Yes, stocks are down for 6 of the last 7 sessions, and the last 4 sessions have been closed further below 4,500, says Steve Reitmeister, editor of Reitmeister Total Return.

The headlines on main investment media outlets are trying to elicit your concern.

Now let’s have a reality check.

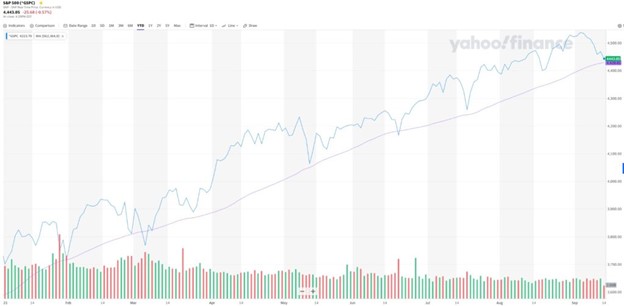

We discover it’s not that ominous when it represents only a mild 2.2% pullback from recent highs. Or the fact that the S&P is still up 18.3% on the year and +103% from the lows of March 2020. Or better yet...how about the fact that all we seem to be doing is retesting the 50-day moving average for the 7th time on the year (see chart below).

So putting things in perspective, all is quite well with the investment world...and quite bullish.

If it is true that we are just retesting the 50-day moving average, then gladly that is only another 15 points below where we are now. However, this time could be different. Perhaps we finally have a more refreshing correction like all the way down to the 100-day moving average at 4318.

Yes, you always have to be mindful that the long term trend line (200-day moving average) is tested 1-2 times a year. That would take us down to 4,090.

Note that I supremely doubt that much of a drop is likely because with interest rates still at historic lows, it makes stock investing the only logical game in town. That is why we keep only testing the 50-day moving average as investors see every dip as another chance to buy in. The end result is that each decline is short lived and shallow.

This all goes back to one of my favorite expressions: The market is bullish until proven otherwise.

And if bullish, then it's only prudent that we keep our portfolio tilted in a bullish direction...which ours most certainly is. More on that in the section that follows...

Portfolio Update

Yesterday was a classic case of being in all the right places. 13 of 14 picks were in positive territory. Plus, we had some really big winners in APA +7.81% and GPI +3.61% helping to pull our entire portfolio well ahead of the overall market (+1.62% vs. +0.23%).

And good thing we enjoyed that strong session Monday as today our Risk On, higher beta selections were severely mistreated as could easily be seen by the -1.38% drubbing of the Russell 2000.

All in all, we were in the red this past week, but endured a 1/3rd less punishment than the -1.7% tax levied on the S&P 500. And a truckload better than the -2.9% compacting of the Russell.

So no one enjoys losing money. But the key to remember is that every week of outperformance (even just losing less than others) adds up in the end. Certainly, that is the case for us this year.

Now let’s check out the tale of the tape for some of our current positions:

APA Corp (APA): Things were rough out of the gate as the market tumbled. Thus, no wonder an economically sensitive, higher beta play like APA got unduly punished. But as the market showed a little life on Monday it EXPLODED higher by +7.81%.

Yes, that will be the very nature of this position...VOLATILE. But if indeed the bull market is still in place and world economy expands, then typically that is a positive for the energy space for which it is hard to find a better selection than APA.

J2 Global (JCOM): Shares have been underwhelming after yet another strong earnings report this past quarter. This compelled the 5-Star analyst from Susquehanna to make a case for shares to rise to $250 in the year ahead. Yes, $250.

So there is no shame in our 92% gain to date. However, with shares only trading around $136, then I see ample fundamental reasons for holding on to get the full measure of reward that should be coming our way.

Best Buy (BBY): Consumer discretionary has been out of favor throwing out all babies with the bathwater...even babies that just came off a ridiculously impressive 60% earnings beat like BBY. Once again, price action is NOT truth. It often is a complete aberration played by computers more trained on momentum than value. But as the value players sift through the rubble, they will unearth precious gems like Best Buy and bid them higher once again. That is why I can so easily laugh off this recent negativity as it is not borne of any sound logic or rationale. And thus, it should soon give way to a rise in share closer to fair value that I believe is around $140-150.

Insperity (NSP): Shares were too hot. And thus, not surprising that some investors were compelled to take some profits off the table. Still believe shares will be more like $120 coming into the next earnings report. Another impressive showing like last time would do wonders to get NSP to +50% for us since inception.

ArcelorMittal (MT): The analyst from Barclays is not fazed by the recent weak price action. He just saw it as an opportunity to wave the Buy banner for MT shares with an upgraded target price of $47. This should embolden us to hold on through this undeserved downtown with sound logic for shares to advance in the weeks and months ahead.

Group 1 Auto (GPI): This is another laughable case of bad price action as they had a truly spectacular earnings report leading analysts to raise the average target price to $238...and yet shares continue to languish. Gladly some folks got the memo on Monday leading to a +3.61% session. Plus, it ended in the plus column today when most other shares were getting pummeled. This was likely due to the raised target by the JP Morgan analyst to $210. Hopefully this proves to be the spark that gets these shares on a well overdue bull run.

Oh yeah...GPI also is staying aggressive on the M&A front with today’s announced purchase of the Prime Automotive Group for $880 million. This should put more fuel in their tank going forward.

Closing Comments

That about does it for this weekly commentary. Hopefully, it is true that this will just prove to be another short lived pullback to the 50-day moving average with shares bouncing higher shortly thereafter.

If not, and something more nefarious is in the offing, then I will proactively update you with correlated changes to our portfolio. I suspect that won’t be needed.

Learn more about Steve Reitmeister at StockNews.com.