Investor sentiment is bad, historically bad, states Sean McLaughlin of AllStarCharts.com.

Don’t take my word for it. Check it out for yourself.

Sentiment has only been this bearish four times over the last 40 years: Coming out of rampant 1970’s inflation, the Savings & Loan crisis of the early ’90s, the Great Financial Crisis of 2008-09, and the “Fiscal Cliff” circa 2012.

Do you remember those times?

And you see what happened in the S&P 500 (SPX) after, right? Is history going to repeat itself? And if so, how do we protect ourselves and our portfolios from the “risk” of being underinvested if that happens?

The team mulled over this question during our morning meeting today, and we kicked around some ideas of what would be the best underlying vehicle to purchase way out-of-the-money call options in as a cheap, risk-defined way to participate. We decided the big indexes PowerShares QQQ Trust Ser 1 (QQQ) and S&P 500 ETF TRUST ETF (SPY) were too exposed to tech to be a viable option.

The Technology sector has been a laggard and we’re not comfortable making a bet that tech will lead the next bull rally. JC thought buying iShares Russell 2000 ETF (IWM) would be “too cute” (his words).

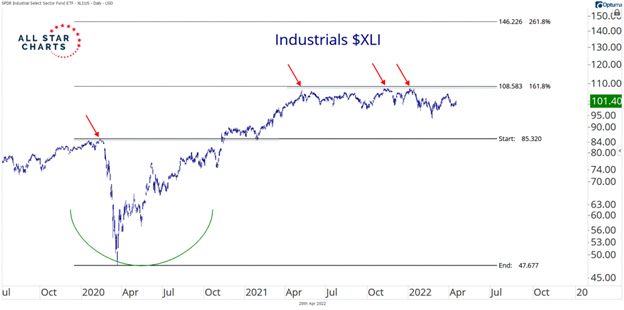

As a team, we zeroed in on either the Financials (XLF) or the Industrials (XLI) as being the likeliest leaders of a bearish sentiment unwind that sees investors scrambling to get reinvested into a rising market. These sectors are currently among the relative strength leaders and leaders are likely to continue leading. Here’s how the XLI chart looks:

The key thing here that we want to accomplish is we don’t want to risk too much capital, but we want to give ourselves the opportunity to win big if we hit a long shot. JC likes to joke that this is a “YOLO trade,” but really we’re just trying to protect ourselves from the risk that we might be underinvested if the market screams higher before the end of this calendar year.

Here’s the Play

We’re buying XLI January 130 calls for 35 cents or cheaper. This is an “all-or-nothing” trade, in terms of us being willing to lose everything invested in this trade. We’re treating it as a portfolio hedge and if it doesn’t work, it’s likely a zero. And that’s ok—it just means we’ll size our position appropriately to accommodate this likelihood.

In the meantime, as is always my best practice when buying long calls, I’ll look to sell half of my position if the calls double in value. This will remove all of my original risk from the trade and allow me to rest easy for the remainder of the duration of the trade—come what may.

Learn more about Sean at AllStarCharts.com.