We may be nearing the end of the recent rotation in stocks and here is why, explains Joe Duarte of In the Money Options.

The New York Stock Exchange Advance Decline line (NYAD) has made a new high just as the implied volatility (IV) of the S&P 500 (SPX) complex—index, SPY ETF, and related futures and options has crashed. Moreover, the decline in IV volatility is occurring at the same time we see a narrowing of the Bollinger Bands, which on its own, suggests that a big move in stocks is approaching. Of course, the direction is always difficult to predict. Yet, as I detail below, a strong case can be made for the current rotation possibly resolving to the upside.

More important, even if there is no major move in the indexes, there are still plenty of stocks, which are either already in bullish trends, or in the early stages of emergence. In fact, during the recent pause in the major indexes, we’ve seen a continued steadiness in the market’s breadth, as measured by the New York Stock Exchange Advance Decline line (NYAD), which is clearly supported by the action in the charts of a wide variety of stocks.

Even more interesting is the fact that many stocks that have outperformed the indexes of late are well outside the realms of the daily press, and thus outside of the usual algo trading venues. This suggests that the algos may have been caught napping and that they will have to turn their attention to these newly hatched uptrends, a fact that could affect these stocks positively as algo momentum programs gravitate toward the positive cash flow outside the mainstream.

All of which means that the bull market is still alive but is evolving into a different phase. And that means that watching the action in the indexes is providing a limited picture as to what’s happening in the market. In other words, unless something very drastic happens, the next up leg in stocks will likely feature smaller, lesser-known stocks.

Finally, the Fed continues to pump money into the bond market, which for now suggests that bearish periods will either be short lived or perhaps be more limited to index stocks.

Options Suggest 420 on SPY is New Support Level

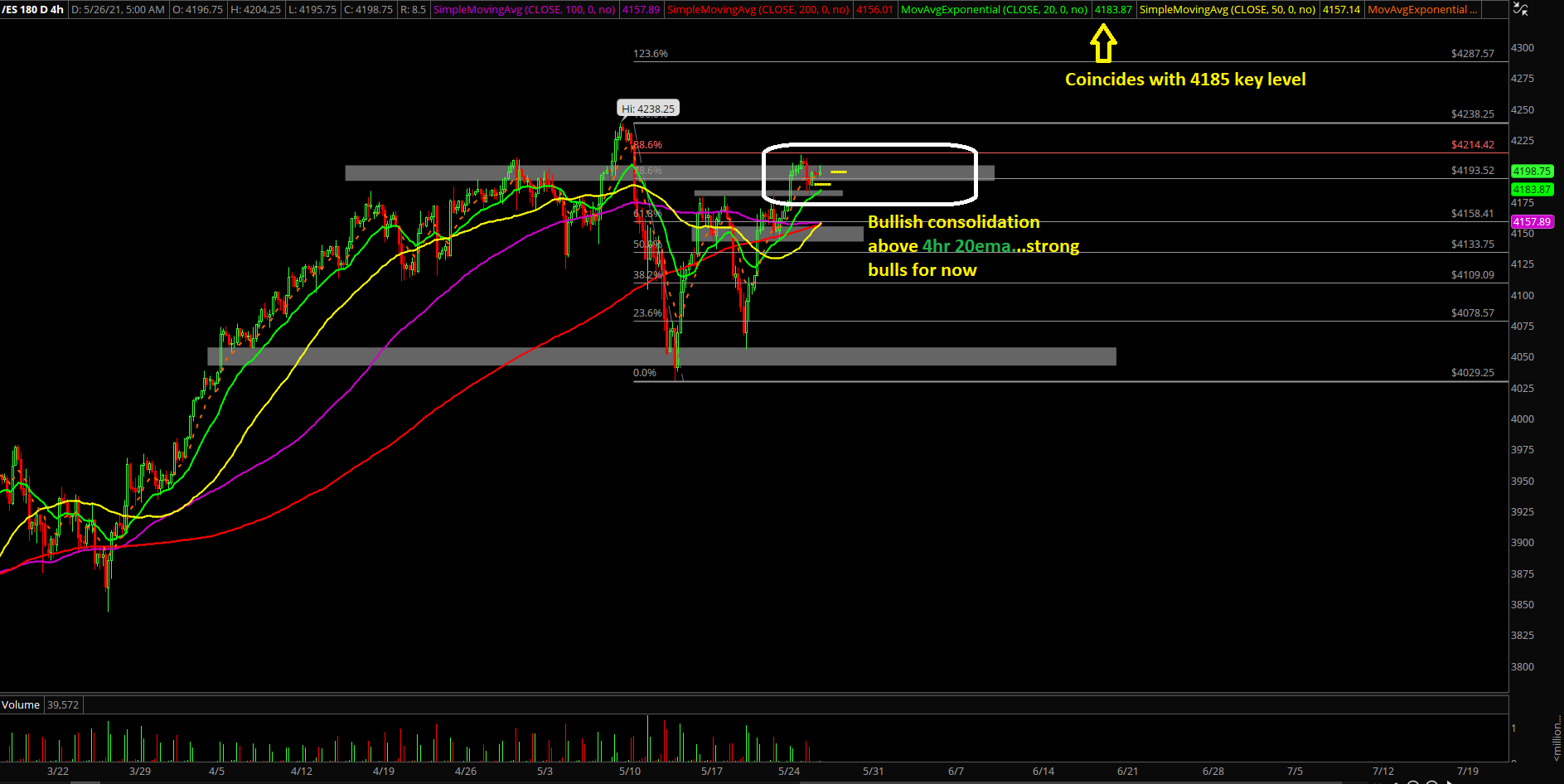

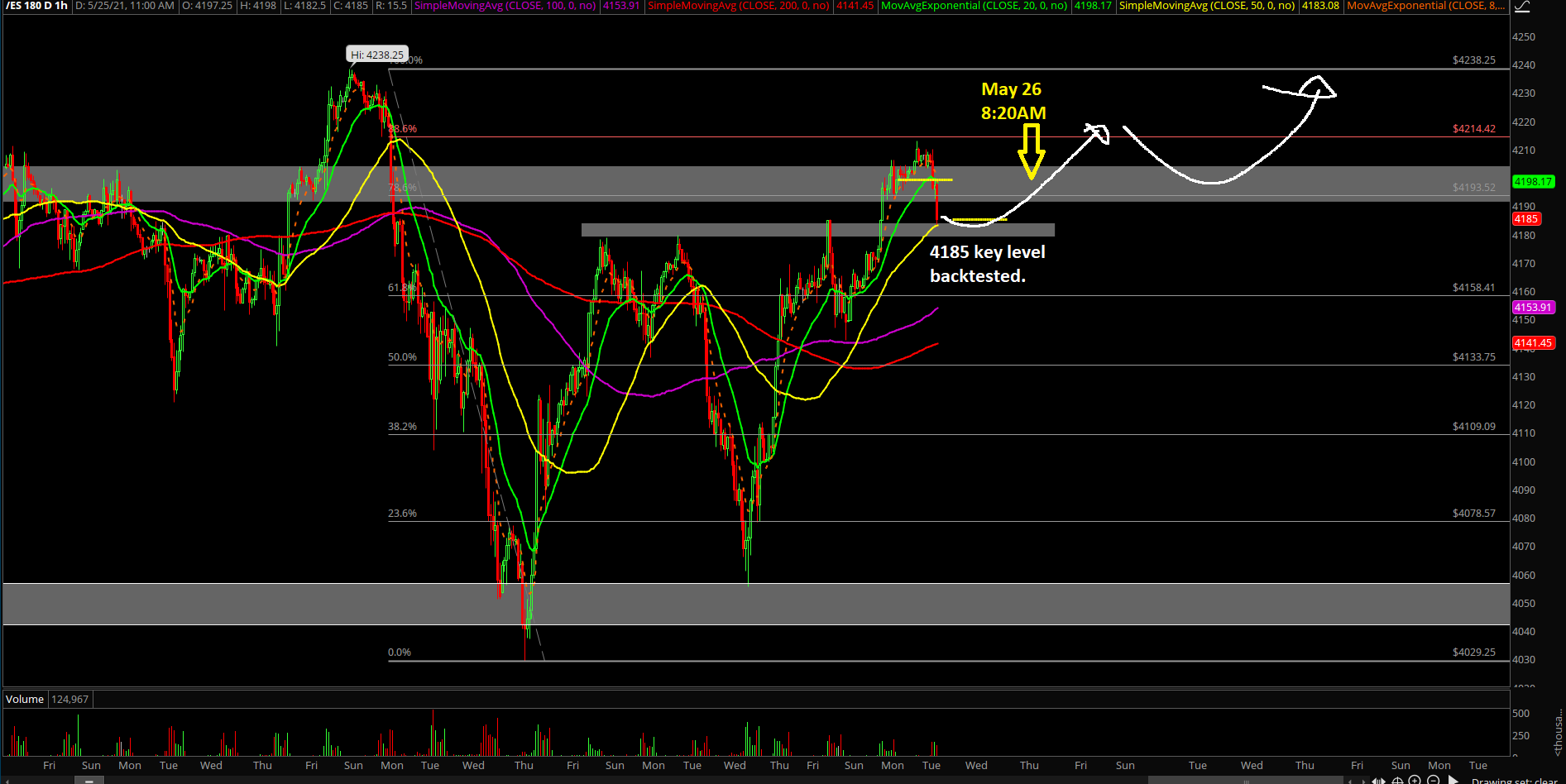

Over the last few weeks, I’ve noted the significance of the 420 strike price area on the SPDR S&P 500 ETF (SPY) for the markets. That’s because that’s the strike price on the weekly expirations (M,W,F) where the algos have increased their put buying regularly as a hedge with the net effect being that SPY is unable to move above that area. Of course, in order to hedge their bets, the algos have been selling stock and stock index futures at 420, and it’s that selling that causes the stall at this key chart point.

However, last week even as the put volume was greater than the call volume at 420, the call volume at 421 and 422 rose and the net effect was that 420 started to become support. This suggests that money flow into stocks is increasing and that the algos are starting to place some upside bets above 420 even as they still hedge their bets by buying puts at 420. So now, what remains to be seen is whether the support at 420 will hold and if this price level will become a launching pad for higher prices. Certainly, the market’s breadth and the overall decrease in Implied Volatility suggest that a big move is in the works. As usual, however, there is always the possibility that the current set up breaks down. So, if SPY fails to stay above 420, we could see a retest of the recent lows or worse.

Double Tech Breakout: Logitech and On Semiconductors Blast Off

I recently recommended shares of computer peripherals maker Logitech (LOGI), just before its recent breakout, along with semiconductor manufacturer On Semiconductor (ON), which is on the verge of breakout. Happily, both stocks have made positive moves suggesting that money is moving back into technology shares. Of course, the action in PC and laptop stocks such as Hewlett Packard (HPQ) shows that they have taken a beating lately, which suggests that any money moving into tech is being selective. Just as likely, though, the recent rotation in the market may also be responsible as money moves out of PC stocks into other areas of technology.

Logitech’s story is particularly interesting as the company makes PC and wireless peripherals such as mice, keyboards, and other useful add-ons. So, it would seem that if PC sales have topped out, so might have peripherals. But on the contrary, it seems as if even if PC sales plateau, Logitech’s peripheral sales are likely to increase beyond even the most recent quarter’s handy beat. That’s likely due to a significant work from home dynamic and a related peripheral upgrade cycle.

The stock recently took out meaningful resistance at $120 and is still not quite overbought with Accumulation Distribution (ADI) and On-Balance Volume (OBV) confirming the breakout. Moreover, Volume by Price (VBP) suggests that buyers are in charge at the moment. So, any kind of consolidation may be a good opportunity to add to positions.

Meanwhile, shares of On Semiconductor (ON) recently moved above $40 per share and reversed an intermediate term price downtrend by moving back above their 50-day moving average. This is a bullish development, which suggests the market is recognizing the company’s managements moves to counter the semiconductor chip shortage and that the recent dip in prices, after a bullish earnings report, was more of a sector driven decline in the stock and an opportunity to buy on the dip.

Certainly, ON is not a household name. But its primary business is to provide semiconductors to the two areas of technology with significant growth prospects, the automotive and industrial sectors. Moreover, as ON tackles the challenges of the current situation—where the chip shortage is predicted to last until 2022, the company seems to be doing all the right things including:

- Shuffling management to suit their strongpoints

- Aggressively managing inventories in order to meet customer demand and

- Changing company policy in order to react to market pressures and changes more rapidly

So far, the strategy is working as the company delivered a 16% year over year growth in revenue and expanded its margins, all during a period riddled with supply chain disruptions and uncertainty. Moreover, the company reversed a loss from the prior year with a $0.20 per share profit while providing upbeat guidance suggestive of continued growth. Specifically, ON saw healthy growth on its electric car related products while its industrial segment—including defense and aerospace also delivered above expectations. Together these two segments make up 60% of the company’s business.

Technically, the stock looks poised to move higher, as long as it can stay above the $40 area. Accumulation Distribution (ADI) has been falling because of short sellers piling on. But On-Balance Volume (OBV) has been rising, which suggests that value players are buying on the dips caused by the short sellers. This is often a very bullish indicator confluence. In addition, the RSI just crossed above the 50 area while ROC crossed above 0 and is gathering steam.

I own shares in ON and LOGI as of this writing.

NYAD Makes New High. Possible Short Squeeze Ahead.

The New York Stock Exchange Advance Decline line (NYAD) broke out of its trading range last week with a new high again supporting the notion that the stock market’s uptrend remains intact.

Once again, I will reiterate that as long as NYAD continues to make new highs, remains above its 50- and 200-day moving averages and its corresponding RSI reading remains above 50, the trend remains up. This combined set of observations has been extremely reliable since 2016 and shows no signs of becoming unreliable as of this writing.

The Nasdaq 100 index has recovered some and is now trading above its 50-day moving average. Moreover, there is the potential for higher prices here if short sellers, who have increased their activity of late as indicated by the collapse in Accumulation Distribution (ADI) at the same time that On-Balance Volume (OBV) has held up, get clobbered. As I noted above, there has been an increase in call option volume on SPY of late, which suggests that a potential short squeeze is building. That short squeeze, if it materializes is likely to spread to the QQQ ETF and thus NDX.

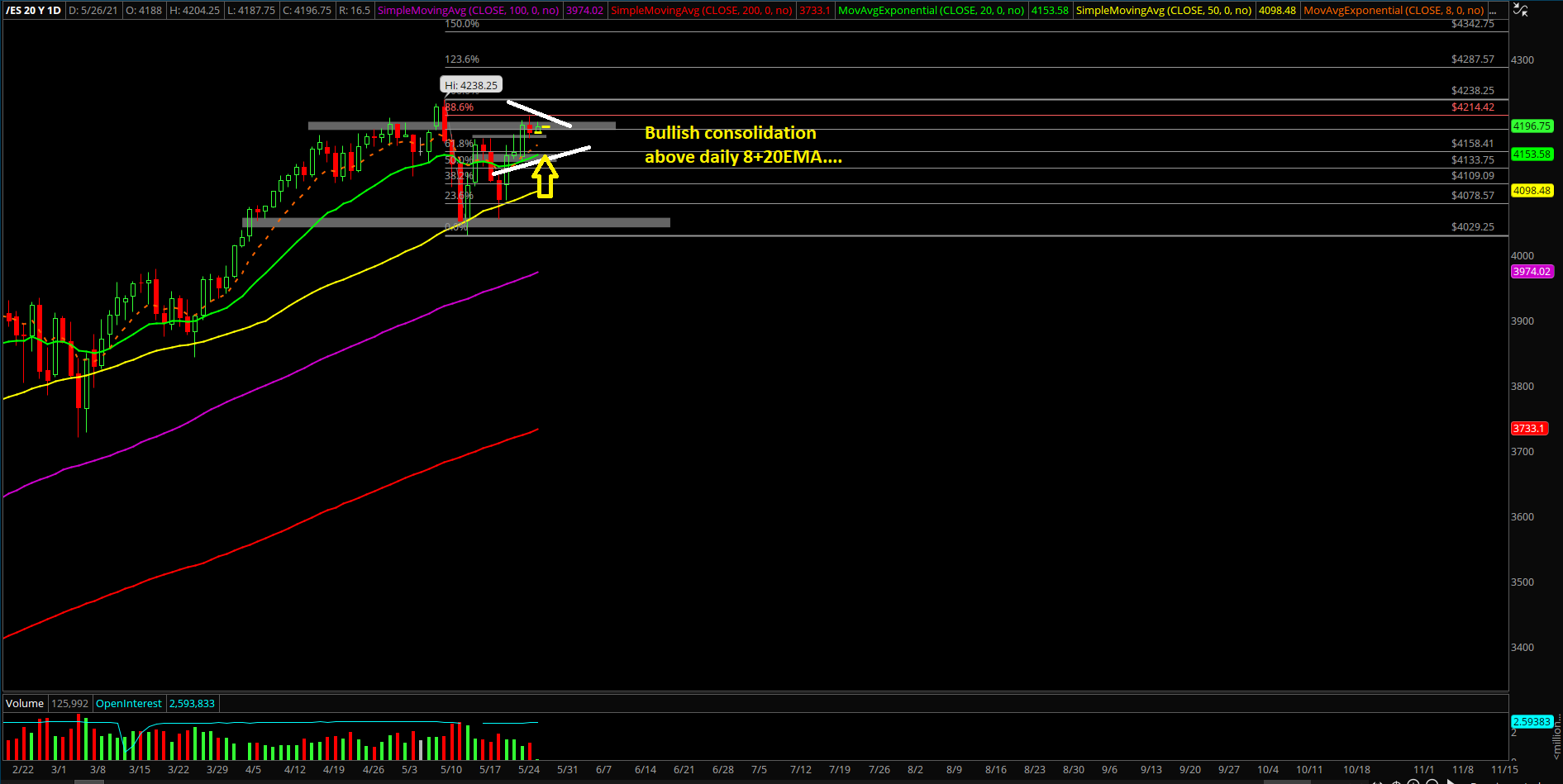

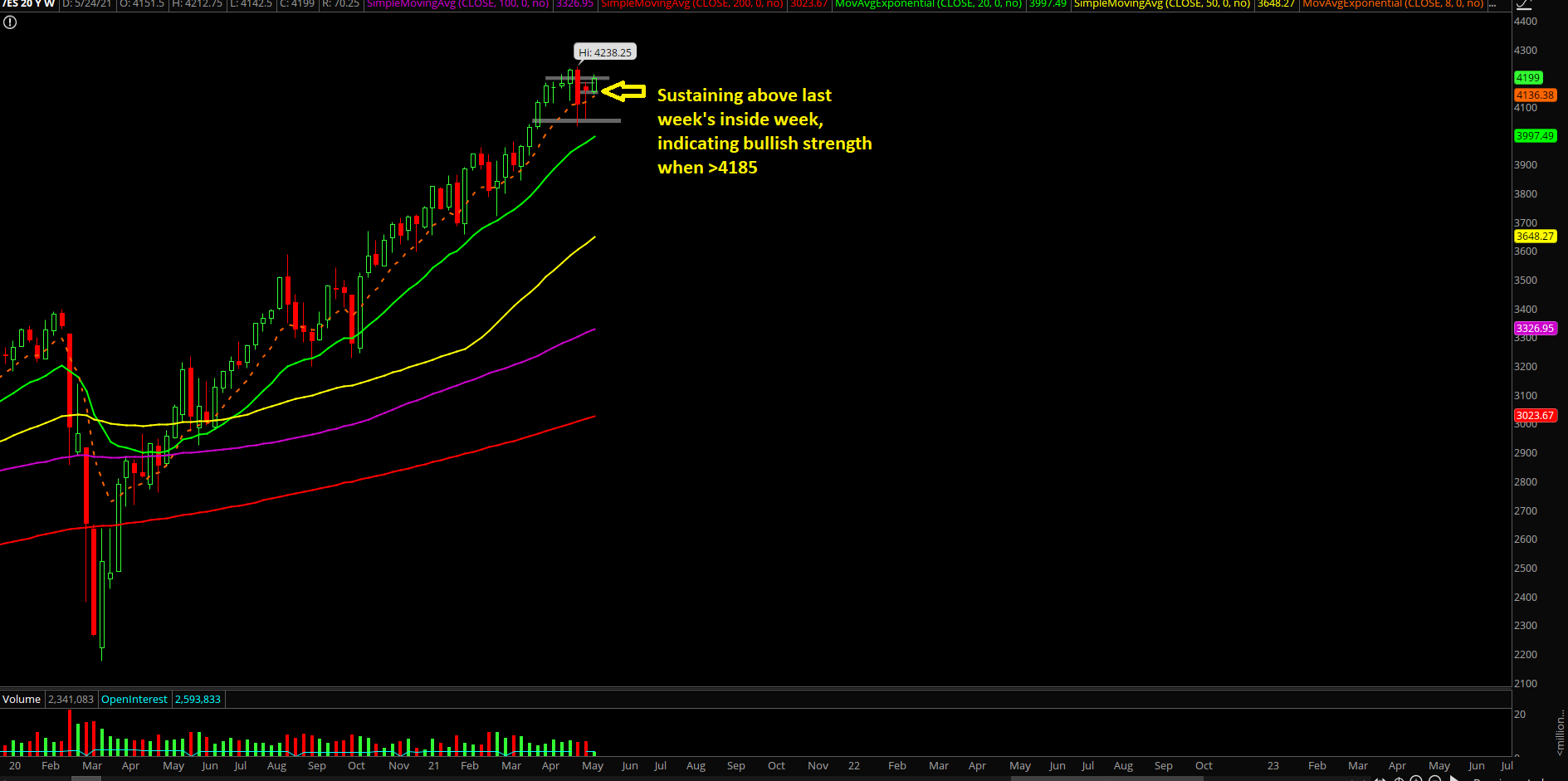

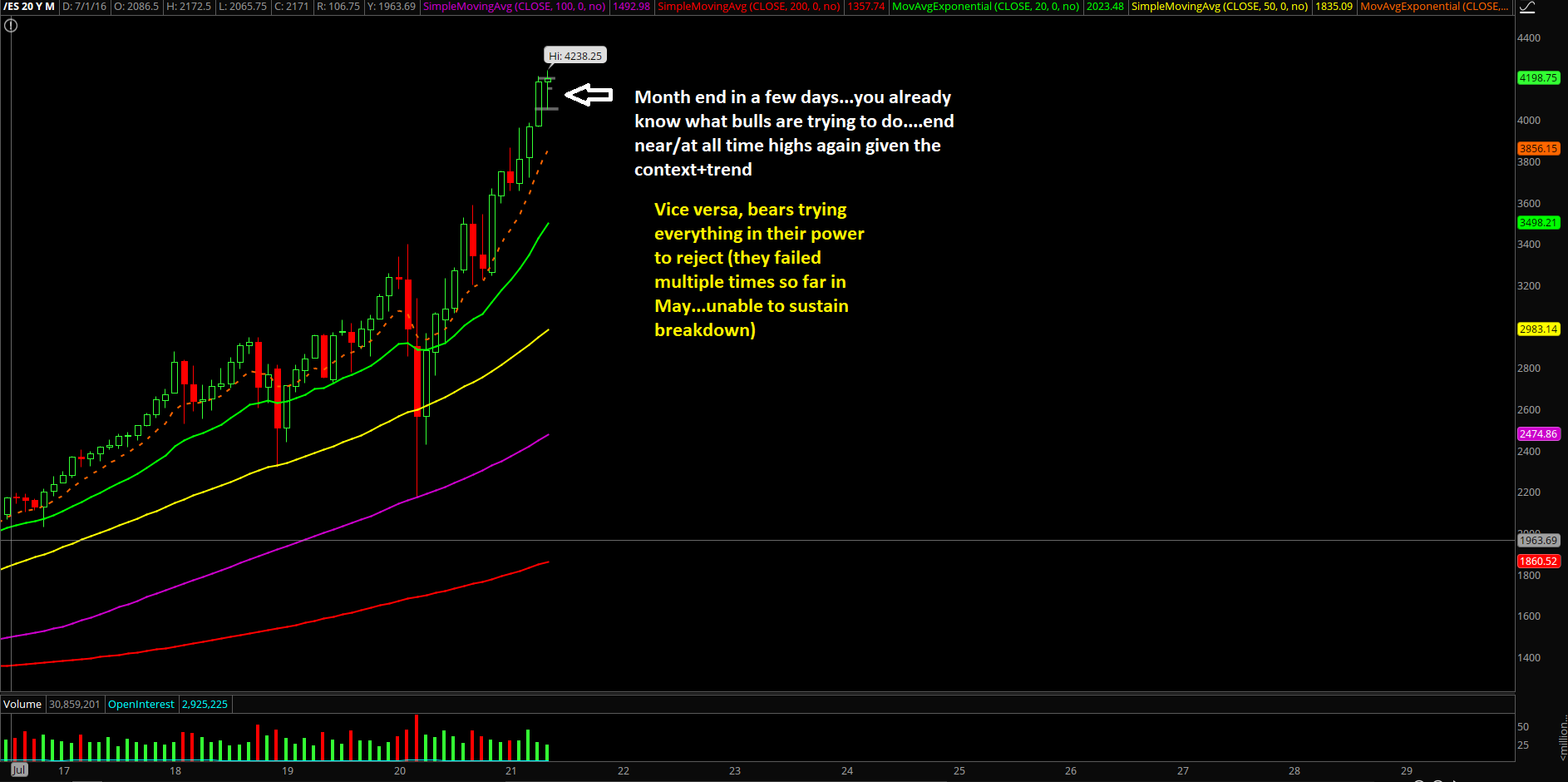

Meanwhile, a similar pattern (see ADI and OBV comments above) to what is developing on NDX is apparent in the S&P 500, which means that we could be on the verge of a breakout to the upside. The index has shown significant resilience of late remaining above its 20-, 50-, and 200-day moving averages while other areas of the market have suffered.

To learn more about Joe Duarte, please visit JoeDuarteintheMoneyOptions.com.