowadays in a near-zero interest rate environment, money on the savings accounts earns next to nothing. Consequently, over time it loses purchasing power. Consequently, from a purely financial point of view, it is far better to invest all the savings in the market to earn higher returns than the inflation rate and retain one’s purchasing power in this way.

After all, if things go wrong and traders face some financial emergencies, they do have at least two options. They can simply liquidate some of their investments and use the funds to address the current financial problems. Alternatively, they can use their credit cards to fix the financial issues and then repay the balance later.

Avoiding Unnecessary Losses

The arguments mentioned above do make a lot of sense for some people and might sound quite logical for us as well. However, for the sake of accuracy, it is important to point out that there are several distinct problems with those arguments.

Firstly, it is important to keep in mind that, if people invest all of their savings in trading, then they might be forced to sell some of their investment at a loss. To understand this better we can take a look at some real-life examples.

Let's go back a few years. In the first image, we can see the daily GBP/USD diagram:

As we can observe from the above diagram, in the middle of September 2020, the GBP/USD currency pair was trading close to the $1.29 level. During the subsequent days of trading, the British pound suffered some notable losses, with the GBP/USD exchange rate dropping down to the $1.27 level.

However, from that point onwards, the British pound recovered and during the subsequent weeks of trading made some steady gains. As a result, by the end of October 2020, the GBP/USD pair had reached the $1.30 level.

Now, let us suppose that an individual trader has opened a long GBP/USD position at the beginning of this period. We know that if the trader helps the position open until the end of October, then the overall size of profit would be the equivalent of around 100 pips. However, if the market participant had no emergency fund to speak of, then at some point, he or she might be forced to close the position prematurely, suffering some serious losses along the way.

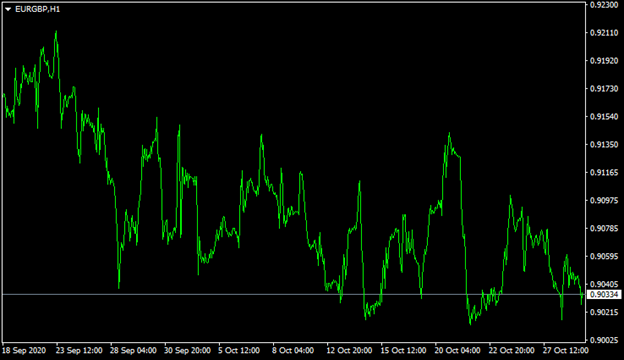

The price movements in the GBP/USD pair are not the only example of such a scenario. For another example, we can take a look at this hourly EUR/GBP chart:

As the above diagram shows, in the middle of September 2020, the EUR/GBP pair was trading near the 0.9170 level. During the subsequent trading sessions, the euro has made some gains and risen to the 0.9200 level against the British pound.

However, those gains eventually turned out to be short-lived. During the subsequent weeks of trading, the British currency has made some steady gains. As a result, by the end of October 2020, the exchange rate of the EUR/GBP had dropped down to the 0.9030 level.

In this case, if some traders had opened a short position with the EUR/GBP pair during this period, they would have gained approximately 140 pips, which is significant. However, if they were forced to close the position early, they would have instead ended up with a 30-pip loss.

Finally, we have a third example from this hourly AUD/NZD chart:

As the above diagram demonstrates, by the second half of September 2020, the AUD/NZD pair was trading close to the $1.08 level. Initially, the Australian dollar rallied and has risen to the $1.09 level. However, after making those gains, the AUD/NZD has declined steadily, eventually falling all the way down to the $1.06 level.

If traders opened the short AUD/NZD position, they would have earned a profit, which would be the equivalent of approximately 200 pips. However, if they had to close the position prematurely, they could have lost up to 100 pips.

So we have seen three real-life examples, where traders had the potential to earn some decent returns, but they could not have done so if they had to close prematurely due to the absence of the emergency fund.

On the other hand, when traders have an emergency fund to count on, they have sufficient reserves to address their financial issues and consequently, keep their investments intact, which can have a positive impact on their overall trading performance.

Credit Card Expenses

So as we have seen so far, one of the biggest downsides of not having an emergency fund is that traders might be forced to close their positions prematurely and suffer some serious losses in the process.

However, some people might argue that there is another solution to this problem: traders can use credit cards in times of financial emergencies and then repay the balance at some point in the future.

This might make sense for some people, but there are indeed some problems with this line of reasoning. Interest rates on credit cards are much higher than on mortgages, car loans, and even consumer loans. For example, if the market participants can get a mortgage for 3% to 4%, the interest rates on credit cards can range from 15% to 25%. So simply speaking we are dealing with an expensive type of debt.

Credit cards do indeed have some periods of interest-free loans. For example, with some credit cards, if the client pays off the balance within 55 days or some other specific timeframe, he or she does not have to pay any interest. However, here it is worth remembering that in some cases, depending on the size of the financial emergency the client might not be in a position to repay the balance in full.

Now, the high-interest rates on credit cards are not the only problem associated with the use of this method. Here it is worth pointing out that there is no guarantee that the bank in question will always offer enough credit limit for the client to cover all of its financial emergencies. The reality of the situation is that according to the terms and conditions of using credit cards, the bank or credit card company can change interest rates or adjust the size of the credit limit at any point in time, without the consent of the client, for whatever reasons, regardless of the circumstances.

Therefore, It is hardly surprising that in times of economic downturn, many financial institutions tend to reduce their risk exposure. One of the ways to achieve this is by lowering the credit card limit for clients.

This means that when a financial emergency strikes, some people who are relying on credit cards might be left without any funds at hand to deal with those problems. This means that a credit card is an unreliable supplement to an emergency fund.

Consequently, it is far better to have an emergency fund in place, so that in times of financial emergencies one can withdraw money without having to pay any amount of interest in the process.

Psychological Factors

When traders do not have a proper emergency fund, this does not only present them with some serious financial problems. There can be psychological factors at play here as well. Nearly all financial experts professional traders and investors warn market participants not to make trading decisions based on emotions.

Now, what happens here is that those traders who have no emergency fund in place are that they tend to have a more difficult time controlling their emotions during trading. Some financial experts and commentators explain this phenomenon in the following terms: if you invest all of your emergency funds in trading, then you have a lot to lose for failed trades and therefore, in the process, you become more likely to make decisions based on emotions.

This is not surprising, since people keep an emergency fund to have enough funds available for groceries, rent or mortgage, and other essential expenses in times of financial difficulty. So, if market participants lose all of their money in trading, then they will have nothing to fall back on in case of financial emergencies and difficulties. Consequently, when they are worried about the prospect of losing all of their money, their decisions are influenced by their emotions. It essentially becomes impossible to keep amounts out of the decision-making process under those circumstances.

At the same time, when the market participants have their emergency funds in place, they are well-positioned to maintain control over their emotions. In this case, they know that in the worst-case scenario, they will at least have enough funds to cover all of their essential expenses like food, rent, fuel, and utilities. Consequently, they are more likely to base their trading decisions on fundamental and technical analysis, rather than their daily emotions.

Here it is also pointed out that having an emergency fund does have some additional psychological benefits as well. Having an emergency fund has the potential to reduce the stress levels for the market participants. When the market participants risk all of their money down to the last penny on trades, this makes the entire experience of trading very stressful.

Over time, this sort of approach can take a toll on traders and interfere with their ability to make rational decisions. At the same time, the fact that the market participants have something to hold on to can make their experience of trading much less stressful. This enables them to focus on objective data and conduct a high-quality analysis, rather than worrying about the size of the potential losses.

By Konstantin Rabin of BestOnlineForexBroker.com, a website listing top forex brokers.