Princeton economics professor and former Vice Chairman of the Fed, Alan Blinder, weighed in on the current rate of inflation, explains Bryan Perry, editor of Cash Machine.

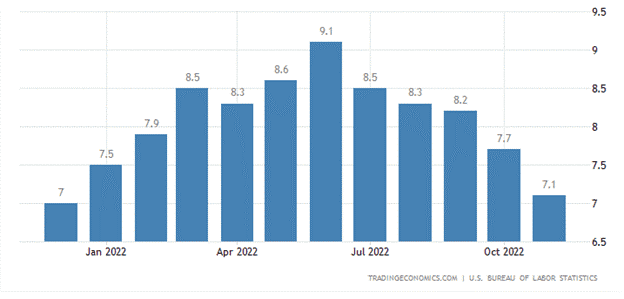

Last Friday, he wrote in the Wall Street Journal that the Consumer Price Index (CPI) inflation rate has been an “alarming 7.1%.”

“But the US economy got there by averaging an appalling 10.6% annualized inflation rate over the first seven months and a mere 2.5% over the last five,” Blinder wrote. “The Personal Consumption Expenditures Price Index (PCE) tells a similar story, though a somewhat less dramatic one. The 5.5% inflation rate over the past 12 months came from a 7.8% rate over the first seven months followed by a 2.4% rate over the last five.”

Blinder further wrote, “Over the past five months (June to November 2022), inflation has slowed to a crawl.” Whether measured by the CPI, which most people watch, or the price index for personal consumption expenditures, or the PCE, a preferred measure of the Federal Reserve, the annualized inflation rate has been around 2.5% for these five months.

This is a powerful argument that the Fed’s target has been reached and that further confirmation in the upcoming inflation data could be just what this anemic market needs to breathe life back into the bullish camp. Whether the market can make this transition away from the Fed’s aggressive tone and put together a positive narrative on inflation already being reined in will take some doing, but the Dow’s advance of 700 points last Friday was notable.

The rest of January will be huge for market sentiment since the inflation data for December will be released, as well as fourth-quarter earnings. This will speak volumes about the health of the domestic and global economies. Inflation peaked back in June 2022 and has been moving steadily lower since, and some comforting news from corporate America that companies are seeing inflationary pressures easing will again…be huge.

The annual inflation rate in the United States slowed for a fifth straight month in November and sets the table for this week’s release of the CPI on Jan. 12. The Producer Price Index (PPI) on Jan. 18. The reading on CPI carries a bigger significance to market participants. Falling gasoline prices, fuel oil prices, and a slowdown in the price of food, used cars, and trucks were offset by stubbornly high prices for shelter and professional services in November.

The cost of energy has declined further this month versus December, thanks to a wave of warmer weather. Retail sales may contract this month, as consumer surveys are showing a more cautious outlook for discretionary spending. All these factors are part of the Fed’s plan to induce an economic slowdown that may cost the economy several million jobs before the Fed’s 2% inflation target is realized.

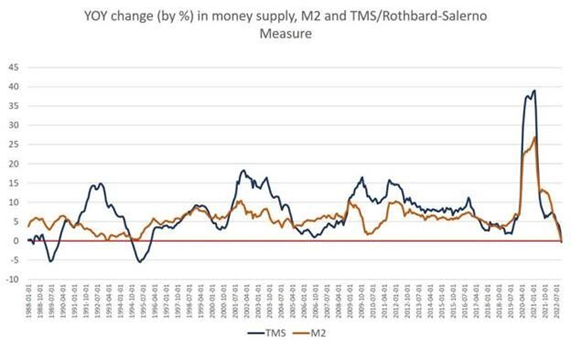

While the market has been tone-deaf to the empirical evidence about slowing inflation, and more swayed by the Fed’s vocal marching orders of future interest rate hikes as a done deal, there have been some very pronounced developments that have raised both red and green flags for market participants. One of these is the fact that the money supply (M2) has turned negative for the first time in 33 years. As storied NYSE floor broker Art Cashin recently stated, “Keep your eye on the money supply.”

Money supply growth can often be a helpful measure of economic activity and an indicator of a coming recession. During periods of economic boom, the money supply tends to grow quickly as commercial banks make more loans. Recessions, on the other hand, tend to be preceded by slowing rates of money supply growth. However, money supply growth tends to begin growing again before the onset of a recession.

So, the drawdown on M2 can easily reflect the rebalancing of all the stimulus money injected into the system that was a catalyst to current inflation that the Fed wants to drain while raising short-term rates. An effective tool the Fed can use during periods of orchestrated slowing, such as the present, is to raise reserve requirements by banks to guard against the rising loan default risk as the economy slows.

www.mises.org

Considering how much money and stimulus was created by both the Fed and Congress during the pandemic, a determined move to reduce M2—when the fourth-quarter gross domestic product (GDP) is forecast to grow by 3.8%, with a 3.5% unemployment rate—is consistent with letting the economy run on its own. The fact that we might get a sixth straight month of reduced inflation presents a compelling debate that, just maybe, bearish investors calling for the S&P to fall to 3,000-3,300 have it entirely wrong.