The headlines crossing the tape of the past week regarding the economy are anything but reassuring, and yet stocks are rising despite negative news, explains Bryan Perry, editor of Cash Machine.

For investors and traders trying to make sense of why stocks rally in the face of missed earnings, and in some cases, lower guidance, it can be a challenge. But time and time again, a big drop in stock prices typically precedes the tsunami of bearish data followed by a rally in the major averages well ahead of when the headlines and data turn positive.

This mental dilemma can make it difficult to pull the trigger and raise exposure to equities when it seems counterintuitive to do so. This past week, initial jobless claims rose to the highest level since November. Existing home sales fell for the fifth straight month to a level that is 14% below what it was a year earlier. Both housing starts and building permits fell to their lowest levels since September. And manufacturing data out of the Northeast from the Philadelphia Fed survey dove further into negative territory, reflecting a sharp drop in new orders for July.

If business conditions are so soft in the housing market, why did shares of SPDR S&P Homebuilders ETF (XHB) rally 21% off their June low? If growth in the job market is about to hit pause, per the rising weekly claims data, then why are shares of Automatic Data Processing, Inc. (ADP), the biggest staffing and employment services company, trading 10% higher than their June low? If the biggest chipmakers in the world are collectively stating they are reducing CapEx spending on new equipment, then why did the VanEck Semiconductor ETF (SMH) vault 19% higher since it plunged to a yearly low on July second. And if manufacturing is tanking, per the Philly Fed report, then the 10% jump in shares of the Industrial Select Sector SPDR ETF (XLI) this past week only complicates matters when trying to figure out what the heck is going on.

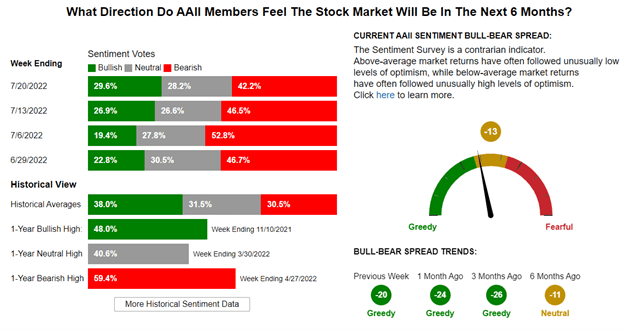

The most logical answer is that investor sentiment has bottomed out as of the first week of July and has been gradually improving over the month, according to the most recent data from the American Association of Individual Investors. While the numbers are still well below their historical averages, this contrarian indicator registered extreme bearishness the week of July sixth, with 52.8% of those surveyed saying they expected the market to decline further over the next six months. This was also when the CBOE Volatility Index (VIX) was up at 35.0 and today sits at 23.0

So, just maybe the deep recession bears are wrong. Maybe the Fed will get its wish and see the rate of inflation decline sharply over the next few months, as some data points would indicate. The CRB Index, which measures the prices of 17 global commodities, has fallen 14.8% from its early June high, reflecting a sharp pullback in the price of oil. This fact is now being reflected in lower gasoline prices.

Indeed, the latest AAA national price for gas is $4.38 per gallon. And Ukraine and Russia signed a deal last Friday that freed up 18 million tons of wheat for export through Black Sea ports in a surprise move that was brokered by Turkey’s President Erdogan.

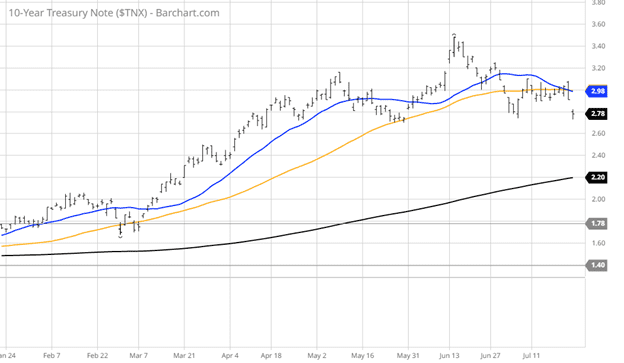

In what is a more telling sign of what may come to pass, Treasury yields plunged in reaction to the economic data. The ten-year Treasury note yield closed the week out at 2.78%, which is well below the 3.50% print in early June. This was right around when the market hit its low for the year, followed by the spike in bearish sentiment. From the chart below, this move lower in yields is a notable break in what had been a steady uptrend for the ten-year note.

The yield curve remains inverted for a third straight week as the Fed readies to raise the federal funds rate by another 75 basis points. But after this hike, the bond market is implying that this week’s hike might be the last, despite the almost uniform agreement that another rate hike in September is imminent. As of Friday, with this sudden move down in yields, that assumption is being called into question.

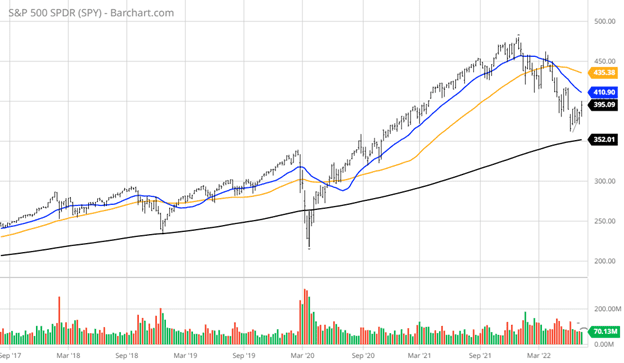

A look at the five-year chart of the S&P 500 SPDR ETF (SPY) shows that the long-term primary bull trend line comes into play just above $350, or 3,500 for the S&P 500 index. This line sits 11% below where the market closed last Friday. Depending on the tone of forwarding guidance by the 75% of the S&P companies that have yet to report second-quarter earnings, it stands to reason that this line will hold. Given the price action of the past week, where ten of the 11 sectors traded higher on two consecutive days, the market sent a message that it might be time for investors to switch from selling into rallies and instead resume buying stocks on any pullbacks.

From early second-quarter reports, it is very clear that inflationary forces, global logistical bottlenecks, Covid-19, and the strong dollar are material headwinds for many companies. But one theme keeps showing up from the leading companies that have reported their numbers—the demand for their goods and services is healthy. America’s leading trucking and railroads are reporting solid demand, as are airlines and lodging companies. Steel producers have posted record profits and gave an upbeat outlook, as did energy services companies.

What seems clear at this point is that there is little dispute that economic growth is slowing, but a recession is looking less likely. Or, at least, the recession will not be one of any significance. It will not derail the stock market from violating its long-term uptrend line. This base case will be much easier to calculate after this week’s Fed meeting and the parade of earnings that will either justify the current rally off of the lows or send a message that a retest is in order.