Foreign developed-country stocks have lagged the S&P 500 (SPX) consistently since the end of 2007. That may be about to change in 2022 as valuation and currency patterns have become potential tailwinds, states Marvin Appel of Signalert Asset Management.

On the valuation front, the gap between projected price/earnings between expensive US stocks and cheaper European ones is at a record wide level.

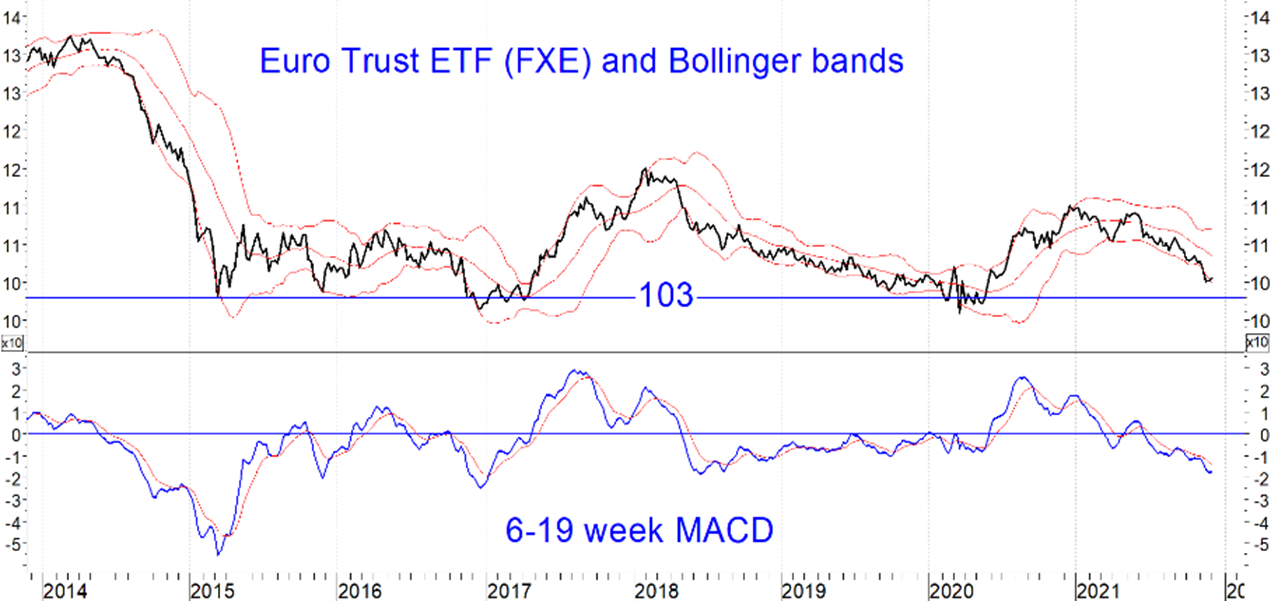

In terms of currency, the euro is near a low level against the US dollar that, in the past six years, has served as support. (See chart below.) Moreover, real short-term interest rates in the US are far lower than in other developed countries, even those with negative rates (such as in the Eurozone). The reason is that inflation is higher here. That, historically, has accompanied dollar weakness and suggests that the US dollar could be near an intermediate-term peak.

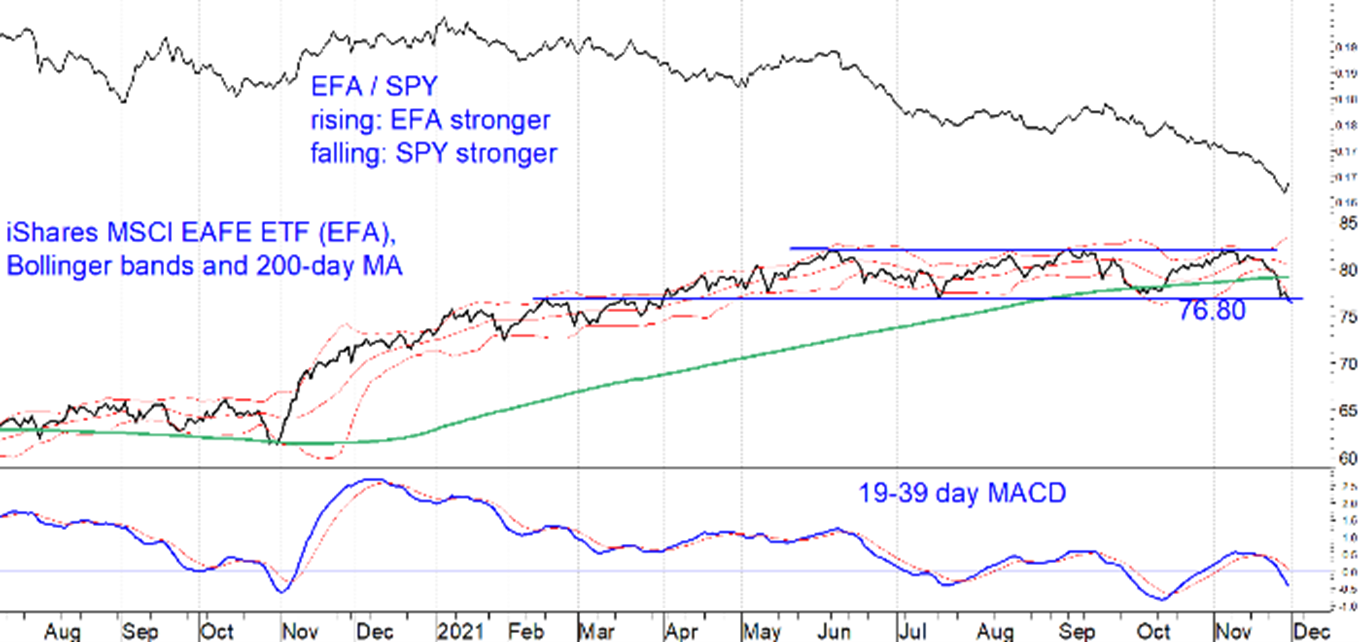

Currency chart patterns, real yields being low in the US, and valuations now all seem to favor foreign developed-country stocks over the S&P 500 going forward. However, price action of relevant ETFs (iShares MSCI EAFE ETF (EFA) to represent Europe+Japan, and S&P 500 ETF Trust ETF (SPY) to represent the US) have not yet signaled a change in the 14-year trend of the S&P 500 being stronger.

The chart below shows that in November, the EFA / SPY ratio hit a new low since the inception of in 2 EFA 2001. Meanwhile, the price of EFA has broken below its 200-day moving average, far weaker than SPY, which remains some 5% above that key long-term trend indicator. MACD has turned negative (again in contrast to SPY) but is not yet so far oversold as to look like a bottom-fishing opportunity.

Lastly, price is king, and EFA’s chart does not look appealing. EFA has been in a sideways trend since February, closing today a bit below the 76.80 level that has been support in 2021. (See chart above.) Given weakness in stocks over the past two weeks and the possibility of US equity sell signals within two weeks, I would watch EFA to see if it breaks down from the December first closing level. (I view this as the most likely scenario.)

Implications

Normally I do not recommend trading EFA using our US equity timing models because long-term results have been much better trading SPY. As a result, we use SPY (and sometimes iShares Russell 2000 ETF (IWM) or S&P MidCap 400 ETF (MDY)) rather than EFA or iShares MSCI Emerging Markets ETF (EEM) for trading in client accounts. However, if you are looking to add positions to foreign developed country stocks for long-term holding, at this juncture I recommend waiting for a fresh US equity buy signal to guide you in determining when to initiate your position.

To learn more about Marvin Appel, please visit Signalert Asset Management.