The market’s story in January was that Fed tightening was about to change the investment landscape for the worse. But in the past few days stocks have bounced, apparently no longer so alarmed, says Marvin Appel of Signalert Asset Management.

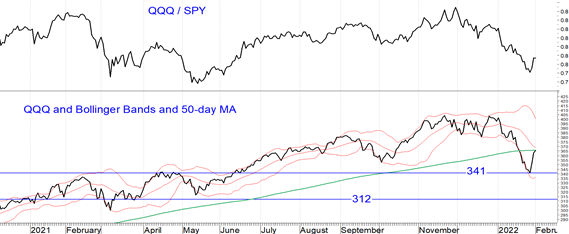

The chart below shows the 7% rally in QQQ from the January 27 closing low. PowerShares QQQ Trust Ser 1 (QQQ) has been particularly sensitive to the prospect of higher interest rates, as it is filled with richly valued companies whose future earnings are not as valuable when discounted by higher interest rates. But the bounce from January 27 has seen QQQ rise more than the S&P 500 ETF Trust (SPY). Meanwhile, breakeven inflation implied by the Treasury market remains well under control, and 10-year Treasury note yields are stable this year in the 1.75%-1.85% area. All of this suggests that the markets have faith that the Federal Reserve can engineer a soft landing (raising rates and controlling inflation without precipitating a recession or bear market). The last time that happened was in 1994.

I will be keeping an eye on high-yield bond funds as a warning regarding economic conditions. As long as high-yield bonds are stable, recession risk is low and losses in stocks, if any, should be modest. I expect the S&P 500 to retest its January 24 intra-day low in the 4260 area at some point in the first quarter, but if that's as bad as it gets, I would consider ourselves very lucky.

To learn more about Marvin Appel, please visit Signalert Asset Management .