Yes, it’s tricky both tactically and mentally to get long in the stock market right now, states Sean McLaughlin of AllStarCharts.com.

One look at the broader indexes would give any rookie market technician pause.

That said, there are still pockets of strength that are working and growing stronger—both on a relative and an absolute basis. Which, by the way, is not uncommon. Even in the most vicious bear markets, there are often certain sectors that see gains. And so a bear market may force us to be more selective when searching for bullish bets, but the opportunities are there for those willing to do the work.

With that in mind, today’s trade is one of those names that is thriving in this current market environment.

Here’s a chart that’s got the team excited:

When viewed on this wide of a timeline, what you see is a pretty epic collapse and then rebound off 2022 lows. And in recents weeks, we’ve seen Occidental Petroleum Corperation (OXY) come back to and hold the prior support level from before the collapse. As one might expect, we are seeing some consolidation at this level where previous bagholders are no doubt lightening their load, happy to have minimized their losses or getting back to even.

However, when we zoom in on a tighter timeframe, you see this high consolation and breakthrough that is incredibly bullish for the nearer-term:

If all goes according to plan, we think OXY can trade up toward the 90’s by this autumn. So let’s get positioned to take advantage of this possibility.

Here’s the Play:

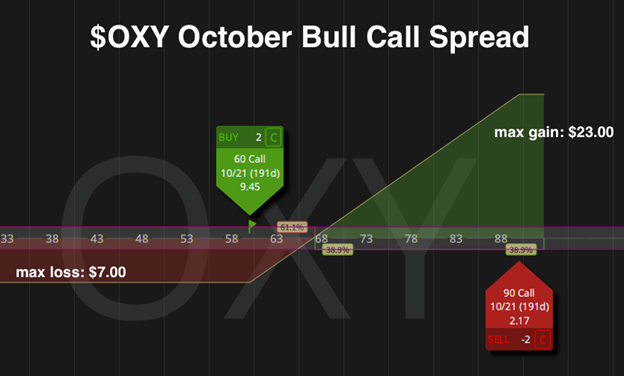

I like buying an OXY 60/90 October Bull Call Spread for an approximately $7.00 debit. This means I’ll be long the 60 calls short an equal amount of 90 calls for a net debit, which represents the absolute most I can lose in a worst-case scenario:

I chose the 90 strike to short because that level is just beyond ASC’s first price target, yet there is ample premium being offered in those calls to make the premium sale worth it.

My profit target for this spread will be to earn $12.00. This would represent capturing a little bit more than 50% of the maximum potential profit if held all the way to October expiration. I hope to be out with my profit long before then. So I’ll leave a resting good ’till canceled order to sell the entire spread at $19.00.

In the meantime, if OXY can’t hold above $54 per share, then that will be my signal that I’m early or wrong in this trade and either way, I’ll look to exit the spread for whatever I can salvage and eliminate the risk of any further losses if we see OXY close below $54.

Learn more about Sean at AllStarCharts.com.