Trading is easy—or so you would think, explains Wieland Arlt of Torero-Traders-School.com.

From a purely technical point of view, one could agree with this, as opening and closing positions are only a mouse click away. Also, the selection of the stock and the trading direction cannot be that complex. The market either goes up or down. Even in a sideways movement, one of the two directions is inevitably taken at some point. Successful trading should be a matter of course from this point of view, shouldn't it? I answer this question in detail below and present five mistakes that turn a self-walker into an aberration—and at the same time offers the appropriate solutions.

Is Trading Really That Simple?

When a trader begins his journey into trading, he encounters an almost unmanageable complexity. But the longer the journey into trading lasts and the clearer the personal path to it, the simpler trading becomes. From this point of view, doesn't it also seem logical that within the framework of a straightforward process—open position, close position—profit/loss—almost anyone can be successful? But if trading is not as complex as is often assumed, why do most traders fail? The answer is simple: it is the human being. He brings the complexity into play. In this sense we can say: Trading is simple, the trader is complex!

So, it is not surprising that the trader himself is responsible for a large part of the losses. The human being is the element that decides about profit or loss. As a consequence, once the initial complexity in trading has given way to simple clarity, a trader needs to get to grips with his own complexity—and thus work on the most important mistakes and stumbling blocks. So, let's get to it!

Mistake #1 - Anticipation

At the beginning of a trade there is always an idea. Based on this idea, entry and exit points are determined in the chart. Then the long wait for the signal to enter begins. What reads as a matter of course for many and is actually quite simple, is for many traders a major stumbling block on the road to success. Because when waiting for an entry, traders often play a trick on themselves. Instead of waiting patiently for the desired signal and only then venturing an entry, many traders jump into the market already during the formation of a possible signal.

Many traders tend to anticipate the desired outcome of a session in the hope of thereby catching a better entry than planned. Thus, the position is opened—at least partially—already during the formation of the expected signal. As a result, traders often experience that they are directly on the wrong side in the hope of a favorable entry. In addition, if they had waited patiently until the signal actually formed, they might not have opened a position at all.

Due to his impatience, the trader is duly punished:

1. He has suffered a loss based on a behavioral error.

2. This loss might never have occurred if the company had adhered to its own entry criteria.

For illustration purposes, let's take a look at Figure 1, in which we see gold/ USD in a 60-minute chart. We can see that gold is initially in a sideways movement and breaks out of this range up and down every once in a while. Point 1 is a nice example of how candles can change their message. If the candle was still fully red at the break of the low and thus with a clear statement of the "bear power" to understand, the lower fuse of the finished candle finally shows the false breakout and the return of the buyers clearly. Traders who opened a short position here in anticipatory obedience put themselves on the wrong side—and were consequently stopped out at point 2. We also see a false breakout at point 2 and we can imagine that the doji candle indicated the clear strength of the bulls during the current trading hour, only to end up showing indecision. Accordingly, the buyers who bought point 2 are again on the wrong side—and are again stopped out at point 3...points 3 and 4 should be understood similarly. It is worth noting that at point 5, finally, all traders fall behind who learned from the previous points that the market bounces off the support and accordingly placed themselves here with a limit order—which tore the long position taken on it directly into the abyss.

Figure 1: Gold/ USD, 60-minute chart, source: www.go.guidants.com

Solution #1 - Anticipation

The solution to this common trading mistake is obvious: instead of jumping straight into the market just because you think you already know how the session will close, it's to stay patient and let the market make its moves until finalization.

From this point of view, all signals that arise during a trading session can be considered invalid, because:

- Breakouts are often false breakouts

- Candlesticks can take all sorts of shapes in one session: From hammer to shooting star and back. Only the closing price marks the finished candlestick.

At the same time, it is important to consider which type of order makes sense. For example, instead of a limit or market order, a stop-entry order is advisable. Then the market can freely decide whether it takes the trader with its movements, or the order remains unexecuted due to movement weakness.

Figure 2: Gold/ USD, 60-minute chart, source: www.go.guidants.com

Figure 2 now shows the correct possible entry marks. Instead of speculating on a breakout at points 1 to 4, which was already negated in the respective session, it makes sense to go in the opposite direction by stop-entry order. So, at point 2 short, at point 3 and 4 consequently long. In addition, it is possible to trade the upper breakout by placing the stop-buy orders above the breakout candles. The stop loss can then be placed below the breakout candle with a good risk-reward profile. The order at point A was not executed, but the orders at point B and C were, at least for a while, in profit. At the latest with the return to the trading range and the associated bearish candle at point D, the long positions would have to be closed again. At the same time, a short entry offers itself, since the powerful red candle expresses the will of the bears more than clearly. Per stop-sell order traders come here in the market. You may notice that there is no entry marker entered at point 5. The reason lies in the unfavorable risk-reward ratio that the long candle at point 5 has for a short position.

Mistake #2 - Too Tight Stops

Determining the risk to take per trade is one of the most important tasks of a trader. Traders are always caught between maximizing profits through a large position size and minimizing losses through a professionally set stop loss. Especially traders who speculate on a breakout from previous lows and highs as part of a trend-following strategy sometimes face a challenge here, as the distance between entry and stop loss can be particularly long. Since many traders tend to focus on the potential profit rather than keeping an eye on the potential loss, it is obvious that the stop loss is then often too close to the entry in favor of the position size—in a rather inconvenient place.

This is accompanied by the bad habit of many traders to immediately pull the stop loss to deuce after the first points in the right direction. The result of both is then not long in coming: In a normal move, the market corrects the previous move and runs directly into the trader's trailed break-even stop. The result can be stated soberly: Nothing but expenses.

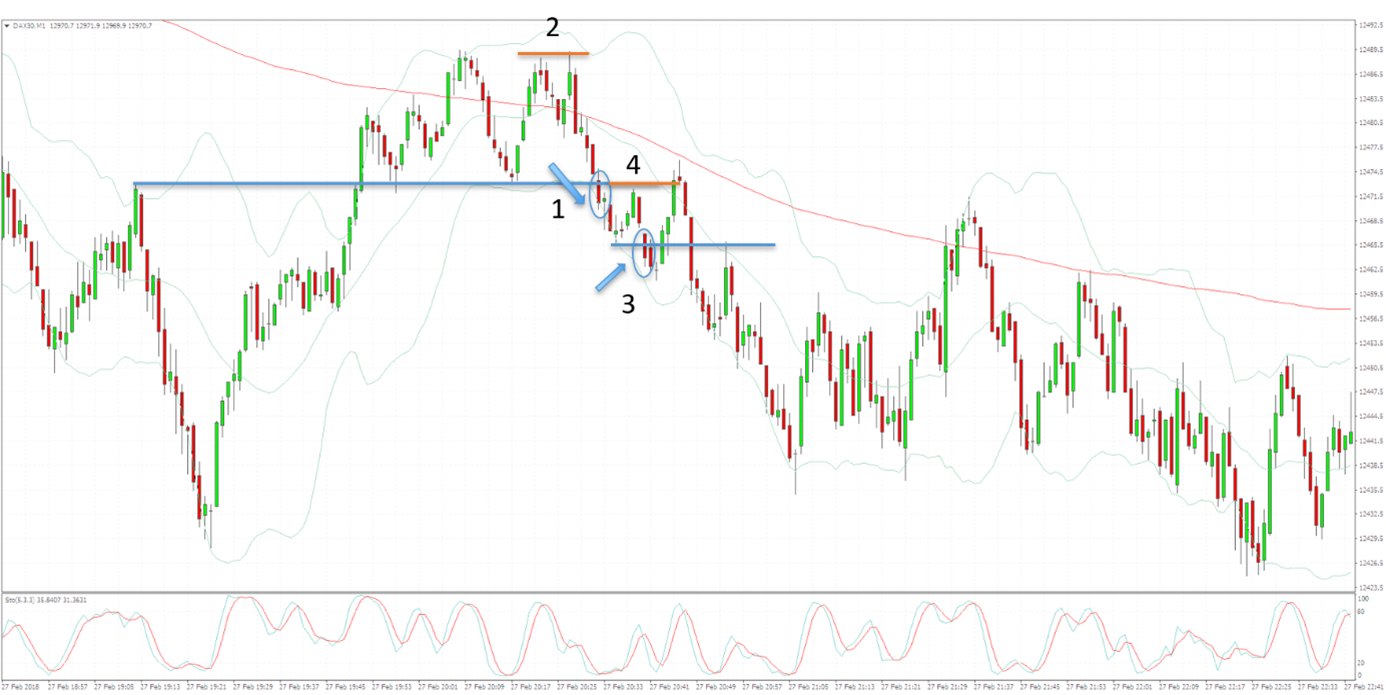

Let's look at an example for this as well: In the DAX®, we see a triple top that was confirmed with the breakout of the low. The candle at point 1 makes it clear that the breakout and thus the trend reversal is holding. Traders who open a short position here typically place their stop loss at point 2, above the triple top. As the price corrects to the breakout level as expected, the stop at point 2 is spot on. The subsequent breakout at point 3 gives the first opportunity to open a trend-following trade, also the breaking candle encourages this. In the hope of a good risk-reward profile, most traders place the stop loss for this at point 4—as do traders who quickly tighten the stop loss in order to hedge more favorably. Thereby it comes, as it must come: With the setback, the point 4 is just broken before the downward movement is continued.

The bottom line is this: Right idea, wrong implementation. Instead of justifiably hoped-for profits, realized losses.

Figure 3: DAX30, one-minute chart, source: Metatrader4

Solution #2 - Too Tight Stops

The fact that a stop loss is mandatory does not need to be discussed further. The sensible placement of the stop, however, does. If you set your stop loss too tightly, you run the risk of taking yourself out of the game—and deliberately and actively causing the undesired loss! The same applies to a trailing trailing stop. Of course, trailing at cost is tempting, as it is always said that traders would then have a free play. Unfortunately, this is not always the case. Because through the interplay of impulse movement—correction movement, the price regularly approaches the entry level of a trade—and beyond. If you then tighten the stop too quickly and too tightly after a successful entry, you can just as easily end the trade manually.

The practical tip here is clear: rather give the trade some air and be prepared for the trickery of market participants. After all, the stop loss is supposed to save traders from the worst—not to end the trade wantonly in a loss.

Mistake #3 - Insecurity

Who does not know this: The position is opened, and the price runs in the wrong direction! A desired book profit turns (initially) into a book loss. At this moment, a trader's planning and seriousness are put to the test.

Thereby, the challenges of the trader are manifold:

- A candlestick reversal signal is tested again

- A breakout from a range comes back again

- Alternating red and green candles are formed, which are broken sometimes upwards, sometimes downwards

- The price moves around the cost price

Especially traders who trade intraday and follow the price action live run the risk of falling into the trap. Because in the heat of the moment, when the position is opened and the hunt for points begins, every movement is put on the gold scale. If the position runs into the profit everything is in the best way! But if it runs into negative territory, the thinking begins: "Could the market perhaps go in the other direction?" Or: "If I turn the position now, then I get away first with a black eye and am secondly really early in a new movement in!

At this moment, the feeling for the original idea is lost and the trader is only in reaction mode. As a result, the trader then sits on the accumulated high losses, regardless of the direction in which he had originally positioned himself.

Figure 4: DAX30, five-minute chart, source: Metatrader4

To do this, look at the DAX, which corrects after a downward movement upwards to the area of 61.8%. There, the first selling interest is shown by the upper wick and traders could subsequently open a short position. The stop loss for the trade is sensibly slightly above the previous highs (orange line). The trade subsequently fails to gain momentum and prices oscillate back and forth. There is also a first sign that the market could run upwards again, but the market then falls back again, only to then run northwards to the stop loss again. However, this is not reached, and the price falls rapidly from there. Traders who let themselves be misled by this back and forth and change the direction of their trade are worn down between the movements, although at no time was there a reason to intervene in the original trade.

Solution #3 - Uncertainty

At this point, it helps to keep reminding yourself why a position was taken. Let's keep in mind: Once the decision for a position has been made, it is important to consistently follow your own plan. Traders who constantly stick to their plan will bring more peace into their own trading. Sure, losses will occur now and then, no question. But the losses that occur when a trader uncontrollably jumps back and forth between the movements will be incomparably greater.

The practical tip here is accordingly: Reflect on your actual task in trading: The planning and execution of a trade. Analysis and evaluation take place before the trade. Once the position is opened, the market takes over—that is the division of labor in trading.

Mistake #4 - Poor Trade Management

Planning a position is the original task of a trader. With the subsequent opening of the position, the trader's work is done. Or maybe not?

Once the position is opened, the trader becomes the manager, and he moves to maintain his position. Just as the manager encourages his employees to perform at their best, it is now up to the trader to get the best out of the current trade through targeted management. These management tasks in trading include:

- Retracing the stop to meaningful points

- Building up and dismantling a position

- Profit taking at target

- Evaluation of the meaningfulness of an existing trade

Here, too, traders make crucial mistakes again and again, which at least make a good performance more difficult—despite a good trade selection. For example, many traders tend to always enter the market with the full position size—regardless of the quality of a signal or the distance to the stop loss. This happens very often in intraday trading, for example.

Does that really make sense? Of course not. Because the position size always depends on the distance from the entry to the stop loss. Thus, a long distance implies a smaller position size and vice versa. A fixed position size, on the other hand, makes it almost impossible to trade profitably. Additionally, many traders tend to take an "either-or" stance when taking profits. Which can also lead to suboptimal results.

Solution #4 - Poor Trade Management

One thing should be said in advance: Whether trade management is bad or not is initially purely subjective. For example, every trader must decide for himself whether he wants to tighten his stop loss or whether he wants to leave it at the initial stop loss.

We have already discussed that caution is required with a trailing stop loss at deuce. Let us therefore proceed to the choice of the position size. The aspect of the position size in dependence on the difference between entry and stop loss will not be considered here, the connection should be self-evident. Instead, let's take a look at another point.

It is known from practice that trading signals can have different qualities. So why shouldn't the position size vary accordingly? If you are unsure about a position, then simply take only a small part of your originally planned position—you can always increase if the development is favorable.

The same applies to profit taking. Why not secure a partial profit and reduce the risk at the same time? Especially when the market has already run a bit, this approach makes sense. After all, trading is about making money—and with a partial profit-taking you can implement this directly. Speaking of targets: Especially with regard to price targets, the question must also be allowed why moderate targets are not targeted—instead of exaggerated expectations. Playing with probabilities is essential in trading—both when planning positions and when determining exit points. And what could have a greater probability than near-term price targets?

Mistake #5 - Poor Self-Management

Even if traders are masters of their trade in theory and practice, they often forget the most important component of active trading in their deliberations: themselves. When we realize that trading is a highly challenging activity and is rightly compared to high-performance sports, it seems surprising how little traders have a handle on managing themselves. Lack of time management brings hectic into everyday life.

Many traders start trading "on the side." But anyone who thinks they can just make a trade on the side—and make a profit at the same time—is barking up the wrong tree. Trading is a task, a profession, a job—and deserves full concentration. Just sitting down and doing something quickly does not work. Of course, this doesn't mean that trading on the side is impossible, but it does require a certain amount of dedication to be truly successful.

The psyche influences trading: Bad mood promotes bad trades

Authenticity is on everyone's lips in private and professional life. But of course, that's no reason to be authentically bad-tempered. Anyone who takes their bad mood out on their fellow human beings will inevitably get the receipt for it. Logically—and that's how it is in the markets, too. A bad mood does not prevent anyone from using the mouse. But it does prevent a clear view of what is happening and unbiased trading. Trading mistakes and poor trade selection is then the inevitable consequence—with the corresponding results.

Pressure of expectations leads to poor trade selection

Do you know these statements? "I have to..., I should..., but now..." If you put yourself under pressure, you will lose. Because in order to achieve a certain goal, trades are held too long or closed too early, too high risks are taken, or dubious signals are traded. All just to achieve the desired result. Too much pressure to achieve the desired result leads to half-baked trades and spontaneous trading—with all the mistakes and results already described.

Solution #5 - Poor Self-Management

Instead of putting pressure on yourself in terms of the result and certain events, it is more resource-efficient to remember what traders actually do: Trading means making profit from the movements of the market! So why can't traders go about their work in a relaxed manner? Without expectations, without time pressure and without hectic? Because let's be honest: Can you influence market movements in any way? Certainly not. Stay relaxed. Trading is also a game—and who wants to play with someone who can't control himself and is completely out of control?

Therefore, the recommendation here can only be to always approach the topic of the stock market and trading when you:

- ...are fit and well-rested

- ...in intraday trading you have at least 30 minutes of time following a position opening to manage your positions

- ...have nothing else to do on the side

- ...do not want to—or have to—compensate for all previous losses with one trade

- ...have the blues

Conclusion:

Trading is simple—the trader is complex. Simply because we are human beings! While many traders are always looking for new approaches and strategies to achieve an improvement in performance, the look in the mirror is usually reserved for the morning toilet. The most obvious thing to do is to trade the market with the simplest possible means and to take care of our own human weaknesses. After all, what good is the best strategy and the most secret tip if we end up getting in our own way?

We were able to discuss a total of five errors and work out concrete solutions for them. Whether you now directly deal with these, or still want to test a new strategy is, of course, up to you. However, there is no question that you will have to deal with these points during your trader career.

Learn more about Wieland Arlt at Torero-Traders-School.com