The 20%/10% guidelines are essential to our covered-call-writing exit strategies. They represent parameters as when to buy back our short calls, explains Alan Ellman of The Blue Collar Investor.

A frequent inquiry I receive related to these parameters is whether to remove the 10% BTC limit orders in the last few days of a contract. The thinking is that the cost-to-close is not justified by the time value that can be generated after the call is closed. This article will show a trade executed from one of my portfolios where I was able to roll-down with Energy Select Sector SPDR Fund (XLE) with only a few hours remaining until contract expiration.

Can we remove the 10% BTC limit order in the final day or two of a contract?

Yes, as long as we are capable of carefully monitoring our trades through expiration. If that is not possible or desirable, leave the BTC limit orders in place. We can arrange to have email or text notification if and when the short calls are closed.

Trade Notification Example When BTC Limit Orders are Executed

A real-life example with XLE

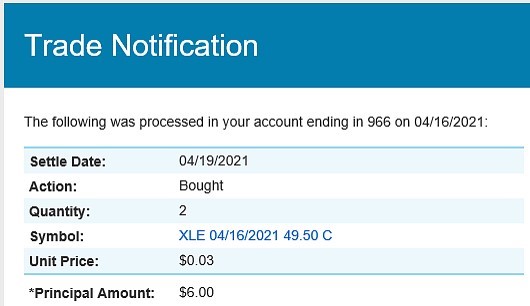

On 4/16/21, the 10% BTC threshold was automatically executed for four contracts of XLE $49.50 strike at $0.03. These contracts were rolled-down to the $48.50 strike at $0.14 for a net credit of $44.00. This was the second rolldown for XLE in the April contract month. No BTC limit order was set as the contracts expired in a few hours and I was able to monitor through 4 PM ET.

Rolling-Down with XLE

Discussion

Exit strategy opportunities decline but still exist as we approach contract expiration. The 10% BTC limit orders should be left in place unless we can carefully monitor our trades through expiration. Preparation and taking advantage of all exit strategy opportunities are major factors in becoming elite option-sellers and maximizing our returns to the highest possible levels.

Learn more about Alan Ellman on the Blue Collar Investor Website.