I know the title of the article sounds outlandish, but we are now in a region of the S&P 500 (SPX) wherein the market is going to decide its next 500+ point move, states Avi Gilburt of ElliotWaveTrader.net.

So, let me take you through my process as to how I arrive at this perspective.

Until the time of RN Elliott, the world applied the Newtonian laws of physics as the analysis tool for the stock markets. Basically, these laws provide that movement in the universe is caused by outside forces. Newton formulated these laws of external causality into his three laws of motion: A body at rest remains at rest unless acted upon by an external force; a body in motion remains in motion in a straight line unless acted upon by an external force; for every action, there is an equal and opposite reaction.

However, as Einstein stated:

“During the second half of the nineteenth century, new and revolutionary ideas were introduced into physics; they opened the way to a new philosophical view, differing from the mechanical one.”

However, even though physics has moved away from the Newtonian viewpoint, financial market analysis has not.

As Ralph Nelson Elliott noted back in the 1930s:

“Many services and financial commentators in newspapers persist in discussing current events as causes of advances and declines. They have available daily news and market behavior. It is therefore a simple matter to fit one to the other. When news is absent and the market fluctuates, they say its behavior is technical. Every now and then, some important event occurs. If London declines and New York advances, or vice versa, the commentators are befuddled. Mr. Bernard Baruch recently said that prosperity will be with us for several years “regardless of what is done or not done [...] In the dark ages, the world was supposed to be flat. We persist in perpetuating similar delusions.”

Now, how many of you have seen markets move in the exact opposite direction you would have assumed based upon the substance of a particular news event? Come on. We have all seen this many times before.

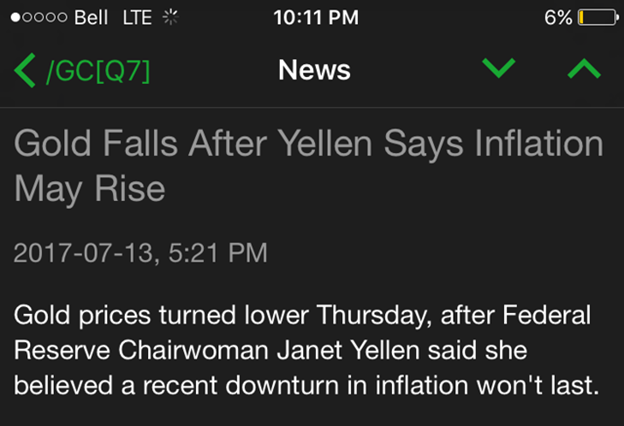

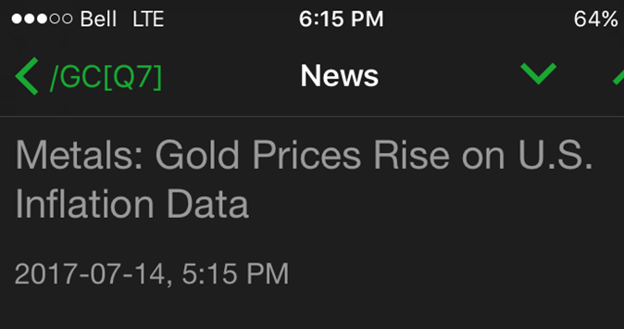

In fact, here is an example of how the gold market moved in exactly opposite directions from the exact same news (a rise in inflation) which came out within 24 hours of each other:

Market News

Market News

You see, external events affect the market only insofar as they are interpreted by the market participants. Yet, such interpretation is guided by the prevalent social mood. Therefore, the important factor to understand is not the social event itself, but, rather, the underlying social mood that will provide the “spin” to an understanding of that external event.

I think Robert Prechter said it best in his seminal book, The Socionomic Theory of Finance—a book which I strongly recommend to anyone who really wants to gain a better understanding of how markets work:

“Observers’ job, as they see it, is simply to identify which external events caused whatever price changes occur. When the news seems to coincide sensibly with market movement, they presume a causal relationship. When news doesn’t fit, they attempt to devise a cause-and-effect structure to make it fit. When they cannot even devise a plausible way to twist the news into justifying market action, they chalk up the market moves to “psychology,” which means that, despite a plethora of news and numerous inventive ways to interpret it, their imaginations aren’t prodigious enough to concoct a credible causal story.

Most of the time it is easy for observers to believe in news causality. Financial markets fluctuate constantly, and news comes out constantly, and sometimes the two elements coincide well enough to reinforce commentators’ mental bias toward mechanical cause and effect. When news and the market fail to coincide, they shrug and disregard the inconsistency. Those operating under the mechanic paradigm in finance never seem to see or care that these glaring anomalies exist.”

In fact, that book will likely shock you with some of the facts and quotes that Mr. Prechter presents.

You see, most market participants today believe that fundamentals drive markets. And, the reason they believe that is because that is what they were taught in school, or, worse yet, by the media.

For those that do not know my background, allow me to explain that I did not come at my market perspective without a deep understanding of market dynamics. I not only went to school to obtain a law degree, as well as a master of law, but I am also an accountant, completed a dual major in accounting and economics in college, and was a national director and partner in a major national firm. So, I remember learning economics 101 and 102, and well beyond that too.

Early in my learning of economics, I remember being introduced to the Efficient Market Hypothesis as the basis for economic theory, especially as applied to the stock market. Now, I am not going to go into how ridiculous the basis under which the Efficient Market Hypothesis was developed is, but needless to say that one of the underlying themes for this theory is that all market participants have the exact same knowledge and develop that knowledge at the exact same moment. I don’t think I have to go beyond that to highlight how ridiculous this theory really is.

Now, I am going to show you something that will shock you:

Eugene Fama, the father of the Efficient Market Hypothesis, told the New Yorker in January 2010:

“I’d love to know more about what causes business cycles. I used to do macroeconomics, but I gave up long ago. Economics is not very good at explaining swings in economic activity. We don’t know what causes recessions. We’ve never known.”

Yes, the one who developed the Efficient Market Hypothesis came out and said it does not work. But do you think the world of economics has abandoned this methodology? Nope. In fact, it is still taught as the basis for economic theory in colleges to this day.

In fact, Benoit Mandelbrot outright stated that one cannot reasonably apply an economic model to the financial markets:

“From the availability of the multifractal alternative, it follows that today, economics and finance must be sharply distinguished...”

Now, I am not going to bore you with further quotes as to why this theory is still taught and widely used, but it comes down to one simple reason as to why it is still used as the basis for prognostication today: Economists admit that they have nothing better. Let that sink in for a moment. Economists and most of you are utilizing an analysis methodology for the market that does not work—according to its creator. And, the reason you still use that method is because they have nothing better to offer. Has that sunk in yet?

So, let’s move on to what I really believe moves markets: And, that is market sentiment.

“Markets can remain irrational longer than you can remain solvent”

While there is some historical question regarding who the author of this saying truly was, it is generally attributed to John Maynard Keynes.

During his tenure as chairman of the Federal Reserve, Alan Greenspan testified many times before various committees of Congress. In front of the Joint Economic Committee, Greenspan noted that markets are driven by “human psychology” and “waves of optimism and pessimism.”

In fact, Greenspan admitted that it is not the Fed that can prevent or stop a market decline. Rather, as he noted, “[i]t's only when the markets are perceived to have exhausted themselves on the downside that they turn.”

Bernard Baruch, an exceptionally successful American financier and stock market speculator who lived from 1870–1965, identified the following long ago:

“All economic movements, by their very nature, are motivated by crowd psychology. Without due recognition of crowd-thinking [...] our theories of economics leave much to be desired. [...] It has always seemed to me that the periodic madness which afflicts mankind must reflect some deeply rooted trait in human nature—a trait akin to the force that motivates the migration of birds or the rush of lemmings to the sea [...] It is a force wholly impalpable [...] yet, knowledge of it is necessary to right judgments on passing events.”

Greenspan and Keynes are among the most well-known economists in American history and Baruch, as noted, was an exceptionally successful businessman. All three have come to realize that markets are driven by emotion and human psychology rather than fundamentals, as most believe it to be. In fact, how often have you heard pundits say that “the market is simply not trading based upon fundamentals at this time?”

And, if you have been involved in the markets for any real period of time and you are being honest with yourself, there is no doubt you have shaken your head at the market and have muttered this to yourself at one point or another.

But, as these gentlemen have noted, one needs to understand human psychology in order to be able to navigate our financial markets more accurately.

So, back in the 1930s, an accountant named Ralph Nelson Elliott identified behavioral patterns within the stock market which represented the larger collective behavioral patterns of society en masse. And, in 1940, Elliott publicly tied the movements of human behavior to the natural law represented through Fibonacci mathematics. Thus, the full theoretical basis for what we now apply as the Elliott Wave Principle had been fully developed and publicized.

Elliott theorized that public sentiment and mass psychology move in five waves within a primary trend, and three waves within a counter-trend. Once a five-wave move in public sentiment has been completed, then it is time for the subconscious sentiment of the public to shift in the opposite direction, which is simply the natural cycle within the human psyche, and not the operative effect of some form of “news.”

This mass form of progression and regression seems to be hard-wired deep within the psyche of all living creatures, and that is what we have come to know today as the “herding principle,” which gives this theory its ultimate power.

Over the last 30 years, many social experiments have been conducted throughout the world which has provided scientific support to Elliott’s theories presented almost a century ago.

Let me provide just one example of such studies. In a paper entitled "Large Financial Crashes", published in 1997 in Physica A., a publication of the European Physical Society, the authors, within their conclusions, present a nice summation of the overall herding phenomena within financial markets:

“Stock markets are fascinating structures with analogies to what is arguably the most complex dynamical system found in natural sciences, i.e., the human mind. Instead of the usual interpretation of the Efficient Market Hypothesis in which traders extract and incorporate consciously (by their action) all information contained in market prices, we propose that the market as a whole can exhibit an emergent behavior not shared by any of its constituents. In other words, we have in mind the process of the emergence of intelligent behavior at a macroscopic scale that individuals at the microscopic scales have no idea of. This process has been discussed in biology for instance in the animal populations such as ant colonies or in connection with the emergence of consciousness.”

Later, Elliott identified that these market movements abide by natural law, as presented through Fibonacci mathematics. In 1941, he stated, regarding the financial markets, that “[t]hese [Fibonacci] ratios and series have been controlling and limited the extent and duration of price trends, irrespective of wars, politics, production indices, the supply of money, general purchasing power, and other generally accepted methods of determining stock values.”

In recent times, we have seen evidence that Phi even governs man’s decision-making. Social experiments have been conducted which resulted in price patterns, based upon a mathematical standard, that mirror those found in the stock market.

In 1997, the Europhysics Letters published a study conducted by Caldarelli, Marsili, and Zhang, in which subjects simulated trading currencies, however, there were no exogenous factors that were involved in potentially affecting the trading pattern. Their specific goal was to observe financial market psychology “in the absence of external factors.”

One of the noted findings was that the trading behavior of the participants was “very similar to that observed in the real economy,“ wherein the price distributions were based on Phi.

This basically means that mass decision-making will move forward and move backward based upon mathematical relationships within their movements. This is the same mathematical basis with which nature is governed. The same laws that were set in place for nature also govern man’s decision-making en masse, and even on an individual basis.

A few years later, a different study was conducted at the University of California, wherein they concluded that even individuals make decisions based on the properties of Fibonacci mathematics.

“We may suppose that in a human being, there is a special algorithm for working with codes independent of particular objects.”

Specifically, when subjects were asked to sort indistinguishable objects into two piles, their decision-making within that process divided the objects into a 62/38 ratio. In other words, these individuals exhibited a Fibonacci tendency in their personal decision-making.

Now we know that movements in markets occur within waves, as discovered by RN Elliott, and we know that decision-making is governed by Fibonacci mathematics and the properties of Phi. So, how do we apply this to our own reading of the market to identify major turning points?

Based on our methodology, it is clear that the market is now at a major crossroads that will determine the next 500+ move. Yet, it still has not tipped its hand as to the resolution. In fact, I cannot remember another time frame wherein the market was at a crossroads with such a significant and diametrically opposed resolution. Yet, we are now at such a point in the market. For now, I still lean towards the bullish resolution, but I am clearly maintaining an open mind over the coming several weeks.

Last week, I outlined my expectation for the market to rally to the 4100-4200 SPX region. Thus far, it is following through rather well. But, that is the region in which the market is facing a serious divergence of outcomes. Should the market be able to continue higher and provide us with a higher high over the 4325 SPX region, then it becomes much more likely that the low for the market is in place at 3637, and a rally to 5150+ is likely taking shape. While I would still expect another larger pullback towards the end of the year before the trek to 5150 begins in earnest into 2023, a higher high over 4325 SPX makes that pattern much more likely.

However, in order for that pattern to develop in the coming weeks, all pullbacks from this point forth must be corrective in nature. For if we see an impulsive decline (term of art meaning a 5-wave structure), then I would have to view the next 500+ point move occurring to the downside, and pointing us to the 3400SPX region before the market could begin that next rally to 5150+.

In summary, the nature of the market reaction over the next few weeks will provide us with a strong clue as to whether we have begun a rally to 5150SPX+, or if we need one more loop lower towards 3400SPX before that rally begins.

Avi Gilburt is a widely followed Elliott Wave analyst and founder of ElliottWaveTrader.net, a live trading room featuring his analysis on the S&P 500, precious metals, oil & USD, plus a team of analysts covering a range of other markets.