It's no secret that the prices of everyday goods are rising quickly from their pandemic lows due to strong consumer demand and on-going struggles with global supply chains, explains Buff Dormeier of Kingsview Partners.

Not only does this impact consumers' wallets but it also has wide-ranging implications for investment portfolios. However, it's important to keep inflation, consumer sentiment, and the overall growth of the market in perspective when making long-term financial decisions. After all, the same factors that have pushed up the prices of goods have also boosted stock prices, home values, and more. How can investors focus on both sides of this equation when it's tempting to react to individual data points?

In January, the consumer price index rose by 7.5% over the prior year, the fastest pace since 1982. This was fueled by everyday necessities such as food and energy which rose 7% and 27%, respectively. Other major categories continue to be impacted by supply chain disruptions; most notably for vehicle prices, which rose 12.2% for new cars and 40.5% for used ones. Basic needs such as housing and apparel are more expensive as well.

There is no doubt that prices have increased significantly and have remained higher longer than many economists originally anticipated. Inflation affects our everyday lives in several ways and, naturally, this disproportionately hurts consumers who either live paycheck to paycheck or who are in or near retirement. However, it also impacts those who have not benefited from a proper set of diversified investments. Thus, it's important for investors to separate three relevant impacts of rising prices on their financial needs.

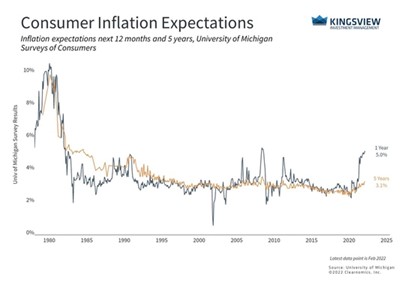

First, inflation is already affecting consumer sentiment. Recent surveys suggest that consumers expect inflation to average 5% over the coming year before beginning to decline. This pattern is consistent with what many economists expect, i.e., that inflation will peak around mid-2022. To the extent that strong demand has been one driver of inflation, consumer expectations that dampen buying activity could deflate prices somewhat. This is also because other boosts to buying activity, such as the stimulus checks of the past two years, are now in the rear-view mirror.

The upshot is that consumer buying activity could slow from their recovery highs to more normal levels. This will likely affect the top-line sales figures of many companies, but it was never sustainable to expect retail sales to remain near multi-decade highs. As long as revenue and earnings growth remain steady, history shows that the stock market and investment portfolios can benefit over time.

Consumers expect inflation to get worse before it gets better.

Key Takeaway:

Consumer sentiment has plummeted in no small part due to rising inflation concerns—in some cases higher than many have experienced in their lifetimes. Still, these surveys also show that expectations fall after a year, which suggests that consumers do not expect inflation to remain high forever.

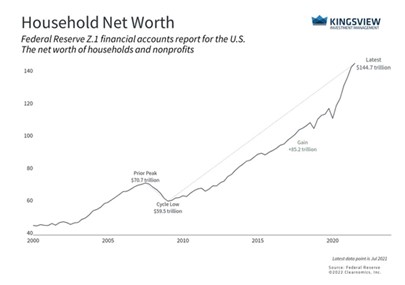

Second, while higher prices affect everyone's pocketbooks, the average consumer is doing well financially. This is because inflation doesn't just increase costs—it also boosts home prices, asset valuations, savings rates, and more. Household net worth in the US is at a record of nearly $145 trillion which can also create a "wealth effect" that supports long-term consumer spending beyond the initial recovery. Thus, it's important to consider the full consumer income statement and balance sheet when evaluating the impact of inflation.

Household net worth is at record levels.

Key Takeaway:

Despite fears that inflation could boost costs, the average consumer is benefiting from the highest level of household net worth in history. In the long run, this wealth effect is what should drive consumer activity rather than the one-time shock of inflation.

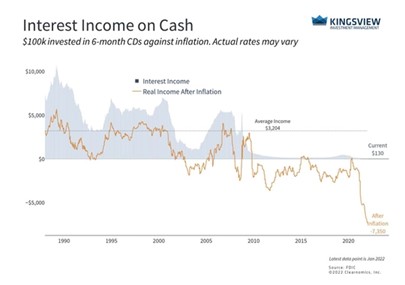

Finally, all of these factors underscore the need to hold an appropriate portfolio to offset rising expenses. Specifically, this means being aware of spending requirements relative to portfolio yield and other sources of income. With consumer price inflation rising quickly, the average savings account or certificate of deposit not only isn't keeping up, but its value can be quietly eroded over time.

Whether inflation continues to rise at this pace depends on what is driving it in the first place. If inflation does prove to be more about supply chains than about monetary policy, for instance, then over-reacting in one's portfolio by only focusing on inflation may not be the right move. Similarly, if inflation does remain hot but in a way that benefits corporate profits, many parts of the market can still do well even as the Fed hikes rates.

Inflation quietly erodes the value of cash.

Key Takeaway:

For many, the primary challenge is that inflation erodes the value of hard-earned cash savings. This underscores the need to properly invest this cash to generate a return in order to preserve purchasing power over time. Stock market returns were robust in the 1960s and earlier, just as they have generally been since the 1980s following the Reagan tax cuts.

As always, it's best to hold a portfolio that can withstand different economic conditions across a full business cycle, ideally with the help of a trusted advisor, in order to stay on track to achieving long-term financial goals.

Learn more about Buff Dormeier here.