The stock market has undergone a reality check over these past two weeks, explains Bryan Perry, Editor of Cash Machine.

The majority of market sectors are enduring selling pressure as investors reprice risk-on assets against a landscape of acceptance that inflation, rising rates, elevated commodity prices, supply chain constraints, and the Ukraine war are going to last longer than first perceived.

These negative forces took a broad toll on all but the utilities, consumer staples, real estate investment trusts (REITs), health care, and fertilizer sectors. Even energy stocks came under modest pressure out of concerns regarding future demand destruction given the high prices of crude oil.

Investor sentiment is downshifting due to the presence of a domestic economy that risks falling into a recession after the February 10 Treasury spread in the yield curve briefly inverted. When short-term rates (two-year) yield more than long-term rates (ten-year), it implies a hard landing for the economy. This is due to the fact that the Fed is aggressively trying to rein in inflation by raising the federal funds rate and shrinking its balance sheet—better known as quantitative tightening (QT), the opposite of the quantitative easing (QE) that has supported asset inflation since 2008.

To say the ground has shifted is an understatement.

Now that the Fed has pulled the punch bowl of financial stimulus and turned decidedly hawkish, the stock market has to stand on its own.

It’s every stock for itself.

As we enter first-quarter earnings season this week, the large banks will have a lot to say about business conditions from their client bases, which covers everything from the demand for credit to funding inventories, expanding businesses and acquiring real estate. Rates have spiked around the globe this past month—and that has raised some red flags.

With the yield on the 10-Year Tresury Note (TNX) at 2.76%, the bond market is already adjusting to levels that expect the Fed to hike rates by 50 basis points at the next three Federal Open Market Committee meetings over the next three months. This comes at a time when the Russian and Ukrainian economies are in a depression, Europe’s economy is in a recession, and China’s economy is slowing. The degree to which this is true, however, is not clear, as the data are roundly manipulated by financial elements of the Chinese Communist Party.

What is a well-known fact is that rising interest rates are a huge drag on debt service, following years of QE and bloated government spending well before, during, and after the Covid-19 pandemic took hold of the global economy—topping $226 trillion at the end of 2020. Global gross domestic product (GDP) is about $80 trillion.

One analyst said, “Global debt, according to a recent report by the Institute for International Finance, amounted to nearly $300 trillion in 2021, equal to 356 percent of global GDP. This extraordinarily high debt level represents a 30 percentage-point rise in the global debt-to-GDP ratio in the past five years.”

Central banks can ill afford to allow short-term interest rates to rise much over 3%, or they will face stressing debt-to-GDP ratios that are already excessive. A 1% increase in short-term Treasury notes adds $300 billion in interest costs to service the US federal debt. That is a steep finance charge and is why the Fed has abruptly done an about-face on its gross underestimation of inflation.

Currently, inflation is running at a 40-year high of 7.9%. The big question facing the stock market is whether inflation is peaking. If so, then there is a good chance that the lows for the S&P 500 (SPX) are in.

More forthcoming data will spell this out.

The LNG train has left the station for sure.

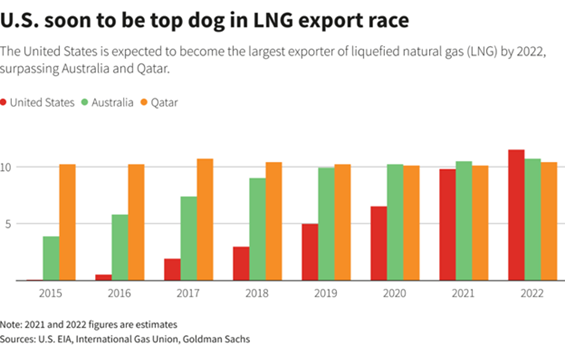

The widespread sanctions that are being applied to Russia will have a lasting impact on a number of industries, both positive and negative. One of the larger secular themes that is playing out is the rising global demand for liquified natural gas (LNG) to replace coal, and to replace Russian imported LNG to Europe. In 2021, 40% of natural gas consumed in the European Union came from Russia.

This is a staggering statistic.

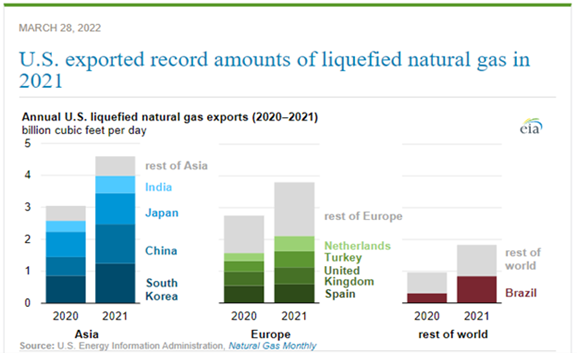

On a global basis, the US is exporting record amounts of LNG as nations rapidly covert to gas burning utilities from coal-fired plants. According to the US Energy Information Agency, “US exports of liquefied natural gas (LNG) set a record high in 2021, averaging 9.7 billion cubic feet per day (Bcf/d), according to our most recent issue of Natural Gas Monthly. US LNG exports increased by 50% from 2020. The increase in US LNG exports was driven by increased demand in both Europe and Asia (particularly China) and by expanding US liquefaction capacity. In 2021, liquefaction at the six US LNG export terminals averaged 102% of nameplate (or nominal) capacity and 89% of peak capacity, according to our estimates.”

On March 25, the US pledged to dramatically increase LNG shipments to Europe to displace its dependence on Russia. The Biden administration is proposing to send up to 15 billion cubic meters (BCM) to Europe, which is only about 10% of the 150 bcm Europe used in all of 2021.

With the LNG production in the US at near capacity, it will keep prices elevated as the supply/demand equation heavily favors producers and shippers of LNG to foreign buyers.

Since there are no pure LNG exchange-traded funds (ETFs) to buy into, investors need to cobble together their own LNG terminal, natural gas E&P, gas pipeline, LNG shipping, and LNG gasification portfolio. These stocks are not hard to find if one simply searches top LNG and natural gas stocks. LNG bridges the several gap years during the transition of fossil fuels to renewable energy.

The LNG sector is in its own stealth bull market—and that’s what matters.

Despite all the volatility, uncertainty, and opaqueness that is going on within the markets, this secular trend has growing bullish visibility that, in my view, will have a profoundly positive impact on investors' portfolios for those that boldly lean into this investment proposition. By definition, it’s shaping up as a generational trade.